But there's already a Banco Amazonas and it doesn't belong to Bezos.

La Banque Walmart du Canada on the other hand...

From Money & Banking:

Walmart and Banking: It's Time to Reconsider

Guest post by Professor Lawrence J. White, NYU Stern School of Business

Overshadowed by the media attention to the proposed repeal of Obamacare, the House Financial Services Committee recently approved substantial changes in financial regulation. The House of Representatives may soon consider the proposed bill—the Financial CHOICE Act—which would make major changes in the Dodd-Frank Act.

However, when financial regulation is being discussed, there is a large elephant that isn’t in the room, but really should be: Walmart. Starting in the mid-1990s, Walmart made two separate efforts to enter banking in the United States, but was repelled both times. After its second effort was rebuffed in 2007, Walmart gave up this effort in the United States (but has since entered banking in Canada and in Mexico).

One question to ask might be, “Why should Walmart be allowed to enter banking?” But a more relevant question would be, “Why shouldn’t Walmart be allowed to enter banking?”

After all, the U.S. economy is generally market-oriented, and entry is generally recognized as potentially beneficial for consumers, as entrants can bring new ideas, innovations, and efficiencies to the market. Of course, incumbents usually don’t like the idea of entrants’ disrupting the status quo; and often those incumbents lobby for regulation and/or legislation that creates barriers to entry. But, for most markets, the presumption in broad U.S. economic policy is that entry should be encouraged—or at least, that policy should be neutral between incumbents and entrants—so that the benefits of entry can be enjoyed by consumers.

Of course, banking is special—as the regular readers of this blog are well aware. And how the specialness of banking and the presence of Walmart in banking can be reconciled must be addressed, and will be addressed below.

But first, consider what the entry of Walmart into banking might well achieve: Walmart is well known for providing reasonably priced goods to low- and moderate-income households. Its position as the largest company in the United States—as measured by sales and by employment—is a testament to that reputation.

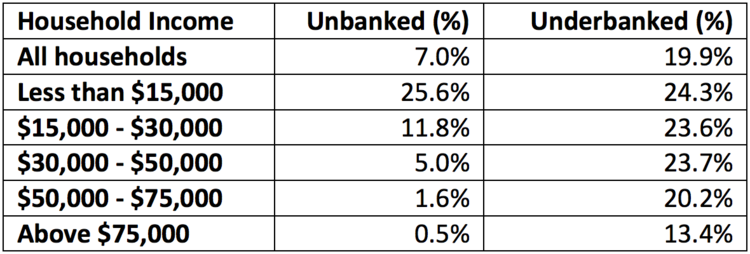

But it is exactly this demographic group—low- and moderate-income households—that is most in need of reasonably priced financial services. The percentage of U.S. households that are unbanked (i.e., do not have a bank account) or underbanked (i.e., have an account but rely on non-bank providers for some financial services and products) has been a longstanding policy concern. The most recent data (from a FDIC report that covers 2015) in this regard—based on a survey of more than 36,000 households nationwide—show that 7% of all households were unbanked and an additional 20% of all households were underbanked. Unsurprisingly, the percentages are substantially larger for low- and moderate-income households (see table).

Unbanked and underbanked households (Percent of total), 2015

Note: Unbanked households have no bank account. Underbanked households have an account but rely on non-bank providers for some financial services. Source: FDIC National Survey of Unbanked and Underbanked Households, 2015 (October 20, 2016)

Further, since 2009 (when the FDIC first began reporting these data), the percentage of unbanked households has declined only modestly, while the percentage of underbanked households has actually increased.....MORE

It is worth remembering that these percentages are present in a financial system where (as of year-end 2016) there were over 5,100 commercial banks, another 800 savings institutions, and an additional 5,900 credit unions! And the total number of branch offices of all of these financial institutions exceeded 90,000!

So, given Walmart’s general business strategy, it seems likely that the entry of Walmart into banking would lead it to extend more financial services to its primary clientele—and thus improve financial access for an underserved group.

It is also important to remember what Walmart is not known for. There have been few (if any) media stories of abusive sales practices toward its customers. And, Walmart has never been accused of predatory pricing: maintaining super-low prices until other retailers go out of business, and then raising its prices to monopoly levels.

Accordingly, it seems quite unlikely that the Walmart Bank would engage in such practices in the financial sphere. Given the recent revelations of unsavory practices at Wells Fargo (as well as the continued concerns over practices at payday lenders and mortgage servicers), this is a nontrivial claim.

But, as I noted above, banking is special. We expect banks to be operated in a safe-and-sound manner, such that the likelihood that they would fail—and cause losses to their creditor-depositors (or to the deposit insurer that backs them)—should be quite small. And the elaborate system of prudential regulation for banks is a reflection of that expectation.

So, how would the entry of Walmart—and, presumably, other non-financial companies that are interested in entering banking—fit into that system of prudential regulation?...