We've seen this in copper over the last few days with an almost perfect inverse relationship, moving the futures price higher despite a very soft end-use market in China.

From Bloomberg via Yahoo Finance, late in the day July 12:

The dollar has defied predictions of a prolonged slump since at least the beginning of the year but top money managers say it’s now on borrowed time as US exceptionalism wanes.

The greenback is weakening as US interest rates near a peak and the Federal Reserve’s aggressive tightening begins to take a toll on the world’s largest economy, investors say. That will set the stage for the likes of the yen, kiwi and emerging-market currencies such as the Brazilian real and Colombian peso to strengthen, according to AllianceBernstein and UBS Asset Management.

The dollar’s resilience has confounded bears who had warned that the currency was headed for a multi-year decline following a surge in 2022. But there’s a growing conviction that they may finally be proven right as easing inflation backs the case for the US central bank to wrap up its rate-hike campaign in the coming months.

“Broadly we would probably assume that the US dollar has had its peak and there might be room for other currencies to perform better in the latter half of 2023-2024,” said Brad Gibson, co-head of Asia Pacific fixed income at AB. This is because the US economy will slow and the Fed is likely to start easing, he said.

The reaction to Wednesday’s cooling US inflation data appear to justify the tide of bearish calls against the greenback. The Bloomberg Dollar Spot Index slumped to a 15-month low, with the gauge now down over 11% from a September peak.

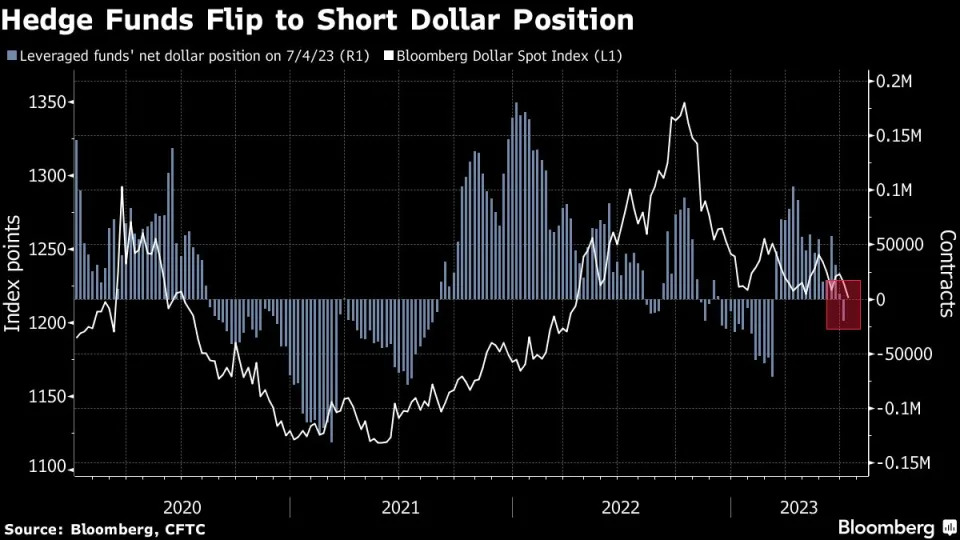

Hedge funds had been bracing for weakness, as they turned net sellers of the dollar for the first time since March, according to data from the Commodity Futures Trading Commission aggregated by Bloomberg.

Against this backdrop, investors are lining up their bets on which currencies will gain from the greenback’s decline. The yen is seen as a prime beneficiary with bulls seeing catalysts from fears of a US recession to narrowing yield differentials to speculation the Bank of Japan may tweak its ultra-loose policy in the coming months.

Jim Leaviss, chief investment officer of public fixed income at M&G Investments which oversees $366 billion, is shorting the dollar against the yen.

“There are lots of currency opportunities out there at the moment,” said Leaviss. “Quite a few of the emerging market currencies look cheap.”

Weaker Dollar

Every Group-of-10 currency has strengthened against the greenback over the past month. The yen rallied 4% in the past five sessions, the Swiss franc rose to the strongest since 2015, while the euro and pound reached their highest in more than a year....

....MUCH MORE

The hedge funds apparently did not read Paul Krugman's recent column, "Wonking Out: De-Dollarization Debunked", illustrated with this graphic: