Ooops, wrong topology, this post is about 'puters and networks and nodes, oh my.

A repost from July 2016:

I don't personally like the idea of preventing crashes since they present opportunity not seen in the humdrum day-to-day but it's good to know what smart folks are talking about in-between nibbles of the canapés.

From Nautil.us:

New regulations are applying network science to restructure global finance.

Could Kevin Bacon have saved us from the 2008 financial crisis? Probably not. But the network science behind six degrees of Kevin Bacon just well may have.

According to the famous saying, every movie actor is separated from Kevin Bacon by six degrees of separation or less, going from co-star to co-star (actually most are separated from Bacon by only three degrees). Actors form a “small-world” network, meaning it takes a surprisingly small number of connections to get from any one member to any other. Natural and man-made small-world networks of all kinds are extremely common: The electric power grid of the western United States, the neural network of the nematode worm C. elegans, the Internet, protein and gene networks in biology, citations in scientific papers, and most social networks are small.

Most of these small networks use hubs, or nodes with an especially large number of links to other nodes. Kevin Bacon is a hub, because he’s starred in so many movies. The RMG neuron in C. elegans’ tiny brain is also a hub and coordinates its social behaviors (such as they are). Hubs make small-worlds small by supplying shortcuts between otherwise distant nodes. And that can be a very good thing.

After the 1978 Airline Deregulation Act phased out government control, for example, airlines moved to hub-and-spokes flight routing. Airfares went down and occupied seats rose from 50 to 85 percent of the total. When Lowe’s hardware stores switched to a hub-and-spoke distribution system in the early ’90s—by creating one 30-football-field-big center to serve every hundred or so of its stores—it cut distribution costs by between 40 and 50 percent.

This efficiency comes from the way small networks consolidate complex operations. Links can be expensive to build and maintain, and small networks have fewer of them. Networks based on hubs and spokes are also simple, and robust against random node failures—since most nodes are not hubs and therefore not so crucial to the network’s operation.Unless you’re an aficionado of finance, I’ll bet that you haven’t heard the words “topology” and “2008 financial crisis” in the same sentence.

Which brings us back to Kevin Bacon and 2008. You’d think that, if you were designing a really important network, like, say, the global financial system, you’d want to use a small-world network, with a very small number of hubs. That is not, however, what our financial networks looked like—until recently.

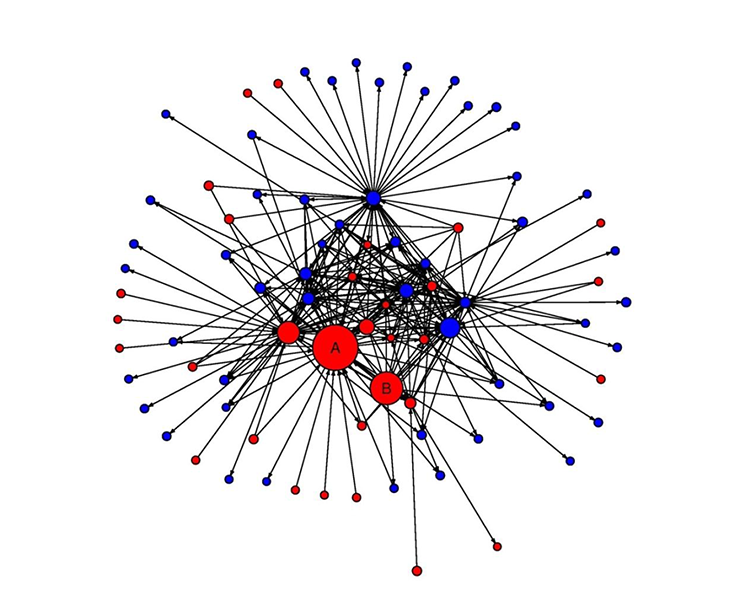

In 2013, then Vice-Chair of the Federal Reserve Janet Yellen showed what looked like a tangled ball of yarn to a roomful of economists1:

The messy-looking figure represented the credit default swap (CDS) market network, and looked like too many cords crammed into too small a drawer. The tangle results from the way banks have traditionally traded which each other, called OTC for “over-the-counter”: directly, freely, whenever, and however they wished. It’s the way most derivatives have been bought and sold since the 1970s, when a boom in derivatives made them the world’s largest market. Today, far more money flows through the financial system from derivatives trading than from all the world’s stock and bond markets combined.2,3,4

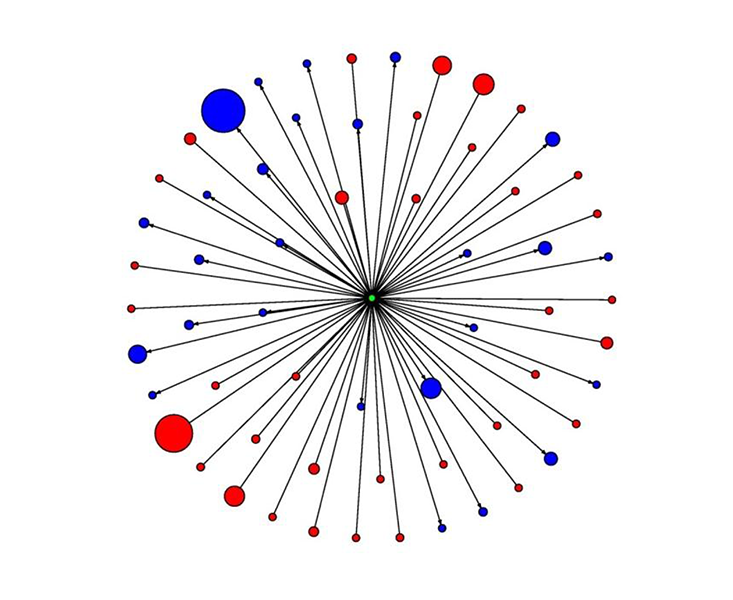

Yellen took issue with her ball of yarn’s tangles. If the CDS network were reconfigured to a hub-and-spoke shape, Yellen said, it would be safer—and this has been, in fact, one thrust of post-crisis financial regulation. The efficiency and simplicity of Kevin Bacon and Lowe’s Hardware is being imposed on global derivative trading.

In the wake of the crisis in September 2009, the leaders of the G20 (the main economic council of developed nations) met in Pittsburgh and acted to impose hub-and-spoke networks.5 They agreed to impose something called the “clearing mandate” on the OTC derivative market—a regulation meant to make the financial system safer by making hubs and spokes mandatory. The mandate works by requiring that all standard OTC derivatives be traded on exchanges and cleared through central clearing counterparties, or CCPs. CCPs are simply companies that stand between the buyers and sellers of derivatives. In 2010, the Dodd-Frank law codified this requirement in the U.S. Other countries have since followed suit. Now, in contrast to the free-for-all that dominated derivative trading before, most of the time, when Bank A wants to buy derivative X from Bank B, B must first sell X to a CCP, which then turns around and sells X to A....MORE

And that requirement takes the CDS network in Yellen’s first picture, and combs it out to the tidy hub and spoke of her second, with the CCP at the hub.

Implementation of the mandate is still a work in progress, but mostly it’s a done deal. Interest rate derivatives comprise nearly 80 percent of the OTC market and now, because of the mandate, CCPs like CME Clearing in the U.S. and LCH Clearnet’s Swapclear in Europe are clearing 70 percent of the interest rate derivatives traded each week.6 Credit derivatives are even further along, at 79 percent. Yellen considers this progress toward making the system safer.

But is it?...