Readers may have noticed a change in the sources we've been going to after the close the last few days. It's because the current environment has the potential to get out of hand, so more IBD and ZH, fewer cat videos....Well, the Down Jones' are off again - 285 (-1.07%) with the NASDAQ doing worse (again), down 1.93%.

The danger zone for a seriously scary decline is probably a yield on the 10-year treasury bond of around 4%. We're a long way from that but those longer bonds bear (pun) watching.

So, it's still a bull market. As old Charlie Dow might have put it, the current move is a ripple on top of the wave on top of the tide. And now even Tim Knight is contemplating

From Slope of Hope:

I spend so much time with my hat held gently in hand, sitting politely, explaining why, yes, the market could just keep going higher – – that I’m going to break with that and actually share – – GASP – – why we might actually be heading lower. I know this is a violation of everything the world holds sacred, but let’s give this a shot.

First, there is the Dow Jones Composite. It has broken its trendline. Period. This isn’t a matter of interpretation or speculation. It’s simply read. The trendline broke, and when it attempted to make (yet another) lifetime high yesterday, it was repelled by the trendline, whose job is now RESISTANCE instead of SUPPORT. That’s how trendlines work.

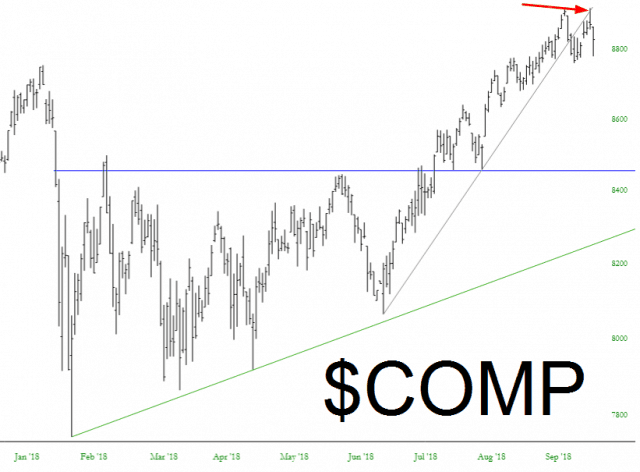

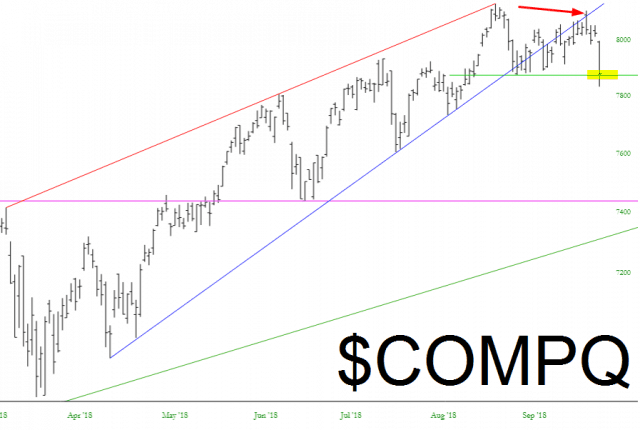

The same can be said of the NASDAQ Composite, the difference being that it was repelled a few days ago, not just yesterday. Further, and importantly, it cracked a minor supporting horizontal line (green below). A close beneath this on Friday would be importantly bearish.

The NASDAQ 100, too, was rejected at its trendline four days ago, having failed below its wedge....MOREAlso at Slope of Hope:

Alan Greenspan, Benjamin Bernanke, and Janet Yellen must be laughing their wrinkly assess off, now that goy-boy Jerome Powell has been stuck holding the biggest stinking bag in the history of the universe. What a schmuck. And he seems like a pretty decent guy! Shame....That's from the post immediately following the above.

Minimal Misery