Global Value Chains, And Who Is Most Exposed

Via ZeroHedge:

An acquaintance of ours is in the plate and glassware trade,

supplying luxury hotels and resorts in the US with Chinese-made

tableware. From our conversations over the years we have

learned this is a really good business. Orders tend to be custom made

since the hotel/resort typically wants their name on the items. That

means nice margins for our friend. And, of course, plates and glasses

break during normal usage in a commercial setting. So demand is pretty

constant, even outside of replacement/upgrade cycles.

When the US and China first started levying tariffs, we asked him what he was doing to offset the incremental expense. His

reply: “No man… I don’t have to deal with that. Plates and glasses

aren’t on the tariff list. All my customers think it’s because your

President buys a lot of plates for his resorts and hotels.”

With that, he changed the topic to why Hermes men’s loafers are so much better than comparable Gucci footwear. As we said, he does well with plates and glasses.

That exchange has stuck with us, and a recent World Trade

Organization report on global value chains reminded us that things are

rarely as straightforward as our friend portrayed. Plates and

glasses are an example of simple value chain: discreet products produced

in one country and bought by another. But in reality that’s not how

global trade typically works, as the report shows.

Here are our 3 key takeaways from the WTO report of interest to investors just now (link at the end of this section):

#1. “More than two thirds of global trade occurs through

global value chains (GVCs), in which production crosses at least one

border, and typically many borders, before final assembly.” The historical growth patterns for these multi-country value chains look like this:

- “From 2000-2007, GVCs (especially complex ones) were expanding at a faster rate than other components of GDP.”

- “During the global financial crisis there was naturally some

retrenchment of GVCs, followed by quick recovery (2010 – 2011) but since

then, with the exception of 2017, growth has, in the main, slowed.”

Takeaway: as with so many other things the Financial

Crisis left a lasting mark on global trade, slowing the growth of

complex multinational supply chains. You’ve probably seen some

scary charts recently about the decline in global trade over the last

few years – the slowing expansion of GVCs plays an important part in

that.

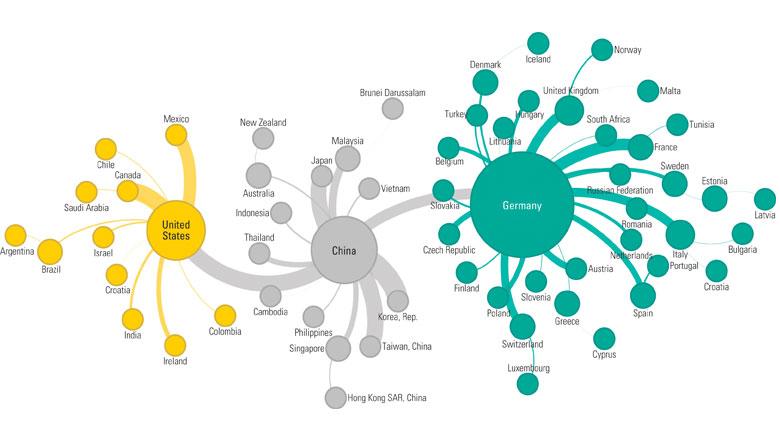

#2: There are distinct loci of GVC concentration, both by industry and geography:

- “GVC linkages are especially important for high-tech sectors and

it is in these areas that we see highly complex value chains involving

many countries.”

- “Between 2000 and 2017, the weight of intra-regional GVC activities

in “Factory Asia” came to exceed that of “Factory North America”. Over

the same time, however, both North America and Europe became more

interconnected via GVCs with China.”

- The WTO paper makes a distinction between “complex” GVCs, where the

US and Germany are the most important hubs, and “simple” GVCs where

China has the lead because it is both a source of demand and supply....

....

MORE