From Australia's MacroBusiness, May 3:

Albert Edwards of Societe General.

Not much shocks me in the world of economics and finance nowadays, but the latest IMF report on the US fiscal situation stunned me into momentary silence.

Having dusted myself down and digested the report more fully,I thought I would pen some thoughts about where we may be heading over the next few years.

Recent events have taught us to think the unthinkable.

While the mainstream media fixates on the differences between presidential candidates Trump and Biden, there is one thing both (an dindeed both parties jostling for control of Congress) appear to agree on: an ever deeper fiscal deficit is nothing to worry about.

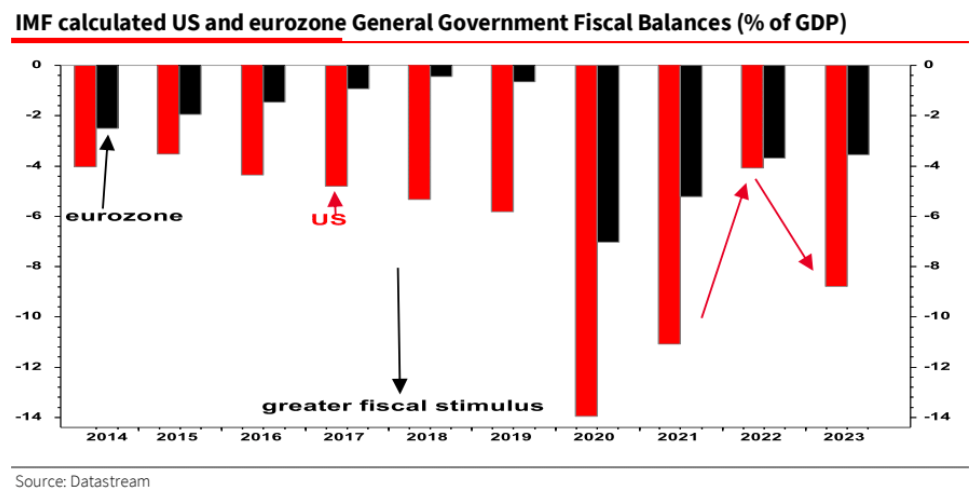

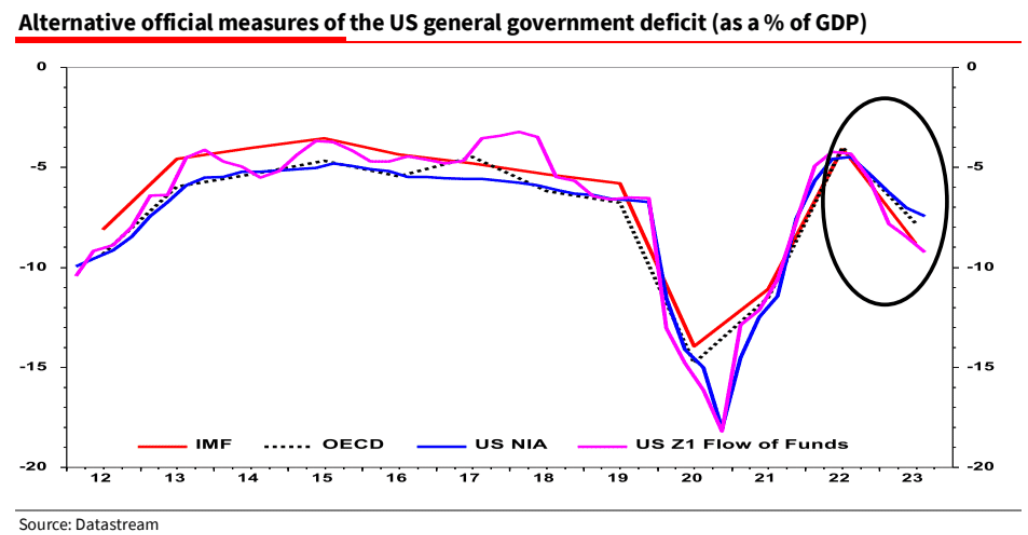

Sure, we all knew the deficit had grown under the ‘Inflation Reduction Act’ etal, but it still shocked me that the latest IMF calculations show the overall government fiscal deficit exploded to 8.8% of GDP in 2023 from 4.1% in 2022 (see chart below). Wow!

First, there is the mind-boggling magnitude of the deficit at a time of near full employment.

Second, the whipsawing of the US deficit over the last couple of years helps explain why GDP stalled in 2022 but then surprised on the upside in 2023 when most economists were forecasting recession.

These data may also give us some pointers to the GDP for the rest of 2024, which faces notable fiscal retrenchment on the IMF data–and in the medium term, their warning of an explosive and unsustainable debt situation.

The outsized fiscal deficit also helps explain the recent behaviour of the equity market.

For as my former colleague James Montier recently pointed out in a mea culpa, the surprisingly large fiscal deficit is one of the key reasons for the booming corporate profit margins-link.

