"The State of European Tech 2017: Record funding and an intensifying battle for talent"

From TechEU:

Europe is on track to end 2017 with a record $19 billion worth of tech investments, according to a report from VC firm Atomico, meanwhile the European tech industry is in the midst of a ‘Battle Royale’ for talent that is showing no signs of slowing down.

The State of European Tech 2017

was published this week at the Slush conference in Helsinki. It has

collated data from surveys, Dealroom.co, LinkedIn, Stack Overflow, EIF,

and several other sources to provide a comprehensive guide to the health

of the European tech industry, from investment to regulation and talent

shortages to gender diversity.

Record year for funding

In 2017, $19 billion was invested in European tech companies, up from

$14.4 billion in 2016. Data for the remaining weeks of the year is

based on projections. There were more than 50 funding deals that crossed

the $50 million line, including The Netherlands’ Picnic, which secured $110 million and Spain’s Cabify taking in $100 million. There are now 41 tech companies in Europe that are valued at more than a billion dollars, such as Angry Birds maker Rovio (which went public this year) and Slovenian gaming company Outfit7, which was acquired for $1.1 billion.

The UK is still the biggest recipient of VC funding, taking in $5.4

billion in 2017 ($2.5 billion for Germany and $2.1 billion in France).

However, there were more deals closed in France this year than in the

UK.

Deep tech, in particular, has caught people’s attention. Investors

have pumped $3.5 billion into the field – robotics, AI, blockchain,

autonomous vehicles – in 2017 (up 40% from last year). Examples include

Improbable raising more than $500 million from Softbank.

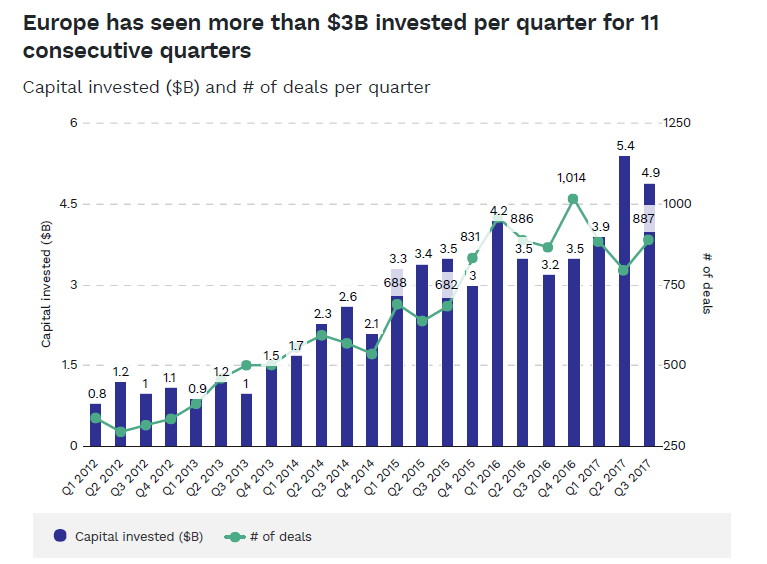

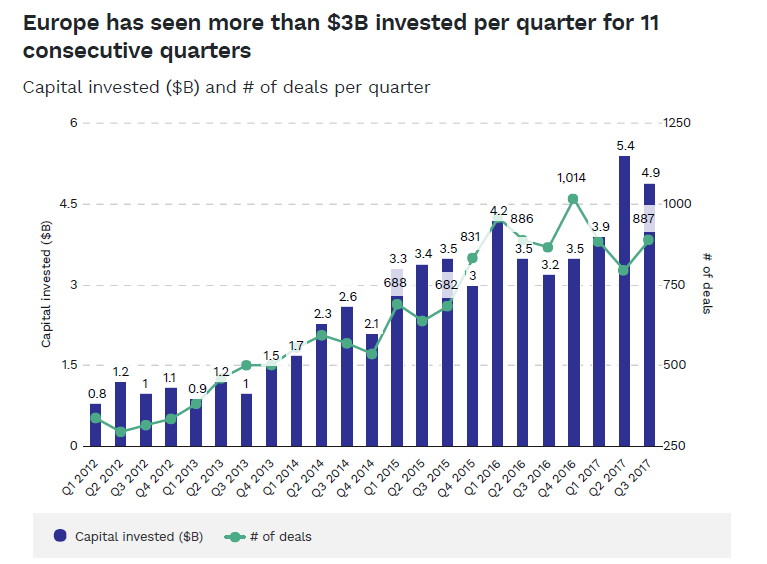

More than $3 billion has been invested in Europe per quarter for 11

consecutive quarters with fintech being one of the biggest verticals

that VCs are putting cash into. There was however a decline in the

number of deals below $2 million.

The median Series A round is now $5.5 million, up from $3.3 million

five years ago. The competitive landscape among VCs in Europe has pushed

this average up.

There’s more cross-border investment activity with 33% of investments

made by European VCs going into companies in other countries. The big

four cities of London, Berlin, Paris, and Stockholm still dominate but

there has been a steady growth in the capital invested in so-called

second tier cities like Amsterdam, Munich, Oslo, and Barcelona.

In terms of investment per capita, Europe is still far behind Israel

and the US but there’s also been an increase in the number of Asian

investors putting money into Europe....MUCH MORE