From ZeroHedge, June 12:

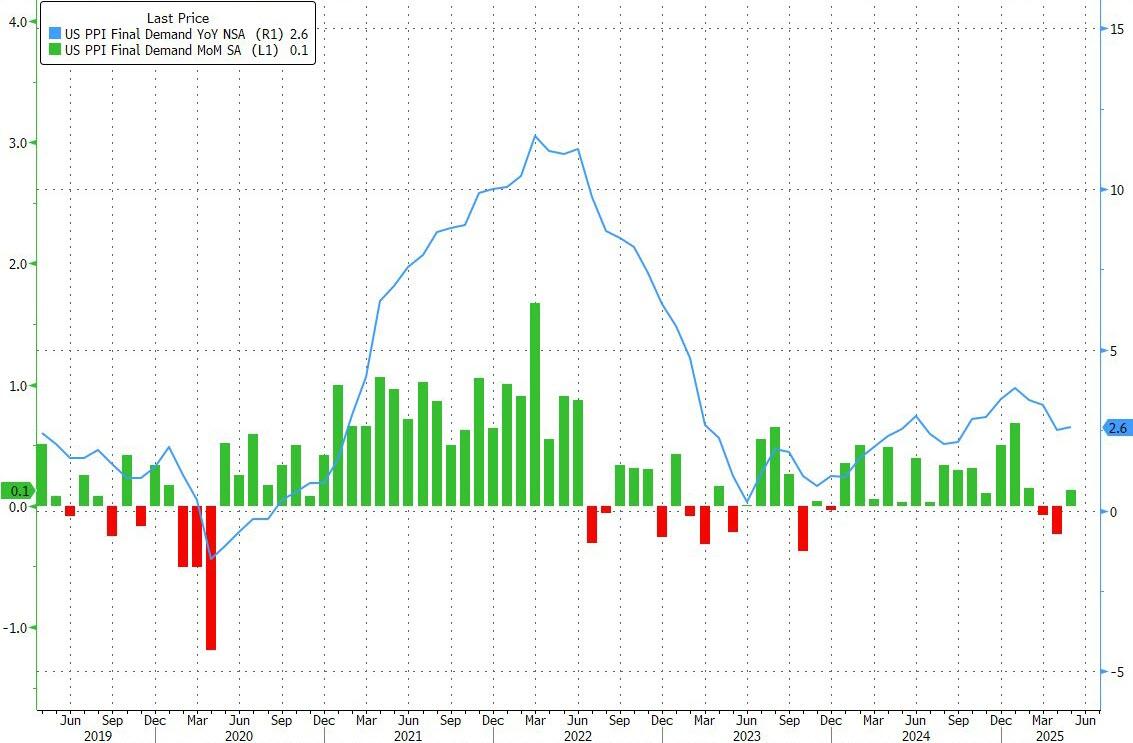

Following another month of cooler than expected CPI, US Producer Prices followed and printed well below expectations in May (if not quite the plunge observed last month), rising only 0.1%, below the +0.2% MoM exp (but we note that just like March's 0.4% MoM decline was revised up to unchanged, so May's -0.5% drop has been also revised higher to -0.2%). Meanwhile, the headline print posted a modest increase, rising from an upward revised 2.5% in April (from 2.4%) to 2.6% in May.

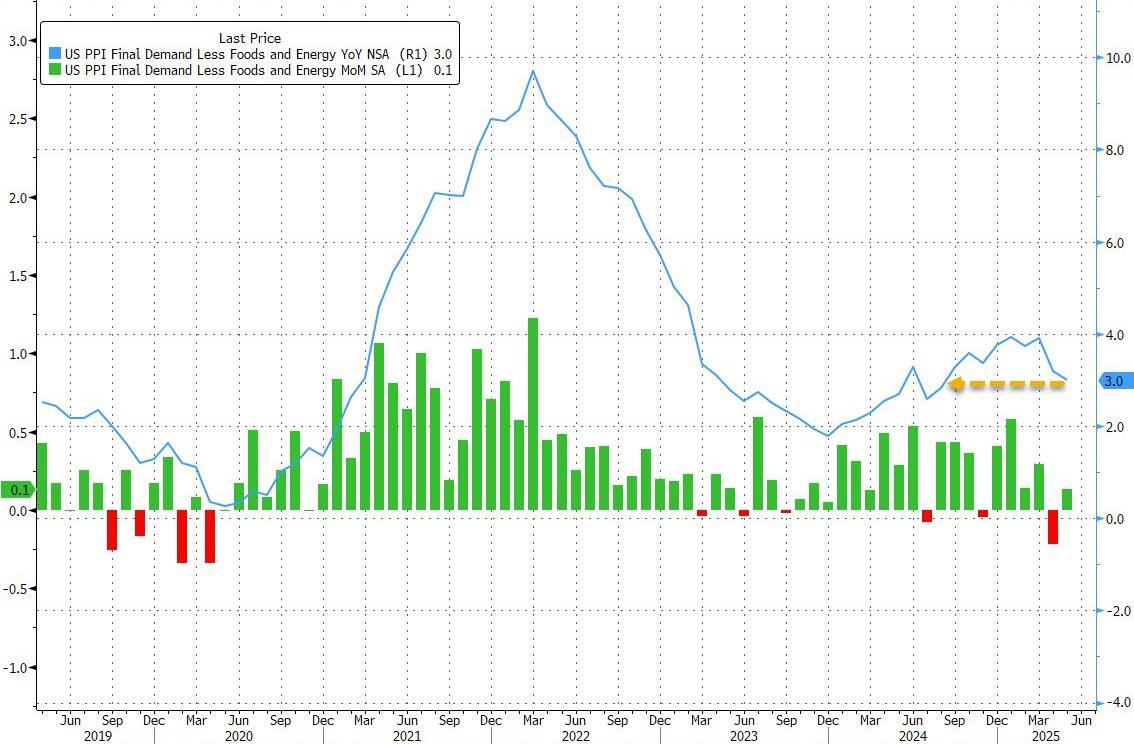

But while headline PPI posted a modest annual increase, core PPI continued to slide, rising just 3.0% in May, the lowest since August 2024 (below the 3.1% estimate), down from an upward revised 3.2% in May, as a result of a 0.1% monthly increase in core PPI, which also missed expectations of a 0.3% increase.

Looking at the PPI components that matter for PCE calculation, airline passenger services contracted another 1.1% m/m in May, after a 1.8% decline in April. Portfolio management contracted 1% after a 7.1% decline in April. Home health and hospice care flat, and hospital outpatient care contracted 0.3% m/m in April.

Under the hood, prices for final demand services rebounded 0.1% in May, reversing the 0.7% plunge in April which was the largest (pre-revision) decline since the index began in December 2009, driven by portfolio management services....

....MUCH MORE

Not seeing a lot of action in the pipeline either, at least as far as intermediate goods go. Here's the full release from the Bureau of Labor Statistics, June 12 (35 page PDF):

https://www.bls.gov/news.release/pdf/ppi.pdf