Diversifying portfolios away from U.S. stocks is important, but not a cure-all

U.S. stocks’ performance so far this year offers a perfect illustration of why investors should not exaggerate the benefits of international diversification.

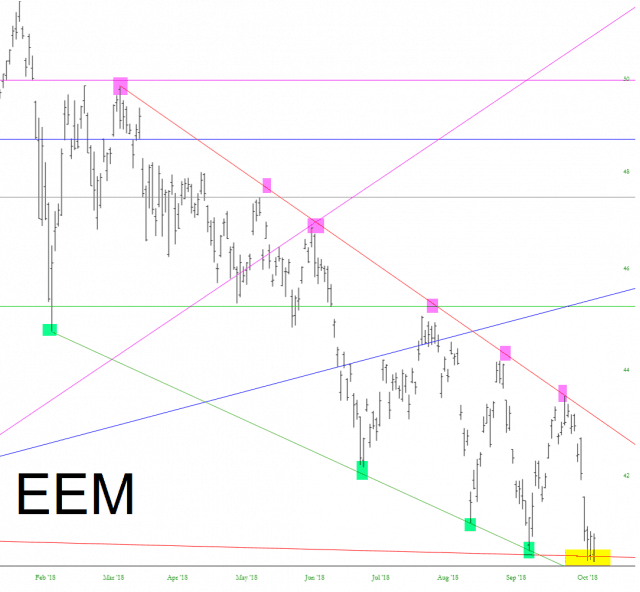

When the U.S. stock market plunged more than 10% in late January and early February, for example, international stocks lost even more. Far from cushioning the fall for investors, they made things slightly worse.And from Slope of Hope a look at the action in the iShares MSCI Emerging Markets ETF:

When the U.S. stock market again fell sharply, between Mar. 9 and Apr. 2, international stocks also fell. Though this time they didn’t fall as much as U.S. equities, the cushion they did provide was scant comfort.

In both cases, international diversification did not live up to its advance billing as providing a “free lunch” of reducing portfolio volatility while forfeiting very little return in the process.

To be sure, these two instances by themselves add up to little more than anecdotal evidence. But it turns out that, historically, what happened in these cases is more the rule than the exception.

What then accounts for the “free lunch” narrative that is widely associated with international diversification? Because, on paper, such diversification is supposed to work a lot better: Even though international stocks exhibit relatively little correlation with domestic stocks, their return over the long term is quite similar. A portfolio divided equally between domestic and international stocks should therefore produce the same return as a domestic-only portfolio but with significantly less volatility.

The key word is “should.”

The problem is that the correlation between domestic and international stocks is not constant. It instead shifts with the bull and bear cycle of the market itself: The correlation is lowest when the U.S. market is rising, and highest when U.S. equities are falling....MORE

1 day ago (09, Oct 2018 11:02:33 AM)

Emerging Support?

Just to shift gears, I’ll offer something somewhat bullish (although I don’t mean it for a second).

The emerging markets, mentioned here incessantly on Slope, have been extraordinarily chart-able for 2018. That’s plain to see from the tints I have provided below. At the moment, my eye is on that yellow since, which for the third day appears to be providing support.

That yellow tint also marks a very important long-term trendline, which I’ve marked with an arrow. This trendline is acting as support for the moment...MOREToday the ETF is down another 2.24% (-0.9143) to $39.84 putting the EEM close to full blown capitulation.

A good thing for those who have resisted the the entreaties of the asset allocators (this time)