The fact that stands out about all the commodity fund failures is they didn't get to the short side, either in time or ever, which raises the question: Were they getting paid 2-and-20 on the way up for what was essentially leveraged beta?

For folks with a darkly realistic sense of humor the funny thing is, for the whole decline in the CRB from 370+ in 2011 to the Feb. 11 low around 155, the margin clerks were making the right trade with every sell-out and not charging a percentage to do it.

Tee-hee.

From Bloomberg:

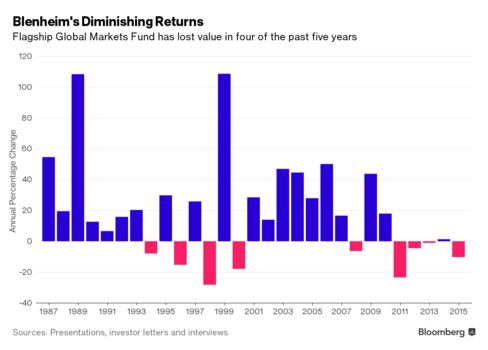

- Flagship fund has been down in four of the last five years

- Assets under management have fallen nearly 85% to $1.5 billion

Thirty miles west of Wall Street, in an anonymous office park set among rolling hills and shady streets, lurks a giant of the commodities world.

Behind the bland facade in Berkeley Heights, New Jersey, lies the headquarters of Willem Kooyker, one of the most powerful and enigmatic traders in the game.

For half a century, Kooyker has quietly ridden the ups and downs of oil, copper, cocoa and more, first in his native Holland and later at Commodities Corp., the legendary trading-company-cum-think-tank that served as a training ground for market wizards Paul Tudor Jones, Louis Bacon and Bruce Kovner.

Only now, at 73, Kooyker is struggling to contain the damage from a commodities collapse that even he never saw coming.

Before the worst hit -- $20-a-barrel oil no longer sounds so crazy -- Kooyker’s hedge-fund firm was already hemorrhaging billions in assets, people close to his operation say. With returns at Blenheim Capital Management LLC’s flagship fund down for four out of the past five years, some investors are heading for the exits.

The numbers tell the story. At its height in 2011, Blenheim was the world’s largest commodities-focused hedge fund, with $9.1 billion in assets, people familiar with the firm say. Today, its assets have fallen nearly 85 percent to $1.5 billion.

What went wrong? The short answer is that Kooyker didn’t think things would get this bad. He and his colleagues underestimated the economic troubles in China and never thought commodities prices would fall so far, so fast, the people said, speaking on the condition they not be named to avoid jeopardizing business relationships.

It’s a remarkable turnabout for Kooyker, whose tenure atop Commodities Corp. in the 1980s set the stage for two wildly lucrative decades at Blenheim. In 1999, for instance, as oil sank below $10 a barrel, Kooyker bet that commodities would bounce back -- and his hedge fund soared nearly 109 percent. Billions of investor dollars poured in.

Few outsiders had any idea what Kooyker was up to. Most still don’t. He’s long operated under the radar, arguing that any publicity, good or bad, only hurts investment returns.

Most Secretive

“They are the most secretive I have ever met," Christoph Eibl, chief executive officer of the $800 million commodity investor Tiberius Asset Management AG, said of Blenheim.

Kooyker and others at Blenheim declined to comment on the fund’s recent performance, assets under management or trading strategy.

The question now is how Kooyker can recover from a rout that has shaken investors, corporations and entire economies. Already, Blenheim investors like the $21 billion New Zealand public pension fund have pulled money out, according to annual reports from the Kiwi fund and interviews with people familiar with the matter.

Commodities Pain

Granted, many other commodities specialists are suffering too. Cargill Inc., the agricultural giant, has shut one of its funds. Trafigura Group Pte, the oil and metals trading house, has closed its flagship Galena Metals Fund. Trafigura estimates that the world’s 10 top commodities hedge funds now manage $10 billion altogether, a fifth of what they did in 2008.

No one would mistake Kooyker for one of the rough-and-tumble traders who used to rule commodities from the trading pits of New York and Chicago. Tall and stately, with a shock of gray hair, an aquiline nose and deep blue eyes behind rimless glasses, he cuts an elegant figure on the New York social and philanthropic circuits. He has donated millions to the Metropolitan Opera, where his wife, Judith-Ann Corrente, is president of the board, and is a leading donor to Democratic political candidates.

An admirer of Winston Churchill, he named his firm after Blenheim Palace, Churchill’s birthplace and ancestral home in Oxfordshire. Busts of the British statesman adorn Blenheim offices. Kooyker tends to work out of one on Fifth Avenue in Midtown Manhattan; his London offices overlook Her Majesty’s Treasury, beneath which lie Churchill’s famed Cabinet War Rooms....MUCH MORE