One thing I am sure of, the goop that will come down the Keystone XL pipeline is not destined for U.S. markets. It appears the plan is to refine at the Gulf coast and ship product to Europe.

From RBN Energy:

The new Turner Mason (TMC) study titled “North American Crude and Condensate Outlook” (NACCO) forecasts a high case 8.2 MMb/d increase in crude supplies from US and Canadian production over the next 10 years. While most crude imports will be pushed out by this production surge over the 10-year period, a minimum structural import level of about 1.4 MMb/d will remain. As domestic and Canadian crude supplies overwhelm refining capacity in coastal regions TMC predict crude exports will be required to balance demand. Today we review TMC’s crude market and refinery operations predictions.

In the first episode of this series last week we looked at production forecasts in the study (see Charge of the Light Brigade). TMC’s high case production scenario forecasts another 4.4 MMb/d added to US domestic supplies by 2022 – mostly light and super light crude from shale plays. Canadian production increases will add a further 2.6 MMb/d by 2022 - mostly heavy bitumen crude. This time we’ll offer you a peek at TMC’s expectations of the impact on refinery operations of backing out more and more imported crude from the Gulf Coast as well as prospects for crude exports to non-Canadian markets. This analysis follows up on our preview of last year’s TMC study (see Turner Mason and the Goblet of Light & Heavy).

The TMC study predicts that over the next few years, increased supplies of crude will back out waterborne imports – to leave a residual 1.4 MMb/d of mainly heavy crude on the Gulf Coast and on the West Coast. In line with most current forecasts, TMC expect that light crudes and condensates coming into the Gulf Coast region, will push out light sweet imports by the end of 2013 and then start to back out light and medium sour grades during 2014 and 2015. Even in the high production scenario TMC says that imports will not continue to be pushed back, but that they will level off in 2018 at a structural residual level.

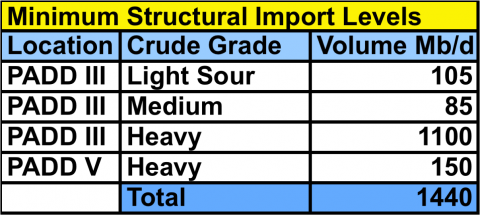

The table below shows the distribution of crude imports that TMC expect to remain after 2018. They expect there to be about 1.3 MMb/d remaining on the Gulf Coast (Petroleum Administration Defense District – PADD III) the majority of which will be heavy crude. These volumes are deemed “structural” because refineries owned by producer countries will import them – principally Saudi Arabia (partial owner of the 600 Mb/d Motiva refinery), Mexico and Venezuela. TMC says these countries will use their own production before buying cheaper domestic barrels to protect their market share. And it is true that Mexico has appeared to discount its barrels into the Gulf Coast recently to protect declining market share. TMC also expect about 150 Mb/d to still be imported to the West Coast (PADD V) because there will not be adequate domestic or Canadian supplies to replace them.

Source: Turner Mason (Click to Enlarge)

The surge in new crude production and the pushing out of imports of light then light sour and medium sour crudes will have a marked impact on the quality of crude that US refineries process. The gravity and sulfur content of the slate of US crudes refined will change (see chart below). Gravity will increase because new U.S. crude production has a higher API gravity. The overall sulfur content of US crude refined will be lower. That is because light crudes from the Eagle Ford, Permian Basin and North Dakota have lower sulfur content than the existing crude slate. The nature of these changes in quality will be similar in both the TMC high production scenario and the low production scenario....MORE