From ZeroHedge:

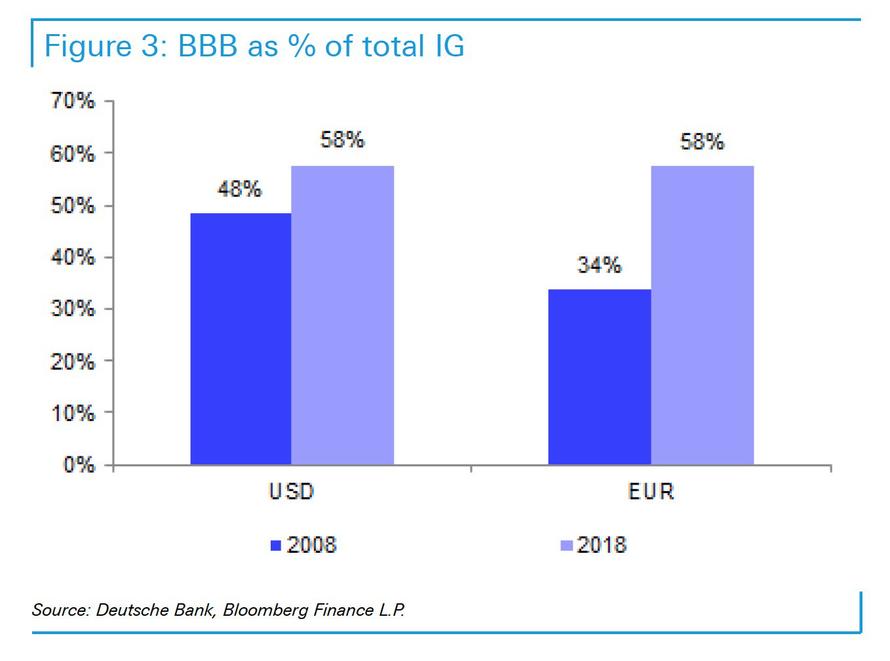

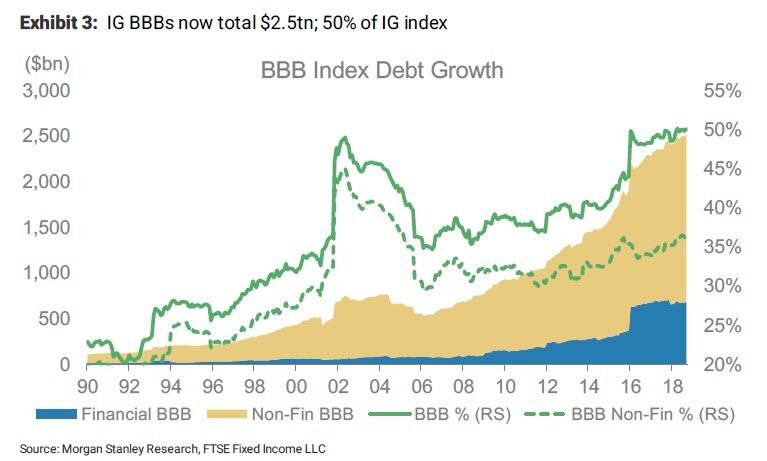

Over the past year, one of the key concerns to emerge in the $6.4 trillion investment grade corporate bond market is when and how will BBB-rated bonds, which now comprise 60% of all outstanding IG names in the US, be downgraded and whether a new financial crisis will follow

We addressed this issue most recently in "The $6.4 Trillion Question: How Many BBB Bonds Are About To Be Downgraded" while the broader question of the "next bond crisis" was address in "Over $1 Trillion In Bonds Risk Cut To Junk Once Cycle Turns." It wasn't just us, however, with financial luminaries, regulators and investors such as the Fed, the BOE, the IMF, Oaktree's Howard Marks, Doubleline's Jeff Gundlach, JPMorgan, and Guggenheim all warning that the "fallen angel" threat is arguably the most serious challenge facing the US corporate bond market during the next recession.And now, it's the turn of the central banks' central bank, the Bank of International Settlements, to join the bandwagon, warning that the surging supply of corporate debt in the riskiest, BBB investment-grade category has left markets vulnerable to a crash once economic weakness triggers a bout of rating downgrades, and sends over $1 trillion in IG bonds, or fallen angels, right into junk bond purgatory.

Highlighting numbers which have been discussed previously, the BIS notes that in 2018, BBB-rated bonds accounted for about 45% of U.S. and European mutual fund portfolios, up from only 20% in 2010, according to the BIS, and cautions that due to rating trigger limitations, many investors may have to sell those bonds if they fall out of the investment-grade scale....MORE

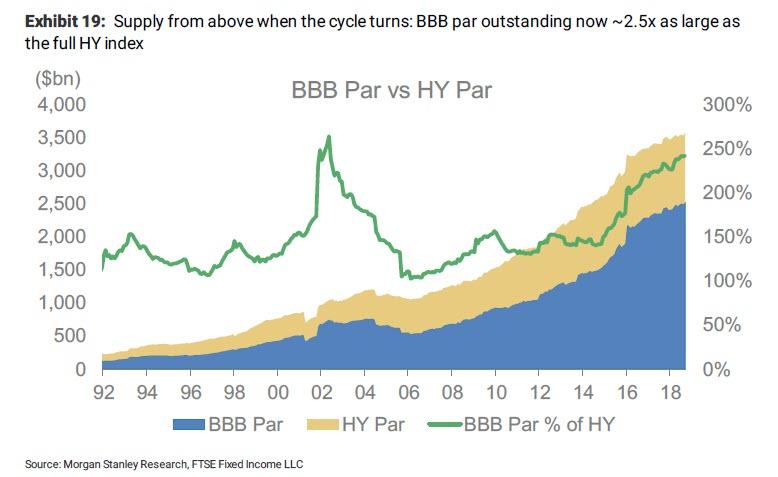

And, once an economic downturn prompts credit-rating cuts, this could trigger a market crash as investors dump newly ineligible debt from their portfolios, according to the BIS, precisely what we warned about last October warning that over $1 trillion in bonds could be downgraded during the next downturn, effectively doubling the size of the entire US junk bond market.

The BIS' warning boils down to this: a wave of downgrade would result in a liquidation firesale as all those who held on to hundreds of billions in IG debt are suddenly forced to liquidate, potentially resulting in a bidless market:

“If, on the heels of economic weakness, enough issuers were abruptly downgraded from BBB to junk status, mutual funds and, more broadly, other market participants with investment grade mandates could be forced to offload large amounts of bonds quickly,” wrote analysts at the the Basel-based institution in a quarterly report.

“While attractive to investors that seek a targeted risk exposure, rating-based investment mandates can lead to fire sales.”...

On June 26, 2007 (i.e. pre-"Quant-quake", pre-Bear Stearns, pre-ought-eight-near-catastrohe) we posted a short little piece:

"(Off-topic) Banks' banker warns of downturn":

June 2008THE risk of a 1930s-style economic slump has been heightened by "euphoric" markets tapping cheap global credit, one of the world's pre-eminent financial institutions has said.In its annual report, the Bank for International Settlements noted that the conditions that led to the Great Depression of the 1930s and the Asian crises in the 1990s reflected the current environment.From The Age

BIS: Don't Worry, Inflation Not a Problem Because Global Economy Will Crash

May 23, 2013

Evans-Pritchard: "BIS and IMF attacks on quantitative easing deeply misguided warn monetarists"

I didn't see the BIS comments as an attack, just a heads up on what's going on.* I don't really care what the IMF says....

So yes, we listen, even if, as in that last case they can be early, the BIS seems to understand this central banking stuff.