From naked capitalism, July 12:

There was much drama around the last-minute congressional deal to raise the debt limit in June. The heavy focus on this public debt, which had climbed above $31 trillion for the first time, is misplaced, however; it’s private debt that should be the center of attention. That’s according to Richard Vague in his new book, The Paradox of Debt.

The news on that front is less than ideal:

- With inflation biting, credit card debt in the US has been rising at one of the fastest rates in history and is at record highs.

- The Supreme Court just struck down the Biden administration’s modest student loan relief plan. 100 million Americans are struggling with healthcare debt, and 20 million of them don’t expect to ever pay it off.

- Increasing precariousness has homelessness rising across the country, including up 40 percent in Los Angeles County over the past five years. It’s jumped18 percent this year in New York City.

What gives? The US economy has grown at 3.2 percent, 2.6 percent, and 2 percent in recent quarters.

Vague’s Paradox of Debt explains that for the economy to grow, debt must rise. It is, according to Vague, “an inherent feature of the modern economic system.” The problem is this eventually leads to too much private debt, bad lending and a crash before the debt continues to grow ever higher. While economists obsess over public debt, financial crises are overwhelmingly caused by out of control lending in the private sector:

Total debt has always grown as fast or faster than GDP, except in periods of calamity. Debt outgrows income, and this growth is not a cycle, but instead a jagged yet nevertheless unending upwards march.

It isn’t just high private debt alone that causes a crash, rather it is the rapid acceleration of debt growth that signals rough times ahead. Vague’s research with his colleagues shows the following:

When the ratio of private debt to GDP in a major, developed country increases by at least 15 percent to 20 percent in five years or less, then a financial crisis or some other calamity is likely, especially if the overall private debt ratio is at 150 percent or higher.

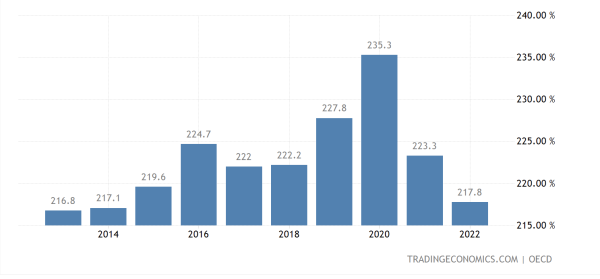

Here’s what total private debt to GDP looks like in recent years:

Private sector debt (the sum of household and non-financial business debt) percent of GDP is overwhelmingly in the household mortgage and commercial real estate debt.

Is Economic Growth Possible Without Overreliance on Debt?

In his book Vague goes into fascinating detail on all aspects of US private debt and debunks widespread myths on government spending and inflation with thorough research. Vague describes how private debt deleveraging requires public debt growth (and vice versa) in order to maintain GDP growth and household income (which helps explain the decline in private debt in the graph above following pandemic government stimulus).

While public debt ratio to GDP used to decline when the private debt ratio increased and vice versa, since the 1980s in the US both private and public debt ratios have continued to grow.

Increasing net exports is one option, although it’s difficult (the US hasn’t had a surplus since 1975). The other option is to moderate debt growth, although again, that’s easier said than done as debt is outgrowing GDP in the 300 – 600 percent range in the world’s large economies.

Vague also offers compelling examinations of the different debt profiles of the world’s seven largest economies. It’s not great news anywhere despite the different debt growth strategies. China, for example, follows a path that relies heavily on business sector losses and debt and has been struggling to change course without slowing the growth of household income.

Germany, which for decades had followed a trade surplus model, is searching for a new route of growth following Berlin’s decision to sever itself from Russian energy and amid worsening ties with its largest export market in China. The shift is likely to be painful for most Germans.

He also examines the UK, France, India, and Japan. One common theme in all countries is that this debt paradox also drives up inequality.

“One Entity’s Liability Is Another’s Asset.”

While Vague says the debt growth we should be worried about is private debt, there’s also this fact: rising levels of government debt lead to rising inequality.

So without changes to government policy, it seems we should also be worried about government debt. While it may not portend some sort of crash, it causes its own calamity in other ways.

On the private debt front, the bottom two-thirds of Americans are the ones falling further and further behind, which only enriches the wealthy even more....

....MUCH MORE