Today's word is chaos.

From ZeroHedge:

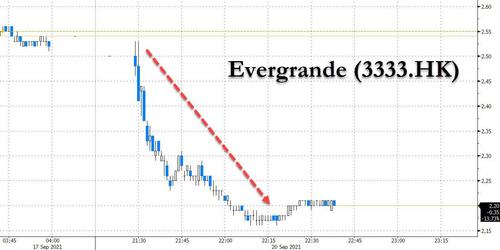

Well, as we warned, the Evergrande contagion has finally arrived and with China closed for holiday traders are getting out while they can and where they can, and on Monday morning in Asia that means Hong Kong, where Evergrande - which is about to default - has crashed by another 13% this morning and is on track to close at its lowest market cap ever (to be expected ahead of a bankruptcy that will wipe out the equity)...

... and with Evergrande property development peers such as New World Development & Sun Kung Kai Properties both down over 8%, and Sunac China and CK Asset plunging over 7%, the Hang Seng property index has crashed more than 6%, its biggest drop since 2020 to the lowest level since 2016...

... and the broader Hang Seng index is down 3.5% in early trading, to the lowest level since November 2020.

And with traders on edge about the rapidly spreading contagion (as we described earlier) even sectors supposedly immune to China's property woes, such as the Hang Seng Tech Index are plunging, sliding as much as 2.7%.

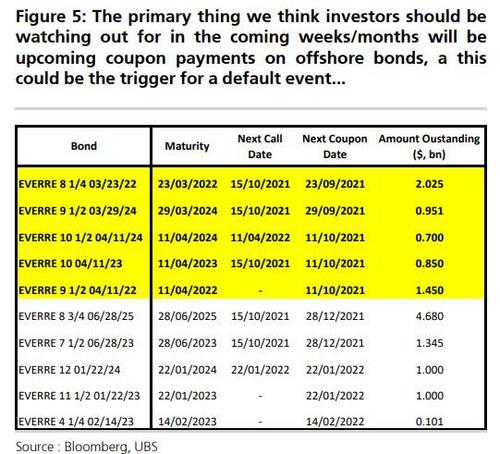

And speaking of Evergrande's imminent default, we noted earlier that while the company is scheduled to pay $83.5 million of interest on Sept. 23 for its offshore March 2022 bond, and then has another $47.5 million interest payment due on Sept. 29 for March 2024, the day of reckoning may come as soon as Tuesday: that's because Evergrande is scheduled to pay interest on bank loans Monday, with a one-day grace period. In other words, should it fail to arrange an extension, it could be in technical default as soon as Tuesday (for a much more detailed analysis of next steps please see "This Is How Contagion From Evergrande's Default Will Spread To The Rest Of The World".) Spoiler alert: a default is coming because Chinese authorities have already told major lenders not to expect repayment.

Incidentally, as Bloomberg's Mark Cranfield notes, Hong Kong stocks can't blame low liquidity for the meltdown as "trading volumes on the Hang Seng and H shares indexes are running well above the 10-day average on Monday as both drop by ~4%."

There's more: junk-rated Chinese dollar bonds slid by as much as 2 cents, according to credit traders, pushing their yield to just shy of 15%, the highest since 2011.

Other sectors are also getting hammered, such as Ping An Insurance, China’s largest insurer by market value, which plunged 7.3% in Hong Kong.

“Investors may be concerned about highly-geared names and don’t care about valuation nowadays,” said Philip Tse, head of Hong Kong & China Property Research at Bocom International Holdings Co Ltd. “There will be further downside” unless the government gives a clear signal on Evergrande or eases up on its clampdown on the real estate sector, Tse said....

....MUCH MORE

Some of our recent links:

"Evergrande Denies Rumors Of Bankruptcy As Crisis Boils Over, Social Unrest Breaks Out Across China"

Bringing to mind one of the better quips in finance:

-Warren Buffett*

Sept. 7The problem with these situations is you don't know how deep the rot goes until the positions start to unwind. That's how a stupid (relatively) little family office, Archegos Capital, came close to causing serious problems, re-re-hypothecated collateral and 100:1 leverage in some of the positions meant no one was really aware of what would happen if the market for the collateral stopped ascending.

In the Evergrande case, if the mess gets into the trillions of US dollar equivalents, the Chinese may need more ammo than they posses to contain the fallout. Hence the question of Fed assistance.

"Attention: The Black Swan In The Center Of Beijing's Tiananmen Square Meant Nothing, Please Go About Your Business".