From/via ZeroHedge, June 12:

Wall Street Reacts To Today's Dovish CPI Shocker: "Down And Out"

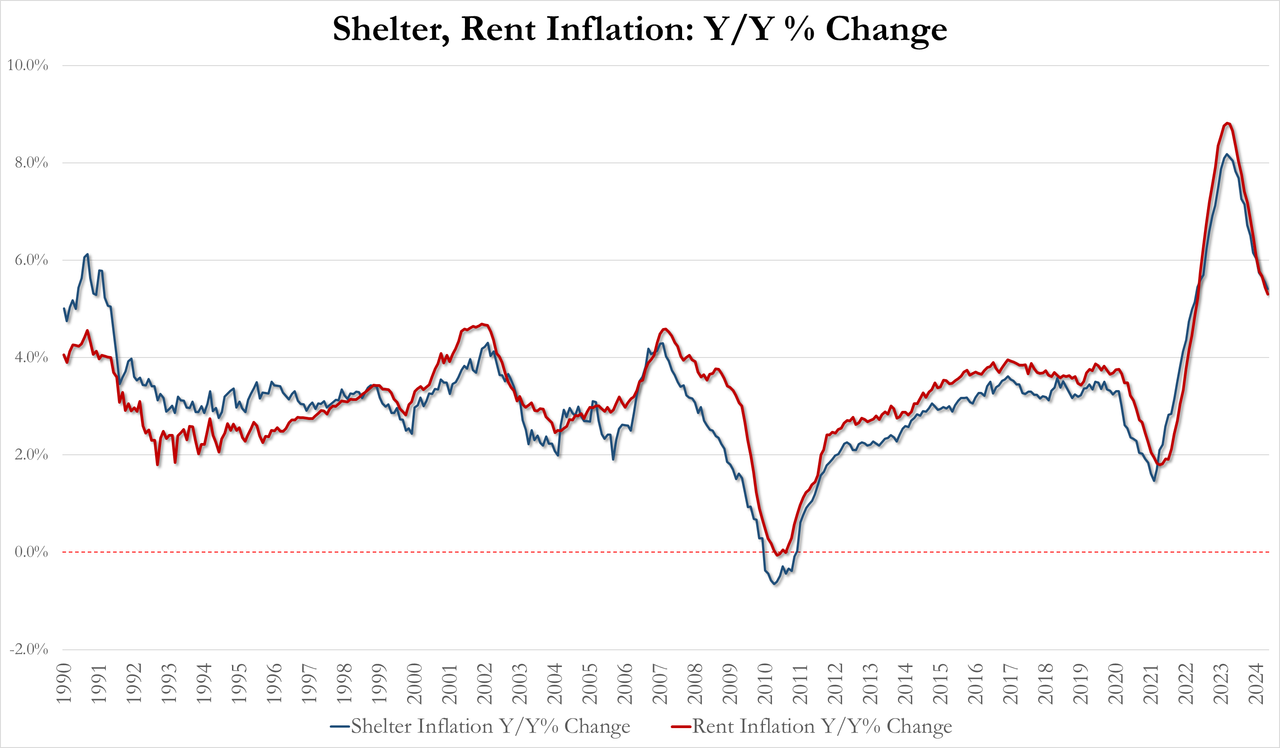

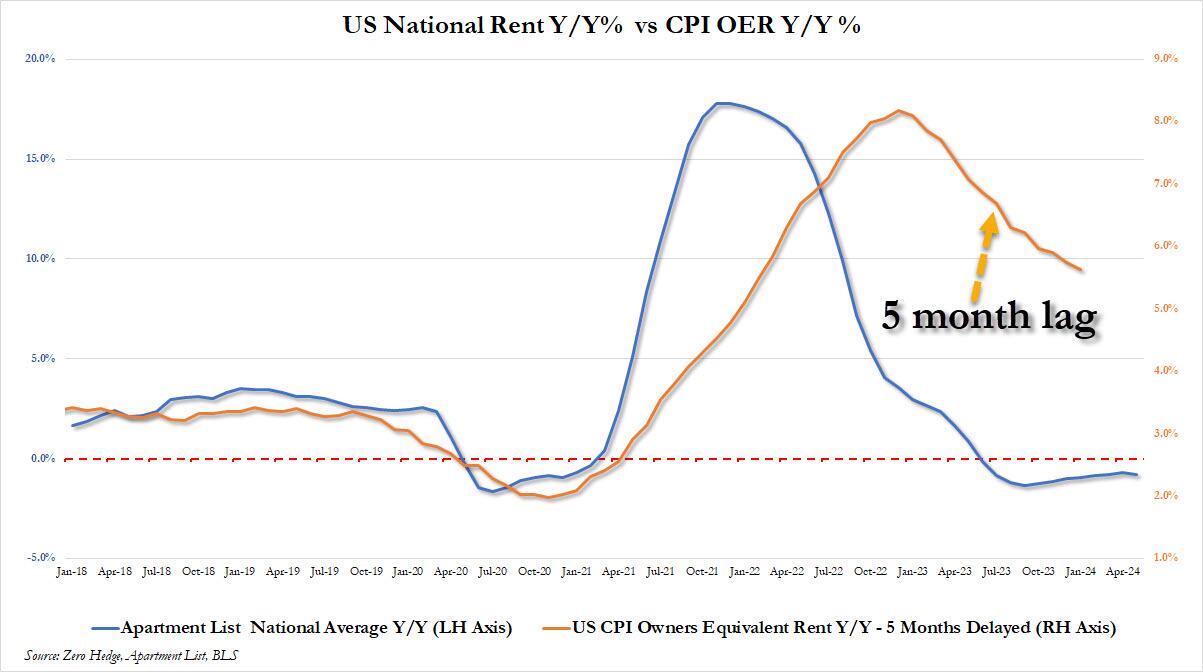

....Meanwhile, the big delta remains housing: as the BLS noted, the shelter index increased 5.4% over the last year, accounting for over two thirds of the total 12-month increase in the all items less food and energy index. Yet with lagged OER/shelter/rent still hot relative to real-time prices, the core monthly CPI gain undershot the median forecast for the first time since October.

And here is the punchline: with real-time rent flat to down for the past year, the BLS-tracked OER 5-months lagged, is up 5.6%, and will decline gradually for the next 18 months as it catches down to real-time rents, even as the latter are actively rising, something which Omair Sharif at Inflation Insights agrees with in his morning note titled "Down and Out" : “A 0.2% monthly core CPI reading should be the base case for the balance of the year, especially as it looks more and more like the long-awaited slowdown in shelter costs will hit as soon as the next report.”

....MUCH MOREIn any case, however one looks at today's report, the bottom line is clear: the doves have it, and now the ball is in the Fed's court to decide whether to keep the dots at 3 cuts for 2024 or move to 2, even as the hawkish "1 cut" case has been officially eliminated. Indeed, here is Bloomberg's Fed Watcher Chris Antsey on this issue: "for any Fed governor or district bank president who had been on the fence about one rate cut or two for 2024, this might have tipped them over. All eyes at 2 p.m. in Washington will be on that median estimate for the year-end policy rate."

And to underscore that, here are some of the more notable Wall Street reactions.

Gregory Faranello, head of rates strategy at AmeriVet Securities:

"The CPI is a really nice inflation reading. The Fed meeting today should see officials move toward two rate cuts for 2024 and softer CPI readings from here will keep a September cut in play."

Omair Sharif at Inflation Insights:

“A 0.2% monthly core CPI reading should be the base case for the balance of the year, especially as it looks more and more like the long-awaited slowdown in shelter costs will hit as soon as the next report.”

Ira Jersey, Bloomberg Intel chief rates strategist:

“The knee-jerk reaction in the Treasury market isn’t surprising given the Fed-friendly CPI print, particularly the “low” 0.2% on core CPI. Jay Powell can now say ‘we’re making slow but additional progress on inflation’ at this afternoon’s press conference. Investors have been asking if members of the FOMC might change their summary of economic projection forecasts after the CPI print, since they are submitted prior to the start of the meeting. Today’s report probably doesn’t really shift expectations much. We’ve been thinking November and December cuts as our base base, and this data solidifies that view.”

Lindsay Rosner of Goldman Sachs Asset Management

“This was good news but it is one piece of news. June is a no-go. We have felt July the same. Again today is a good print for restrictive rates working to quell inflation, so September is a possibility.”

Bryce Doty, Sit Investment Associates senior PM:

“A calm CPI report. This CPI report gives the Fed the flexibility to still cut rates. We still expect the Fed to hold off until after the election though.”

Ashwin Alankar, head of asset allocation at Janus Henderson Investors:

"Until greater dis-inflation evidence is seen both in breadth and depth, today’s softness is supportive of a preemptive cut rather than a pivot in Fed policy towards accommodation.”...

Earlier:

Huzzah!—Headline U.S. CPI Inflation Came In At 0.0% For the Month Of May—Huzzah!