"Il faut bien que je les suive, puisque je suis leur chef."*

A major piece from The Economist:

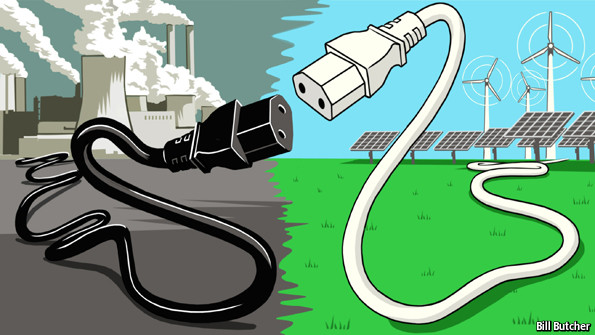

Europe’s electricity providers face an existential threat

ON JUNE 16th something very peculiar happened in Germany’s electricity market. The wholesale price of electricity fell to minus €100 per megawatt hour (MWh). That is, generating companies were having to pay the managers of the grid to take their electricity. It was a bright, breezy Sunday. Demand was low. Between 2pm and 3pm, solar and wind generators produced 28.9 gigawatts (GW) of power, more than half the total. The grid at that time could not cope with more than 45GW without becoming unstable. At the peak, total generation was over 51GW; so prices went negative to encourage cutbacks and protect the grid from overloading.HT: Marginal Revolution

The trouble is that power plants using nuclear fuel or brown coal are designed to run full blast and cannot easily reduce production, whereas the extra energy from solar and wind power is free. So the burden of adjustment fell on gas-fired and hard-coal power plants, whose output plummeted to only about 10% of capacity.

These events were a microcosm of the changes affecting all places where renewable sources of energy are becoming more important—Europe as a whole and Germany in particular. To environmentalists these changes are a story of triumph. Renewable, low-carbon energy accounts for an ever-greater share of production. It is helping push wholesale electricity prices down, and could one day lead to big reductions in greenhouse-gas emissions. For established utilities, though, this is a disaster. Their gas plants are being shouldered aside by renewable-energy sources. They are losing money on electricity generation. They worry that the growth of solar and wind power is destabilising the grid, and may lead to blackouts or brownouts. And they point out that you cannot run a normal business, in which customers pay for services according to how much they consume, if prices go negative. In short, they argue, the growth of renewable energy is undermining established utilities and replacing them with something less reliable and much more expensive.

Power downThe decline of Europe’s utilities has certainly been startling. At their peak in 2008, the top 20 energy utilities were worth roughly €1 trillion ($1.3 trillion). Now they are worth less than half that (see chart 1). Since September 2008, utilities have been the worst-performing sector in the Morgan Stanley index of global share prices. In 2008 the top ten European utilities all had credit ratings of A or better. Now only five do.

The rot has gone furthest in Germany, where electricity from renewable sources has grown fastest. The country’s biggest utility, E.ON, has seen its share price fall by three-quarters from the peak and its income from conventional power generation (fossil fuels and nuclear) fall by more than a third since 2010. At the second-largest utility, RWE, recurrent net income has also fallen by a third since 2010. As the company’s chief financial officer laments, “Conventional power generation, quite frankly, as a business unit, is fighting for its economic survival.”...MUCH MORE

By way of FT Alphaville

*"I must follow them for I am their leader."

-Ledru-Rollin

Again, apologies for the late start.