Local VCs in Berlin — A Network Analysis

Over the last years, Berlin has been on a path to become Europe’s most active startup-hub. According to the Global Startup Ecosystem Ranking, which rates cities’ startup attractiveness, Berlin moved up from place #15 in 2012 to #9 in 2015. EY places Berlin even in front of London, as Berlin surpassed London in startup funding figures both in 2014 and 2015. With flagship companies like SoundCloud and the various Rocket Internet ventures, Berlin has been standing under international focus for years. Berlin-based Wunderlist was acquired by Microsoft in 2015, food service Delivery Hero is valued at $3.1 billion. In 2016, Berlin’s online bank fintech NUMBER26 raised $40 million from various (half of them being non-German) Investors, including Battery Ventures and Peter Thiel’s Valar Ventures. While these exits, billion dollar valuations and large late stage funding rounds are good news, they’re still quite rare.While Berlin has a dozen of incubators and accelerators and is strong in seed funding, startups often still struggle to raise larger growth stage rounds.In this article we’ll show that past-seed capital for Berlin-based startups indeed often comes from non-German investors. We’ll compare our figures via Social Network Analysis to the entrepreneurial role model, Silicon Valley. Using the term ‘role model’ doesn’t mean that every startup ecosystem outside of the US should copy everything that the Silicon Valley does or has done. It’s rather important that cities like Berlin, London, Stockholm and others grow organically and develop their own character. But there’s no question that Silicon Valley has produced the majority of the most innovative technology companies we know today and is pretty much unbeatable in terms of its VC funding environment. If we want to talk about Venture Capital in a maturing ecosystem like Berlin, there’s no way past looking at the rich story of the Valley.

After the Network Analysis and comparison there will be a — not even that gloomy — outlook on Berlin’s future, combined with some words on recent developments that play in our painted Berlin-VC picture.MethodSocial Network Theory is an interdisciplinary method to illustrate, describe and analyze large data sets. It looks at connections and flows of information and resources between individual actors within larger groups (a.k.a. networks). Network Theory lets one conclude about developments, trends and behaviors shown by the actors within the network.

We’ll look at two networks: The networks of co-investing VCs in Silicon Valley and the respective VC network of Berlin. We’ll analyze at the data and networks in terms of quantitative investment figures as well as by comparing the centrality (a statistic measurement we’ll introduce further below) values of each network. R Studio was used to process, analyze and visualize the data.Data· Downloadable for free from CrunchBase (admission required)

· Analysis is based on funding data from Silicon Valley-based and Berlin-based

Startups between 2010–2015

· Only funding of over 500.000$ per investment from VC to startup is

included in dataset (we want to look at past-seed funding)

· For reasons of comparability, Silicon Valley startups in the context of this

analysis are reduced to startups based in Menlo Park, Palo Alto, Mountain

View and Sunny ValleySilicon Valley’s VC network

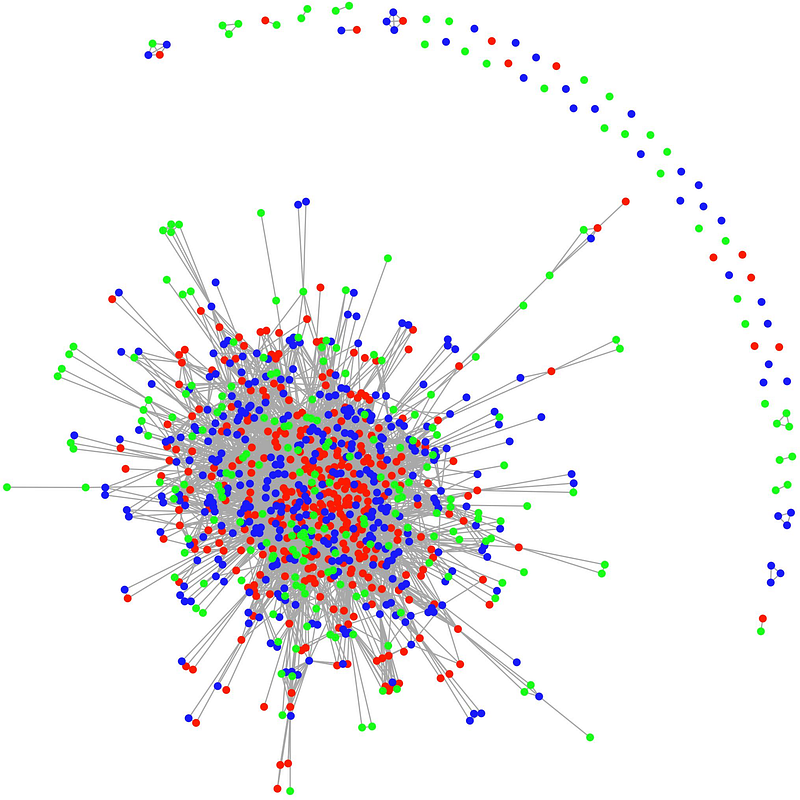

(local VCs: red; Other US VCs: blue; International VCs: green), 2010–2015, Data: CrunchBaseSilicon Valley’s VC network

Network (1) above shows the network of Venture Capital firms that have invested in startups in Silicon Valley. A VC firm (node) is connected to another VC firm (another node) if they both are co-investors in a startup. Just visually, it becomes clear how important local, Silicon Valley based VCs (red nodes) are for the network. They occupy most of the central space in the network, implicating that they are from particular relevance for startup funding in Silicon Valley (the actor with the most ties to another actor is located in the middle of a network). They seem to make the most startup investments, and are by that connected to many other VCs. The blue nodes represent outside-Silicon Valley US-based Venture firms. These are distributed pretty consistent over the network, but aren’t able to penetrate into the network’s center. International, outside VC investors (green) are overall pretty spare relative to US investors. They are mostly located at the outskirts at the network, implying a passive co-investor role in a minor number of VC-syndicates. They’re especially present in the sickle-like formation of VCs and small networks of VCs in the top right. In short: Local VCs seem to dominate the SV startup funding market, other US investors play a significant role, international investors don’t seem to be that important.......MUCH MORE

Meanwhile, Germany's public broadcaster, Deutsche Welle, asks:

Paris the new Silicon Valley?