QE Moved Out of On-the-run

There still hasn’t been any official acknowledgement that QE damages effective liquidity by removing usable collateral from the system. By purchasing US Treasury debt securities, including those just auctioned, the Federal Reserve is reducing what is left for the market to repo and, more importantly for fragmented markets, rehypothecate. The closest we have to facing up to the problem is the academic side of the Fed writing papers about it.

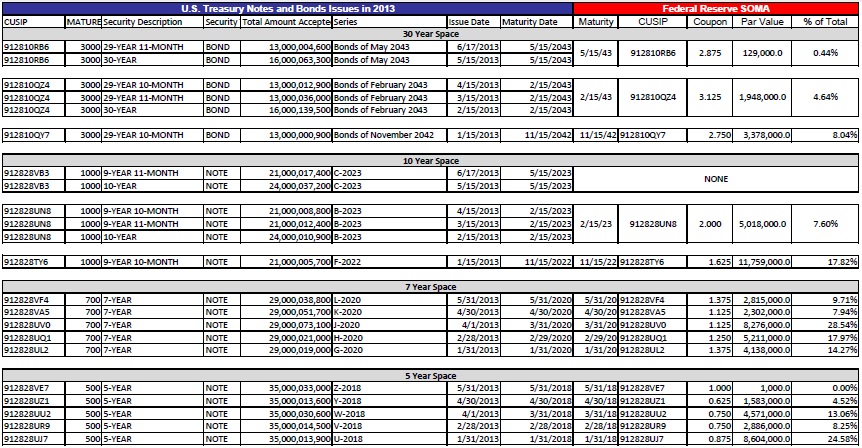

However, if we look at what the Open Market Desk has been doing in its SOMA purchasing (the operational arm of QE), it becomes clear that something has changed since March 2013. QE 4, the UST part of the new balance sheet initiative, as opposed to QE 3 which deals in MBS, isn’t really that old, but this short history of activity in SOMA is quite revealing, in my opinion.

First, we start with the premise that repo counterparties prefer, by and large, on-the-run (OTR) treasuries – the securities most recently auctioned. There is a tremendous liquidity difference between OTR and off-the-run (OFR), and since repo counterparties need to be assured they can quickly sell collateral at reasonable pricing should the cash borrower default, OTR’s provide the most liquid section of the treasury repo marketplace.

That’s not to say that repo dealers and counterparties do not use OFR securities for repo, but the difference is about 90%; that is, once an OTR security is replaced by the next auction, volume of trading in that now-OFR drops by an estimated 90% and making it far less liquid and desirable.

QE’s buildup of UST bonds and notes, after Operation Twist, has continued where only traditionally short-dated debt existed in the SOMA portfolio before. Below is the 2013 list of OTR securities and the QE purchasing activity in them (I have omitted the 2-year and 3-year since the Open Market Desk has avoided them to date).

Starting with the 5-year, the Fed initially bought up almost 25% of the OTR from the January 31, 2013, auction. In March, it was about 13%, and then dropping to less than 5%; and then none....MORE