WTI $49.37, off 51 cents last.

From Bloomberg View, June 28:

Back in February 2015, the price of West Texas Intermediate stood at about $52 per barrel, half of its 2014 peak. I argued then that a renewed decline was coming that could drive it below $20, a scenario regarded by oil bulls as unthinkable. But prices did fall further, dropping all the way to a low of $26 in February. Since then, crude rallied to spend several weeks flirting with $50 per barrel, a level not seen since last year. But it won't last; I’m sticking to my call for prices to decline anew to $10 to $20 per barrel.

Recent gains have little to do with the fundamentals that led to the collapse in the first place. Wildfires in the oil-sands region in Canada, output cuts in Nigeria and Venezuela due to political unrest, and hopes that American hydraulic fracturing would run out of steam are the primary causes of the recent spurt.

But the world continues to be awash in crude, and American frackers have replaced the Organization of Petroleum Exporting Countries as the world’s swing producers. The once-feared oil cartel is, to my mind, pretty much finished as an effective price enforcer. Even OPEC’s leader, Saudi Arabia, is acknowledging the new reality by quashing recent attempts to freeze output, borrowing from banks and preparing to sell a stake in its Aramco oil company as it tries to find new sources of non-oil revenue.

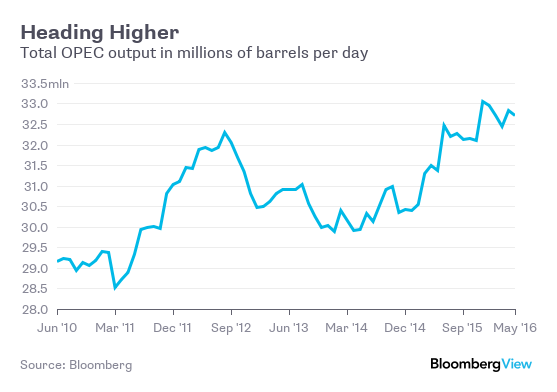

The Saudis and their Persian Gulf allies continue to play a desperate game of chicken with other major oil producers. Cartels exist to keep prices above equilibrium, which encourages cheating as cartel members exceed their allotted output and other producers take advantage of inflated prices. So the role of the cartel leader, in this case Saudi Arabia, is to cut its own output, neutralizing the cheaters to keep prices up. But the Saudis suffered market-share losses from their previous production cuts. OPEC has effectively abandoned restraints, with total output soaring to as high as 33 million barrels per day at the end of last year:

Iran, freed of Western sanctions, plans to double output to 6 million barrels a day by 2020, which would make it the second-largest OPEC producer behind Saudi Arabia. Russia continues pumping to support its economy after the collapse in oil prices devastated government revenue and export earnings. War-torn Libya is also ramping up production as best it can.

The International Energy Agency predicts that even with a successful OPEC production freeze, if U.S. frackers cut production by 600,000 barrels a day this year and a further 200,000 barrels per day in 2017, excess supply would run at 1.5 million barrels a day until 2017. That’s a continuation of the recent oversupply of 1 to 2 million barrels a day.

The price at which major producers chicken out and slash production isn’t determined by the prices needed to balance the budgets of oil producing nations, which are as high as $208 per barrel in Libya and as low as $52 per barrel in Kuwait. Nor is it the "full cycle" or average cost of production that includes drilling costs, overheads, pipelines, etc.

In a price war, the chicken-out point is the price that equals the marginal cost of producing oil from an established well....MORE