Quantitative investing has developed an unjustified PR problem based on the unfortunate tendency of many to associate all quantitative approaches with “Black Box” investing.

The problem with a black box is that you don’t know what’s inside it, because by definition it’s opaque and non-transparent. You don’t know how it works. You put X in on one side, and Y comes out the other, but you don’t know how confident you should be that Y will resemble your expectations for the box’s output. For this reason, Black Boxes are a dangerous place to invest capital.

A famous example of Black Box investing is Long Term Capital Management (LTCM). LTCM was a hedge fund, run by Nobel Prize winners, and used leveraged “market-neutral” strategies that initially generated returns in the 40% range. The chart below tells you all you need know about how things ended for this Black Box:

Yet LTCM had good reasons not to be transparent about what they were doing. They wanted to guard their “secret sauce” and preserve a reputation that they were doing something unique. They didn’t want other firms to know their positions, which could jeopardize their ability to unwind them. They didn’t want to hear opinions about how much risk they were taking. As it turns out, all these reasons came back to bite them.HT: Abnormal Returns

LTCM initially pursued bond arbitrage strategies, but then grew hungry for ways to continue making high returns with more capital. They pursued pairs-related “convergence” trades. They made bets in merger arbitrage. They explored technically driven approaches, involving trend analysis and pattern recognition. In the end, they were not doing something unique, they could not unwind their positions, and they were taking too much risk....MORE

Because LTCM's demise was so dramatic (and because Merriwether & Co were such arrogant twits) we've looked at them a few times:

Time to Attempt the Reverse Long Term Capital Management: Long Treasuries/Short Junk? (TLT; TMF; HYG; JNK)

LTCM Co-Founder, Nobel Laureate, Scholes Says the Fund Was Doomed From the Start (we are still using 1998 as a mental map for 2011)Attempting a 2 1/2 twisting Meriwether, not that high a D-ifficulty score, so to pull it out the execution must be flawless.......And yes! He sticks the faceplant landing!Stuff I think about when dreaming up relative value and convergence trades.

LTCM was shorting the more liquid on-the-run treasuries and buying the less liquid off-the-run to catch a few points or shorting treasuries and buying other sovereigns. It worked until Russia defaulted and the crowd did the flight to quality thing: spreads blew out and it was game over....

How many Nobel Laureates Does it Take to Make Change...And: End of the Universe Puts

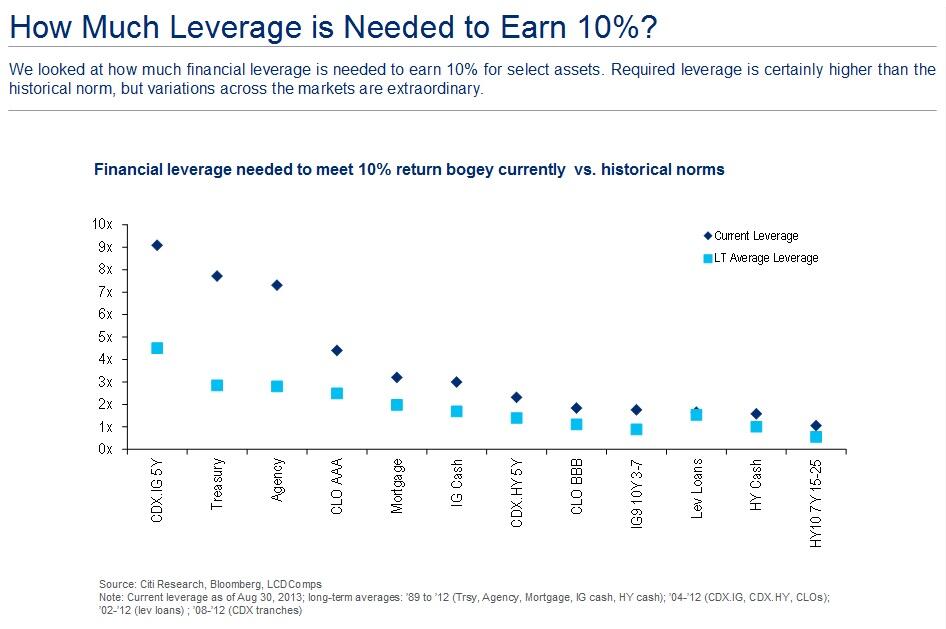

Degree of Leverage Required To Earn Average Returns in Various Interest Rate Trades

A very nice catch by the FT's Tracy Alloway:

This is almost exactly what I was thinking of when I intro'd yesterday's "Is Alpha Dead? Beating the Market Has Become Nearly Impossible":

Fortunately, in real markets anyway, you can take either side of a bet.The returns are still there. You may have to leverage it up and it isn't easy money as you really better be right, but the returns are still available. And you don't have to gear it at 100:1 as LTCM did....

That's why, when I see stories on the end of the commodity supercycle or some such, I get as interested on the short side as I would chasing the latest anti-obesity-drug-touting-biotech on the long.

It helps....