The commodity trading advisors on their own are not that important ( $300 billion total in managed futures AUM, including FX, ag, metals etc.) but the strategies they use are used by funds around the world with maybe 5x as much capital into the trades. 10-year yield: 1.0760% last I saw.

From ZeroHedge:

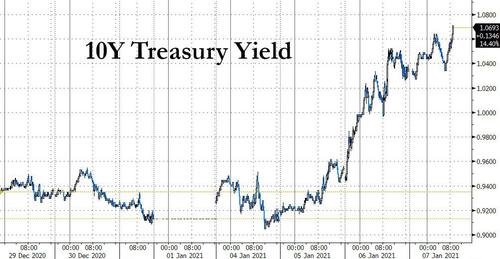

Yesterday's unexpected "blue wave" reality washed over US markets, catalyzing a rise in 10Y Treasury yields past the CTAs' near-term liquidation point of 1.02% (see "CTAs Will Puke Once 10Y Yield Hits 1.02%, Sparking Liquidation Cascade") with yields rising as far at 1.050% at one point...

... a level that has been surpassed this morning with the 10Y yield rising as high as 1.07%.

This jump in Treasury yields, Nomura's Masanari Takada writes today, had ripple effects in other markets, influencing the flow of futures sales through loss-cutting by trend-followers and delta hedging in UST futures (TY) options markets. In the US equity market, on the flip side of concentrated selling of growth and momentum stocks was a conspicuous shift toward high-beta and value stocks, and sentiment in and of itself held solid overall (more on this below) even though as we explained, a 1% increase in yields could hammer PE multiples by as much as 18%.

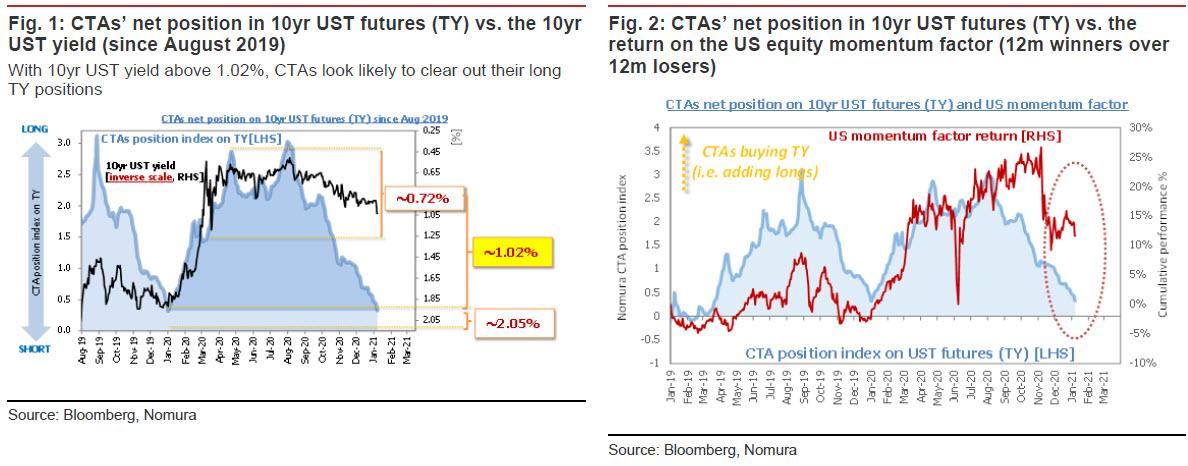

So what does the spike in 10yr yields mean for CTAs’ strategies? To answer this question, Takada highlights two main points.

- Expect lingering pressure on CTAs to sell off their TY long positions at a 10yr UST yield at or above 1.02%.

- While CTAs could even shift to shorting TYs, for this to be sustainable yields would have to remain at or above 1.10% and some sort of macroeconomic theme would need to come into play (such as the Fed abandoning its accommodative stance). This looks somewhat far-fetched as things stand.

Some more details on these two points from a quantitative standpoint.

Regarding the first point, Takada estimates that CTAs have been sporadically cutting losses since 10yr UST yields reached around 1.02%, and they appear likely to keep closing out long positions with yields at 1.02% or higher. Even if other investor types (such as those with longer-term horizons) buy USTs on dips and push yields back below 1.02%, CTAs look likely to unwind their TY long positions heading toward the end of January, as TY longs have already lost much of their allure (Figure 1).

Regarding the second point, one cannot rule out the possibility that CTAs could turn short on TYs out of a surplus of momentum. In such an event, however, 10yr UST yields would need to remain above 1.10% at least (Figure 3).....

....MUCH MORE

Yesterday:10-Year Note Yield Hits 1.0540%, Highest in Ten Months

And Who Does The Steepening Yield Curve Benefit? (BKX)