(the ice bear, not to be confused with an ice bar)

From FT Alphaville:

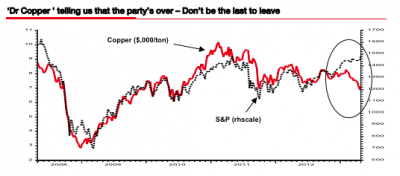

Dr Copper, ‘telling us the party’s over…’

With the S&P 500 making a fresh run higher at pixel time, it would be rude not to share the latest thoughts of Albert Edwards, Socgen’s Ice Age bear. Rather than gawping stocks, he reckons we should be mindful of the red metal…Eis bar

Edwards’ central argument is that just as both the US and Europe are slipping towards outright deflation, investors have convinced themselves they just have to participate in the liquidity fueled frenzy offered by unlimited QE.

But the copper price is saying something different — and it offers a solid reminder that liquidity itself can disappear very quickly indeed, as it did when Edwards’ last drew our attention to ‘Dr Copper’ (and Wile E. Coyote) back in January, 2007…

Too often we hear the spurious argument that liquidity is a key reason for buoyant markets, but ample liquidity is caused by good price momentum rather than the other way around. Liquidity is the caravan not the car, and if they both go too fast it will all become horribly unstable…

We think many commentators often have their causality the wrong way round. It is price momentum that causes people to borrow and speculate on further price movement. Liquidity can accentuate a market movement that is already underway. But as copper investors will testify, if the fundamentals are sufficiently undermining, liquidity arguments are not worth the paper they are written on. Poof! Liquidity can evaporate overnight.In the event, Edwards was four or five months early. This is what he’s saying now…MORE