From ZeroHedge, January 16:

If one asks traders what was the common market theme over the fourth quarter, among the various (often angry) answers, one will stand out: general prevailing chaos, manifesting itself in soaring volatility which coupled with record low liquidity and a sharp pick up in trading volume, resulted in disjointed, erratic price action that crushed all momentum and trend-following strategies (which these days is most of them).

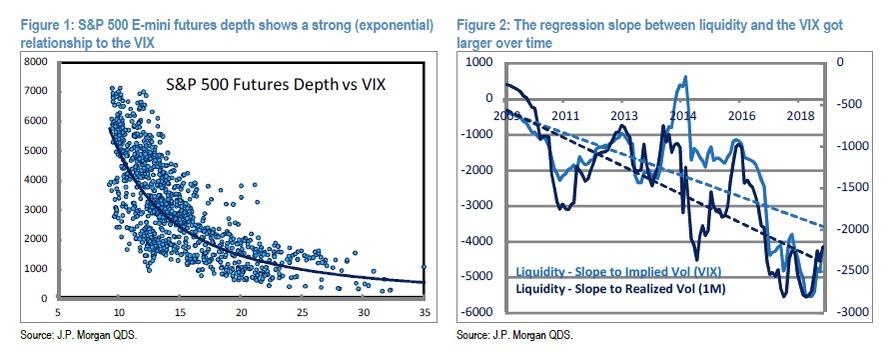

Commenting on this phenomenon among others, two weeks ago JPMorgan quant Marko Kolanovic said, correctly, that "liquidity has become to a large extent driven by market volatility" reinforcing a negative feedback loop between volatility, liquidity and investors flows, and as the most recent examples he cited the unprecedented drop in futures market depth or "record low liquidity" we discussed previously (shown in the chart below), the currency flash crash on Jan 2, or the equity market “upside crash” on December 26.

This topic was then picked up by Goldman, which expanded an this analysis by accounting for the third spoke of the market's unholy trinity, namely trading volume, and how it impact the reflexive feedback loop between liquidity and volatility (readers can reread Goldman's comprehensive market structure assessment at the following post).

So in a follow up attempt to explain the nuances of the recent violent market moves (in response to what appears to have been significant client confusion as most investors are still unaware that in the new abnormal, "liquidity is the new leverage" as Goldman Sachs explained last July), JPM's head quant Marko Kolanovic has published one of his most in-depth, and objectively informative, notes in months elaborating on the feedback loop between volatility, liquidity, and flows, a loop which he calls simply "market fragility" (something Goldman has also repeatedly touched upon, most recently in "Goldman: 2019 - Lower Liquidity, Higher Vol, More Fragile.")

By way of background, Kolanovic says that "interest for this topic comes from various clients – those that are assessing the impact of flows to the broad market and their portfolios (fund managers), those that position for and anticipate these flows (speculators), and those that are assessing the robustness of different systematic investments (investors)."

So in order to provide some additional clarity to clients, first the quant demonstrates the link between Volatility and Liquidity, something he did several weeks ago, while demonstrating how market depth – the key measure of liquidity – got decidedly worse over the past decade as central banks took over.

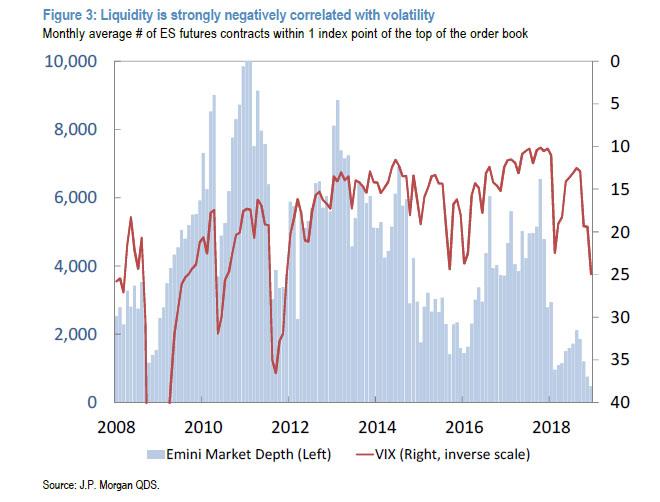

Figure 1 shows the relationship between S&P 500 futures market depth and the VIX. One can notice that this relationship is very strong and nonlinear (e.g., market depth declines exponentially with the VIX). Given that an increase in volatility often results in systematic selling, this relationship is the key to understand market fragility and tail events. The second question was if this relationship was always the same or the situation got worse over time. To answer this we show the historical relationship between liquidity and the VIX over time (Figure 2, rolling regression slope between liquidity and the VIX). One can see that the negative relationship between liquidity and the VIX got worse over the past decade (note that an exponential relationship can be locally approximated with a linear relationship and tracked over time).

Finally, we note that at times of high volatility, the VIX is almost the sole driver of market liquidity. Figure 3 shows the % of liquidity variation that can be explained with the VIX over time (rolling R-squared). The higher the VIX, the more liquidity is driven by the VIX, and recently up to ~80% of liquidity variations were explained by the VIX. To conclude, we showed that there is a negative relationship between volatility and liquidity, that this relationship is getting stronger over time, and that it is particularly strong during times of elevated volatility.

Having covered the two core spokes of modern market (mal)function, namely liquidity and volatility and their constant interplay, Kolanovic than shows that volatility also plays a significant role in determining the flows from various systematic strategies (he defines systematic flows to include derivatives hedging flows, passive and quantitative investment strategies flows, insurance industry and programmatic market making flows).......MORE