The ECB, liquidity fear and an expandable shopping list

The ECB did stuff last week, namely it cut rates while downplaying further cuts, tried to protect the banks under its care from negative rates and pledged to boost its balance sheet.

That was considered, after some confusion, impressive by markets, amongst other things because of the ECB’s shift to buying up private assets — “investment-grade euro-denominated bonds issued by non-bank corporations established in the euro area are to be inccluded in QE,” as Deutsche summarised while others wondered aloud about what else the ECB might end up buying.

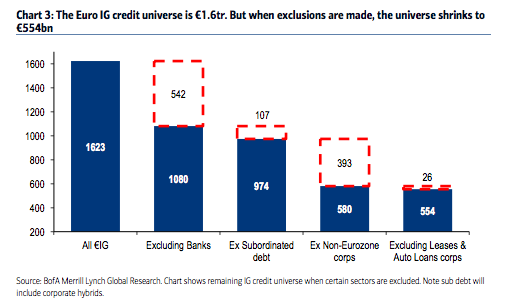

The problem so far, though, is that the universe of assets it can now buy is actually smaller than one might have originally thought.

As BofAML charted it:

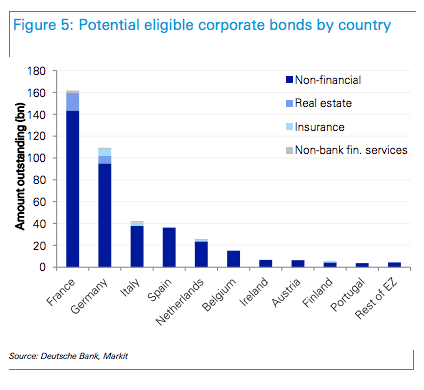

Or Deutsche with a more geographical skew:

You can quibble about the size of that available universe but the broad point is the same — the amount of IG credit the ECB can now buy is not as large as it appears at first glance.

More so, the ECB is constrained by market liquidity concerns. People and central banks are worried about people and central banks being worried about corporate bond market liquidity…

As JPM’s Niko Panigirtzoglou said, with our emphasis:...MORE

So in all, we think the lesson from existing ECB asset purchase programs is that the ECB should limit its purchase pace to only a small portion of secondary market trading volume. Less than 10% and perhaps closer to the 5%, which is the pace the ECB currently applies to its government bond and asset backed security purchase programs....