This is simply explained by a series of National Income Account ‘identities’ known as the ‘Kalecki Profit Equation’.

The FT headline for its story on the IMF report couldn’t have been any blunter: “The IMFhas warned the US that its massive fiscal deficits have stoked inflation and pose ‘significant risks’ for the global economy.”.

Where does this end?

Grant Williams is famous for his newsletter, “Things That Make You Go Hmmm”@ttmygh. Of late he has been interviewing some of finance’s most famous names in a podcast series entitled “The end game”.

The latest episode featured one of the best strategists on the street, Gerard Minack of Downunder Daily fame. Listening in to this great discussion really got me thinking the unthinkable–what is the end game for this fiscal dysentery?

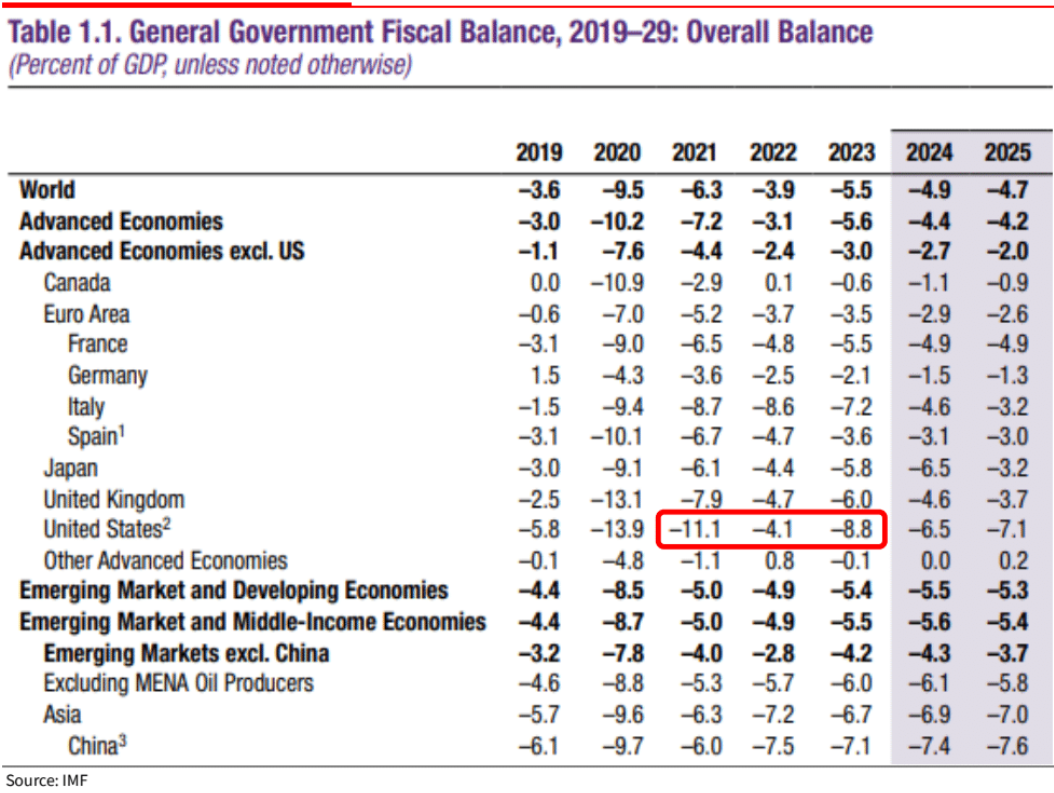

Readers will of course want to take a close look at the IMF’s controversial report that named and shamed not just the US for its perilous fiscal situation but also China. The table below shows US fiscal retrenchment in 2022 (deficit falls from 11.1% in 2021 to 4.1% in 2022) but then explodes up again to 8.8% in 2023 (see red box in table below).

Returning to national income account (NIA) identities, one thing all economists learn in Economics 101 is that the sum of domestic financial (im)balances (public and private) is equal to the capital account of the balance of payments, ie if the public and private sector combined run a deficit, this must be reflected in a capital (current) account surplus (deficit)....

....MUCH MORE

Financial repression and yield curve control. The alternatives are actual hyperinflation (greater than 50% per month) starting within ten years or a debt jubilee.Which, in the case of the sovereign means repudiation. Maybe the liquidators/receivers/cleanup crew could claim it was odious debt or something.

See:

- Kaminska Watch: QE (not QE) Returns; A Mandy Rice-Davies Sighting; Wind Turbines; Fentanyl, The Usual

- Société Générale's Albert Edwards Channels The Doors' Jim Morrison: This Is The End (of the ice age)

If interested see also April 15's "Since Yield Curve Control Is Coming Back We Should Probably Brush Up On How It Worked In The U.S." with the outro:

So YCC first as a way station on the road to full-on monetization.

In the meantime though, Partaaay!