An interesting piece but I fear the authors underestimate the risk of Norway exploding into anarchy with the whole Janteloven (Law of Jante) thing being exposed as simply a 20th century construct while the trading/raiding blood bubbles just below the surface.

Or not. Who knows?

From FT Alphaville:

The price of oil and natural gas has roughly halved in the past three years. That’s redistributed about $1 trillion in yearly export earnings — more than 1 per cent of global gross domestic product — from net producers to net consumers.*

A new report from Brad Setser and Cole Frank of the Council on Foreign Relations explains which countries have had to adjust the most in response, which have yet to adjust, and which remain the most vulnerable to further price drops.

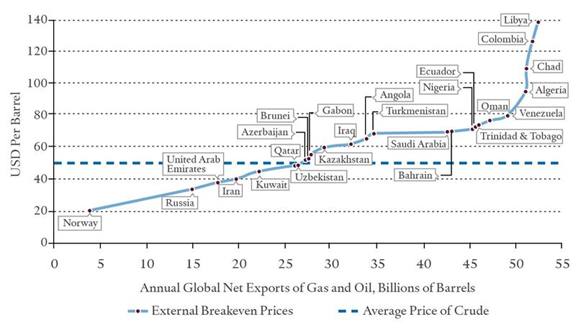

Setser and Frank analysed what they call the “external breakeven”: the current account deficit minus the oil and gas trade surplus, divided by net oil and gas exports in barrels of oil equivalent.

As a reminder, exports are things you make that you don’t get to enjoy. The only reason to export is to pay for imports. That includes not just current imports, but also past imports financed by issuing financial assets to foreigners, as well as all the stuff you expect to import in the future by drawing down savings invested abroad. If your exports aren’t worth enough to pay for the things you want, you have to either raise money from foreigners or cut your spending.

Most significant oil and gas exporters have little in the way of domestic industry and most are incapable of feeding themselves without imports from the rest of the world. (Russia is a notable exception.) Some, such as Norway and a few of the smaller Gulf states, amassed enormous foreign reserves to protect themselves from price declines when times were good, but many did not, instead preferring to spend the temporary windfall on everything from military misadventures to experiments in “Bolivarian socialism”.

The major advantage of their approach, in contrast to other research on “fiscal breakevens”, is that it is easy to make comparisons across countries and across time. The Mexican government might be highly dependent on oil export revenues, for example, but the people of Mexico are not. Motor vehicles and televisions are far more imporant as a source of hard currency. (Also, Mexico is now a net importer of energy.) There are also big differences between the impact of the oil price on government budgets in places that peg their currencies to the dollar, such as Saudia Arabia and the Gulf emirates, and places with floating currencies, such as Norway and Russia.

Here’s what the external breakevens of the major oil and gas exporters look like as of 2015:

The countries below the dashed line are able to cover their past and present future imports out of current oil export earnings with room to spare. The ones above the dashed line have to make up the difference between their wants and their purchasing power by selling assets or issuing new claims to foreign investors. About half of the oil and gas supplied to the world’s net importers in 2015 came from net exporters with external breakevens below the market price....MORE