This is almost exactly what I was thinking of when I intro'd yesterday's "Is Alpha Dead? Beating the Market Has Become Nearly Impossible":

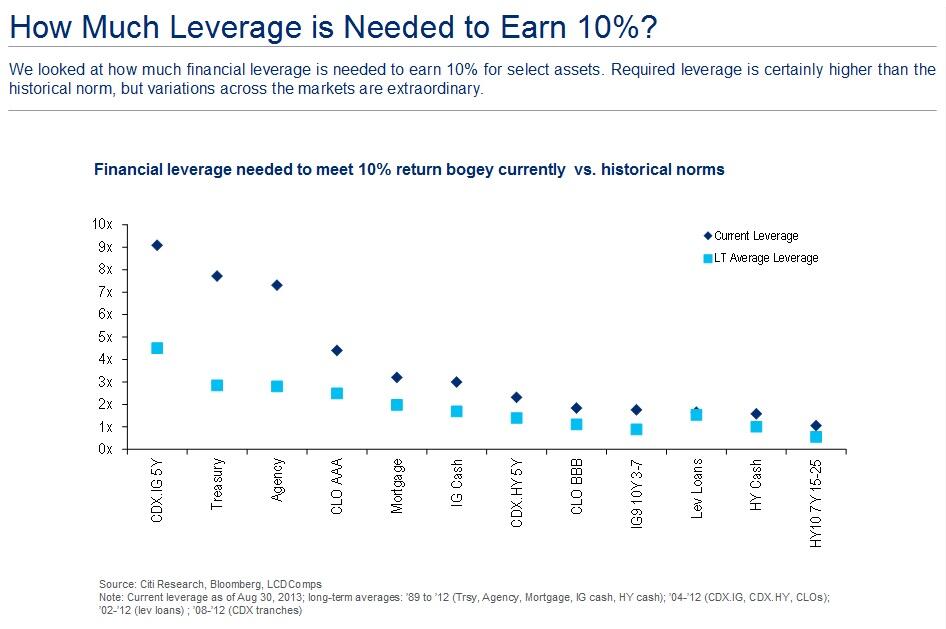

Fortunately, in real markets anyway, you can take either side of a bet.The returns are still there. You may have to leverage it up and it isn't easy money as you really better be right, but the returns are still available. And you don't have to gear it at 100:1 as LTCM did.

That's why, when I see stories on the end of the commodity supercycle or some such, I get as interested on the short side as I would chasing the latest anti-obesity-drug-touting-biotech on the long.

It helps....

See also Izabella Kaminska's quick hit, "End of a commodity hedge fund era".