From Musings On Markets:

In the years since the 2008 crisis, there is no question in finance that

has caused more angst among investors, analysts and even onlookers than

what to do about "abnormally low" interest rates. In 2009 and 2010, the

response was that rates would revert back quickly to normal levels,

once the crisis had passed. In 2011 and 2012, the conviction was that it

was central banking policy that was keeping rates low, and that once

banks stopped or slowed down quantitative easing, rates would rise

quickly. In 2013 and 2014, it was easy to blame one crisis or the other

(Greece, Ukraine) for depressed rates. In 2015, there was talk of

commodity price driven deflation and China being responsible for rates

being low. With each passing year, though, the conviction that rates

will rise back to what people perceive as normal recedes and the floor

below which analysts thought rates would never go has become lower. Last

year, we saw short term interest rates in at least two currencies

(Danish Krone, Swiss Franc) become negative and this year, the Japanese

Yen joined the group, with rumors that the Euro may be the next currency

to breach zero. While it has been difficult to explain the low interest

rates of the last few years, it becomes doubly so, when they turn

negative. I would be lying if I said that negative interest rates don't

make me uncomfortable, but I have had to learn to not only make sense of

them but also to live with them, in valuation and corporate finance.

This post is a step in that direction.

Setting the table

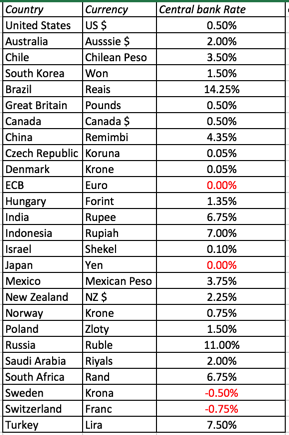

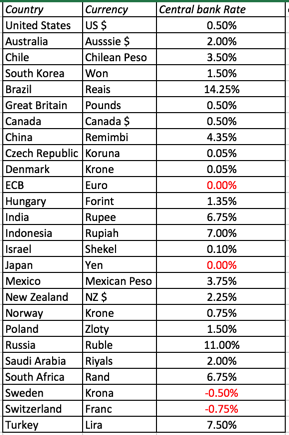

There are a handful of currencies that have made the negative interest

rate newswire, but it is worth noting that the rates that are being

referenced in many of these stories are rates controlled by central

banks, usually overnight rates for banks borrowing from the central

bank. In March 2016, there were two central banks that had set their

controlled rates below zero (Switzerland and Sweden) and two more (ECB

and Bank of Japan) that had set the rate at zero. (Update: The ECB

announced that it would lower its rates below zero on March 10.)

Note that these are central bank set rates and that short and long term

market interest rates in these currencies can take their own path. To

provide a contrast, consider the Japanese Yen and Euro, two currencies

where the central banks have pushed the rates they control to zero. In

both currencies, short term market interest rates have in fact turned

negative but only the Yen has negative long term interest rates

In a post from earlier this year,

I looked at long term (ten-year) risk free rates in different

currencies, starting with government bond rates in each currency and

then netting out sovereign default spreads for governments with default

risk. Updating that picture, the government bond rates across currencies

on March 9, 2016, are shown below:

Joining the Japanese Yen is the Swiss

Franc in the negative long term interest rate column. Why make this

distinction between central bank set rates, short term market interest

rates and long term interest rates? It is easier to explain away

negative central bank set rates than it is to explain negative short

term interest rates and far simpler to provide a rationale for negative

rates in the short term than negative rates in the long term. Thus,

there have been episodes, usually during crises, where short term

interest rates have turned negative, but this is the first instance that

I can remember where we have faced negative long term rates on two

currencies, the Swiss Franc and the Japanese yen, with the very real

possibility that they will be joined by the Euro, the Danish Krone, the

Swedish Krona and even the Czech Koruna in the near future.

Interest Rates 101

I am not a macroeconomist, have very little training in monetary

economics and I don't spent much time examining central banking

policies. Keep that in mind as you read my perspective on interest

rates, and if you are an expert and find my views to be juvenile, I am

sorry. That said, I have to process negative interest rates, using my

limited knowledge of what determines interest rates.

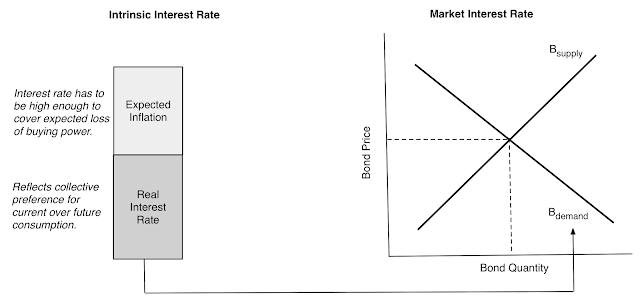

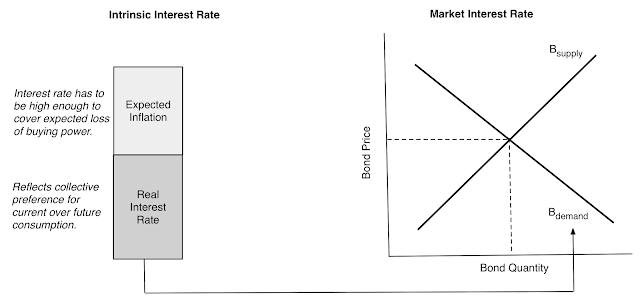

Intrinsic and Market-set Interest Rates

When I lend money to another individual (or buy bonds issued by an

entity), there are three components that go into the interest rate that I

should demand on that bond. The first is my preference for current consumption over future consumption, with rates rising as I value current consumption more. The second is expected inflation in the currency that I am lending out, with higher inflation resulting in higher rates. The third is an added premium for any uncertainty that I feel about not getting paid,

coming from the default risk that I see in the borrower. When the

borrower is a default-free entity, there are only two components that go

into a nominal interest rate: a real interest rate capturing the

current versus future consumption trade off and an expected inflation

rate.

Nominal Interest Rate = Real Interest Rate + Expected Inflation Rate

This is, of course, the vaunted Fisher equation. There is an alternate

view of interest rates, where the interest rate on long term bonds is

determined by the demand and supply of bonds, and it is shifts in the

demand and supply that drive interest rates:

How do you reconcile these two worlds?

To the extent that those demanding bonds are motivated by the need to

earn interest that covers the expected inflation and generate a real

interest rate, you could argue that in the long term, the intrinsic rate

should converge on the market set rate.

In the short term, though, as with any financial asset, there is a real

chance that the market-set rate can be lower or higher than the

intrinsic rate. What can cause this divergence? It could be investor

irrationality, where bond buyers overlook their need to cover inflation

and earn a real rate of return. It could be a temporary shock to the

supply or demand side of bonds that can cause the market-set rate to

deviate; this is perhaps the best way to think about the "flight to

safety" that occurs during every crisis, resulting in lower market

interest rates. There is one more reason and one that many investors

seem to view as the dominant one and I will address it next.

The Central Bank and Interest Rates

In all of this discussion, notice that I have studiously avoided

bringing the central bank into the process, which may surprise you,

given the conventional wisdom that central banks set interest rates.

That said, a central bank can affect interest rates in one of two ways:...MORE