We saw electricity prices up 5.8% YoY in the July 15 CPI report.

From Utility Dive, July 15:

Load growth and aging infrastructure require investment, but customer electricity prices are up 4.5% nationally, almost twice the 2.4% national inflation rate.

Utility regulators across the U.S. face a paradox that demands resolution, panelists at the American Clean Power Association’s CleanPower 2025 conference said.

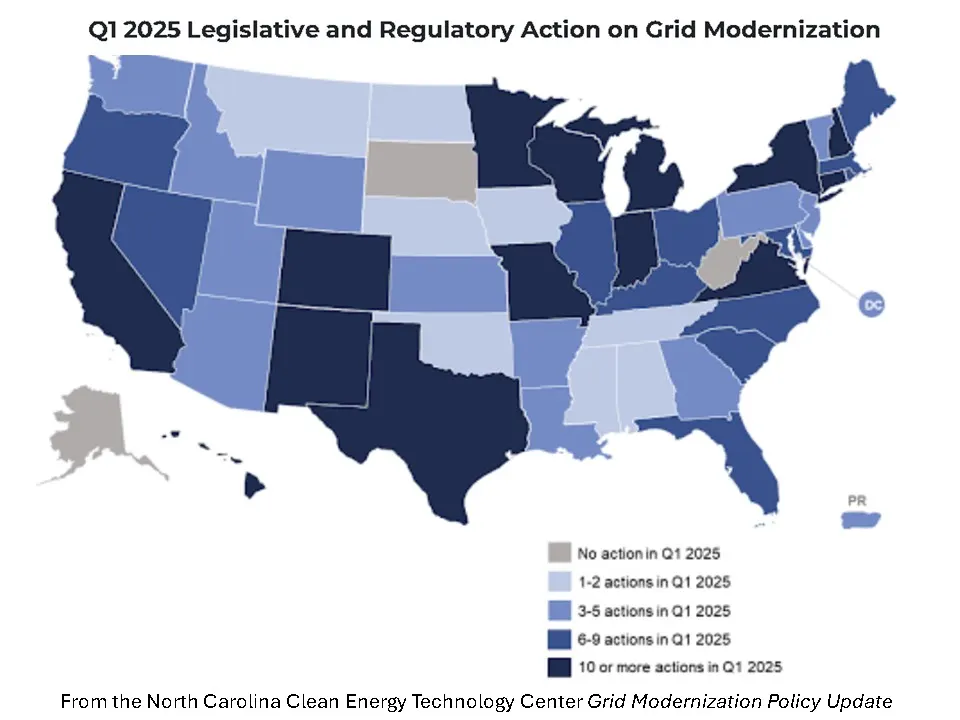

There were 726 policy actions on grid modernization in the U.S. in the first quarter of this year, many requiring significant new investments, per the Clean Energy Technology Center’s most recent Grid Modernization policy update. But customer electricity prices are up 4.5% nationally, almost twice the 2.4% national inflation rate, according to the June Bureau of Labor Statistics Consumer Price Index.

“Utility regulation has always been a complex balancing act and the lesson learned is the need to ensure investment value and utility accountability,” said Regulatory Assistance Project, or RAP, Principal, Research and Strategy, Mark LeBel. Regulators must choose “the most cost-effective investments from a realistic set of alternatives,” he added.

Almost 80% of $186.4 billion spent by U.S. investor-owned utilities in 2024 went to infrastructure, according to September 2024 data from the Edison Electric Institute. And more spending must follow: April’s 120 GW five-year load growth forecast was over five times higher than 2023’s five-year forecast of 23 GW, according to the recent GridStrategies update.

“Regulators can approach modernization investments like they are investors in a business,” said Commissioner Abigail Anthony of the Rhode Island Public Utility Commission. Utilities should present investment information “like a business owner seeking a loan” to eliminate regulators’ concern that approval “is a gamble with customer money,” she added.

Balancing the apparent opposites of spending to modernize and not spending to avoid rate increases is what utility oversight is about, many commissioners agreed. Emerging tools for business case regulation are new metrics, effective planning and well-paced spending that can identify needed investments that add value and make the utility accountable, some regulators added.

Can opposites balance?

Conscientious regulators need new approaches for the hard choice between legitimate modernization investments and the upward rate pressure they cause, state commissioners and analysts said.

Pressures on an out-of-date system are rising and significant investments, mostly paid by utility ratepayers, are needed, said Bryce Yonker, executive director of modernization advocate Grid Forward. As a result, though, if “affordability is the paramount target, it will be difficult to achieve.”

The Georgia Public Service Commission recently initiated a solution to balance costs for new large load customers that many state regulators are adopting, said Georgia Commissioner Tricia Pridemore.

“New rules require Georgia Power to contract for 15 years with new large load customers at a rate that covers 100% of utility costs,” she added.

Georgia Power procures the generation needed by the new large load, and the commission approves the contract in “a collaborative planning process,” Pridemore said. Costs not recovered through the contract go into the utility’s rate case, but recovery of those costs is not likely to be allowed “because negotiating the contract was the utility’s responsibility and not a ratepayer problem,” she added.

With Georgia Power and its regulators facing questions about the utility’s nation-leading profitability, Pridemore stressed the estimated $2.64 per month downward pressure on each residential customer’s rates attributed to the new rule.“Like every state commission,” Georgia regulators are “working to find the right amount of spending to ensure reliability without unnecessary costs,” she added.

New elements for broader balancing of affordability and modernization are emerging in many other states.

Permission granted by NCCETC

The theory of balancing

One emerging tool for effectively balancing spending and rate increases is new metrics.

“Ultimately, potential investments need to be prioritized,” said Newport Consulting Group Managing Partner Paul De Martini, who co-authored a January Lawrence Berkeley National Laboratory report on optimizing distribution system modernization investments....

....MUCH MORE

If interested see also July 20's Electricity: "Pump Prices Aren’t the Problem for Americans. Plug Prices Are".