Yes, yes, but when? A date would be really helpful. Specificity please, Albert.

From Australia's MacroBusiness, January 22:

Always sobering and usually right…eventually. I agree with much of the below but don’t think we are there yet.

Albert Edwards of Societe General bears it up!

Existing trends were pushed to new extremes in 2024. The idea of US equity market exceptionalism has taken such deep root that it’s impacting so much else, including the strength of the dollar as foreign savings pour into US Tech stocks.

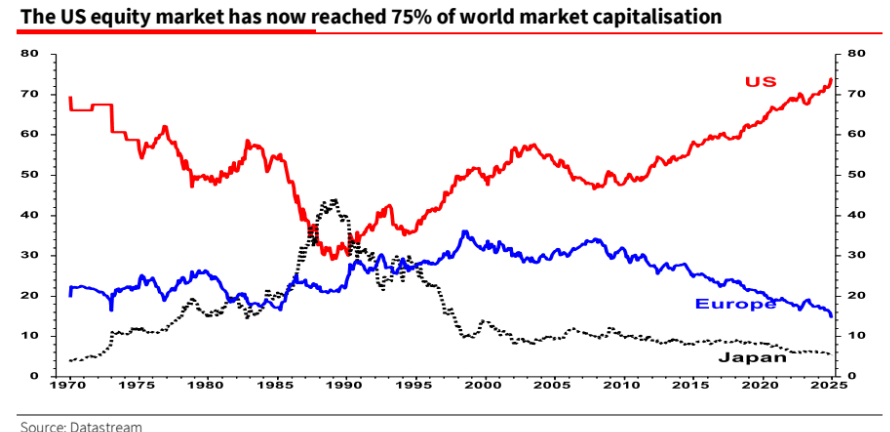

We have now reached a new landmark with the US equity market comprising some 75% of the MSCI World Index.

My own extremely jaundiced view of US equity market exceptionalism is born from decades of hearing similar beguiling stories, be it the Nasdaq bubble in the late 1990s or before that the Asian economic ‘miracle’ of the mid-1990s. Each and every bubble has a compelling narrative that only in retrospect is exposed as nonsense–most recently the 2008 Global Financial Crisis where the consensus view was that there was no bubble to burst.

But just eyeballing the chart below remindsus that at the end of the 1980s the Japanese equity market accounted for close to 50% of the world index–a lasting memory for me as I had just joined Kleinwort Benson investment bank in 1988. The Japanese exceptionalism narrative was also extremely compelling, but bubble equity valuations were soon burst by a sharp rise in bond yields. I keep a copy of my1989 research note handy in which I stressed that a sky-high Japanese bond/equity earnings yield ratio signalled that the Nikkei bubble was about to pop. Back then investors were angry that I even dared suggest such a thing could happen. Each and every bubble ends badly, and this one will be no different.

US Tech dominance has now gone on for so long that most investors seem to believe it is the new permanent state. This is just ‘recency bias’ at play as we have seen time and time again. For example, the abolition of the business cycle due to superior policy management is another idea that rears its head perennially – usually just ahead of an economic collapse, as in the 2008 GFC. This chart below illustrates just why investors should be open to the possibility of radical change.

