From Bloomberg, Dec. 30:

Going long U.S. utilities, managed care and short-term U.S. Treasuries worked, as did shorting euro-zone banks, blockchain and Bitcoin.

Hindsight Capital LLC: End-of-Year Report for 2018.

As this is the last Points of Return of 2018, it is time once again to visit my friends at Hindsight Capital LLC. For readers who have not read my work from before I arrived at Bloomberg, I should explain that Hindsight Capital is a very special hedge fund, able to invest using a strategy that beats all others every year without fail: hindsight. It only puts on the trades at the beginning of the year that it knows will, with the benefit of hindsight, prove to be the best.

Naturally, the rewards for such a fund are potentially infinite, so there some limits imposed. There is no use of leverage (otherwise, returns would be infinite), no single stocks and no trading on the basis of anything that wasn’t knowable at the beginning of the year. For example, trading on the basis of a forthcoming earthquake is not allowed. And there is no trading during the year, with the exception of one opportunity to sell at June 30 — which turned out to be handy in 2018. The fund is allowed to sell short, thus betting that a security will go down.

As you probably have figured out, Hindsight Capital does not exist. Nobody in the real world would take the kind of risks that it can take. But I still enjoy the exercise, which yields some interesting insights. Here, then, are Hindsight Capital’s trades for 2018.

Long U.S. utilities, short Chinese technology.

One big problem permeated the year: It was almost impossible to make any serious money on the “long” side. Global stocks sank into a bear market. Commodity prices fell and bond yields rose in what many proclaimed the beginning of a secular bear market in fixed-income assets. And the dollar rose. The trick lying behind a number of Hindsight’s trades was to get on the right side of “America First” — in other words, to bet against securities that were pummeled by U.S. trade measures and tighter money, while investing in the rather smaller number of domestically focused U.S. names that were immune to international pressures and benefited from the strong U.S. economy.

Betting on the inverse of the “Trump trade” yielded money wherever Hindsight looked. It was evident that President Donald Trump was going to move on to his trade agenda in his second year in office, and that the agenda was more about technology and security than about trade per se. To bet on investors taking cover as a trade war morphed into a tech war with China, Hindsight shorted the CSI 300 Technology Index (-41 percent in dollars) and put the money into U.S. utilities (which made a boring 4.4 percent and remains insulated from all trade concerns). Putting the two trades together netted a return of 74.5 percent.

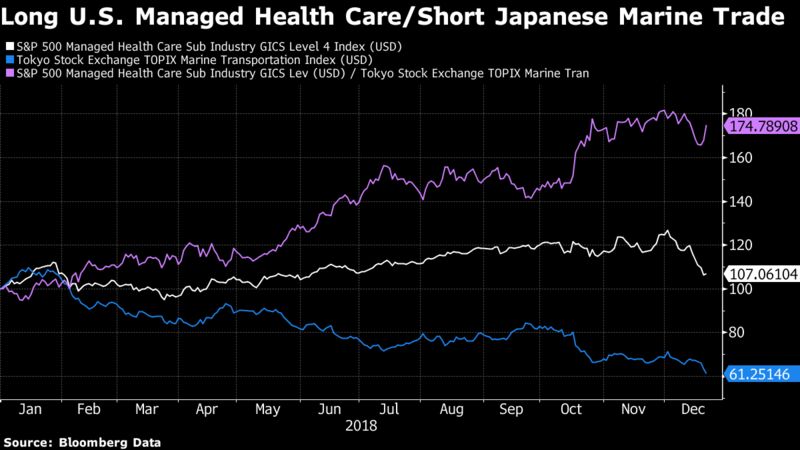

Long U.S. managed care, short Japanese marine trade.

Managed care stocks benefited from Republicans’ failure to repeal Obamacare in 2017. They’re a safe long-term bet thanks to the aging population, and their business provided protection against any trade repercussions. Meanwhile, Hindsight foresaw raw fear over a U.S.-China trade war. And no sector stands to lose more from a big reduction in trans-Pacific trade than Japan’s big shipping companies. So, long the S&P 500 Managed Care Index (+7.2 percent) and short the Topix Marine Trade Index (-39 percent) yielded a 75 percent return.

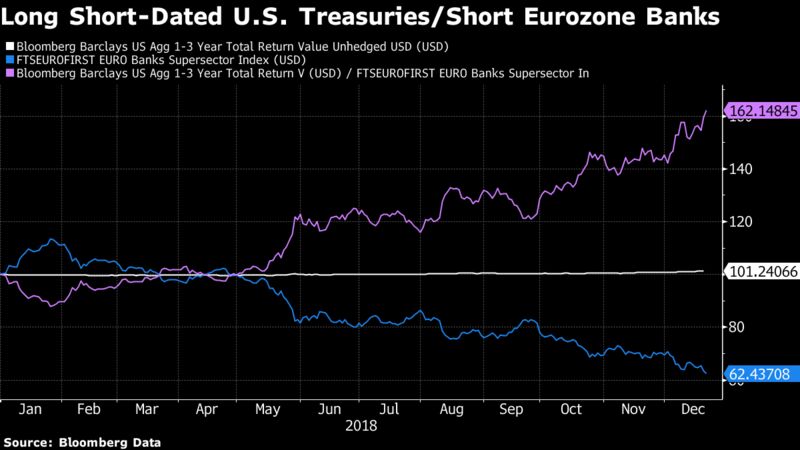

Long short-dated U.S. Treasuries, short euro-zone banks.

Hindsight foresaw that tighter monetary policy in the U.S., which should be bad for the price of bonds, would by the year-end spark enough of a flight to safety that returns on short-dated bonds would be slightly positive. Meanwhile, no sector was pummeled more by a stronger dollar, the repatriation of U.S. tech companies’ profits that had been parked overseas, and reduced dollar liquidity than the euro-zone banks. Many other financials were pounded during the year, including those in the U.S. But the banks of the euro zone, already bloated and with Deutsche Bank in serious trouble, had the most terrible year of all. Long the Bloomberg Barclays Treasuries Index (+1.25 percent) and short the FTSE-Eurofirst Eurozone Banks Index (-37.5 percent in dollars) yielded a 62.1 percent return.

Move to Buenos Aires....MUCH MORE

Money illusion is always your friend. Each year, Hindsight moves to the capital of the country whose currency enjoys the weakest year, as this will automatically flatter the returns....

I must say, long U.S. healthcare/short Japanese shipping, did not jump out at one as a pair trade but, in hindsight...