The great thing about ESG is that the definitions are so vague it can be practically anything you want it to be.

This is one of the reasons the largest of the asset gatherers, the BlackRock's of the world, and the indexers, the S&P's, are so attracted to those three little letters, they want to be the arbiters of what can carry the imprimatur.

It's also a very au courant product to sell.

From Upfina:

As part of its monetary policy, the Swiss National Bank owns $100 billion in U.S. stocks. A central bank buying stocks is a slippery slope because the unintended consequences are unknown. Having a small bid under U.S. shares doesn’t concern any bulls though. If they were to buy more shares and then suddenly sell them all at once creating a decline, it would cause an uproar. Some say the SNB would never sell their shares. That could be false very soon.

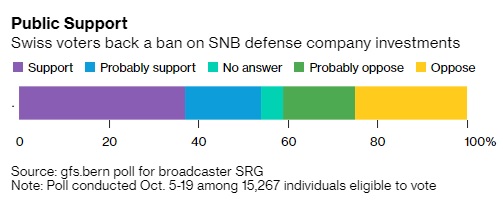

There will be a national vote on November 29th over whether the SNB needs to sell its shares in defense firms. This could cause them to selloff. The proposal to force the SNB to sell shares in firms that derive more than 5% of their sales from arms is supported by 54% of Swiss citizens and opposed by just over 40%. The SNB will need to sell its shares in 300 firms which together are worth 11% of its portfolio of global stocks.

This is another slippery slope because morality might not stop there. It’s possible the voters are asked to decide on an ESG ranking for the central bank’s positions in the future. It’s almost like they are passive shareholders in an index that takes out the stocks which aren’t deemed moral. Normally, many investors would say to try to maximize profits, but in this case, it’s the central bank owning the shares. There doesn’t seem like much downside for voters to support selling defense stocks. We don’t know when the sales will occur, but we do know when the vote happens, it should impact prices immediately. It will be a widely covered story.....

....MUCH MORE

Just don't mention to your friendly neighborhood RIA the duplicity of presenting oneself as a proponent of passive investing and and at the same time pitching the activity inherent in ESG.

They twist themselves in such knots trying to justify the dichotomy that they risk putting pretzel makers out of business.