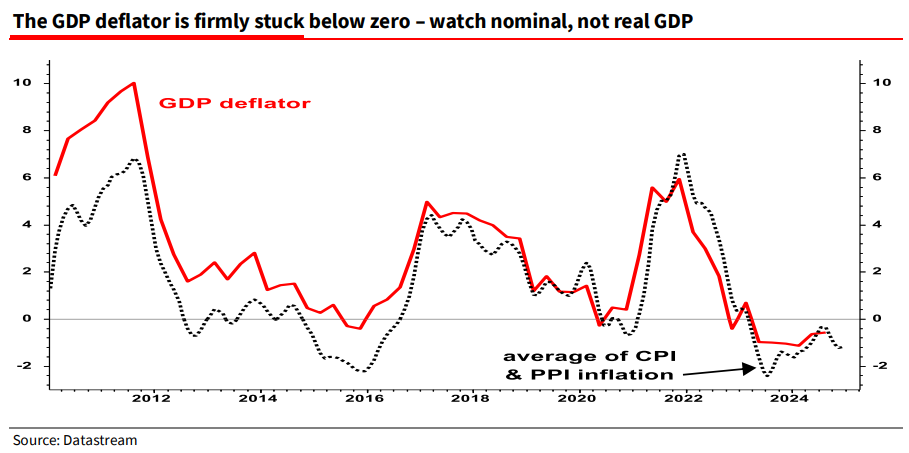

In the context of Chinese deflation, investors should keep a very close eye on the GDP deflator which seems stuck firmly below zero. For a debt-heavy economy, price deflation is a disaster.

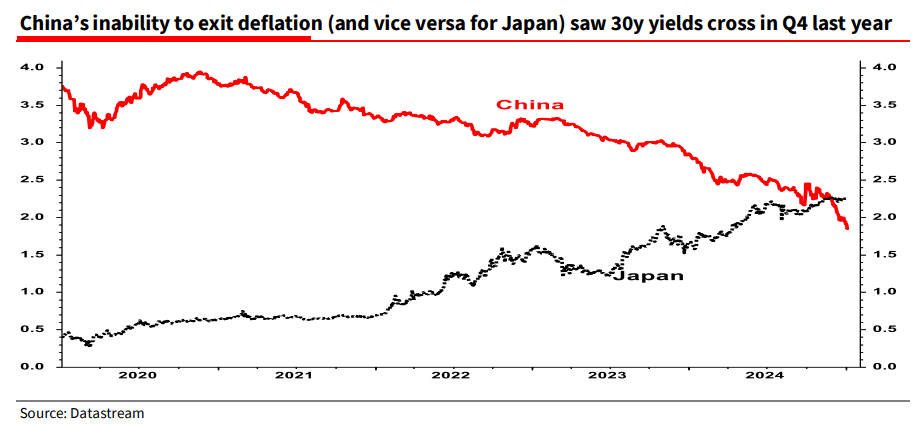

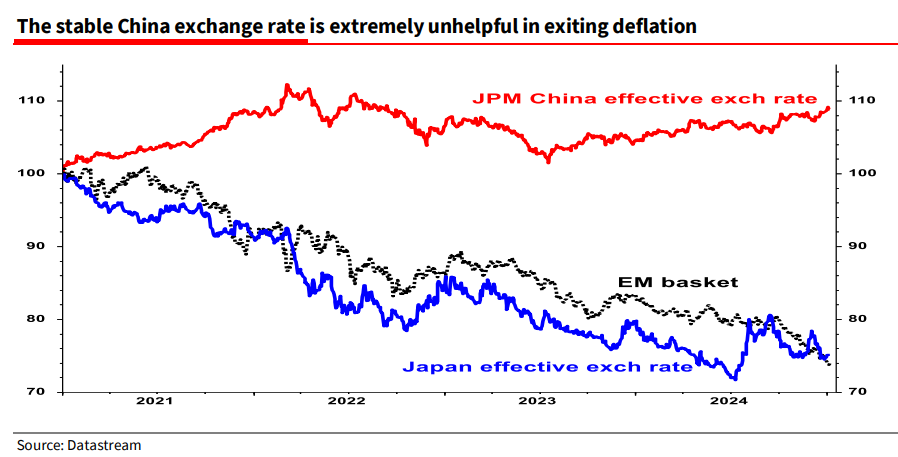

Generating higher inflation is one typical way economies escape from the strictures of excessive debt. Japan adopted the classic weak currency policy in 2013 to help exit deflation. By contrast, China’s currency stability is a major hinderance to exiting its own deflation quagmire.

The US corporate sector could offer the Chinese authorities a few lessons on how to increase inflation. My “2024 Chart of the Year” below showsUS domestic corporate profit margins bursting way above their usual 15% maximum as ‘Greedflation’ took hold. Never in history have corporate margins risen when faced with sharply rising unit costs – until now....

....MUCH MORE