He's early.

The U.S. and Europe are very lucky to have Japan as a pathfinder.

From yesterday's "Japan's Nikkei Soars Again, This Time Up 2.8%":

...Now, with the index at 13,192.59 and USD/JPY at 98.6650 (up from under 78 in Oct.) it's probably time for everyone to take a deep breath....Here's the five day chart from Yahoo Finance:

The Nikkei was down 0.24 points which is reported as 0.00%.

And a solid piece on the big picture from FT Alphaville:

Be excited, be, be excited: BoJ edition

Seemingly everybody is benefiting from the Bank of Japan’s decision to splash the cash. Peripheral bond yields in Europe have fallen and high-yielding carry targets such as Mexico and Brazil are being touted as destinations for Kuroda’s cash.

Where that cash ends up will in many ways define the success or failure of the Abe/ Kuroda push since what really matters is what happens after the cash has left the BoJ.

Nomura’s Nordvig et al had a crack at summarising the multiple channels that have to be understood here — balance sheet expansion and its effects are not linear or easily predictable, see Switzerland for more:

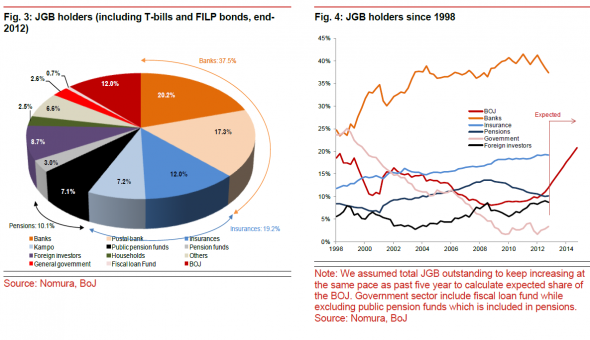

First, there is a portfolio rebalancing channel. What will happen to the cash the BoJ will be handing to current holders of JGBs? This is the most direct and most mechanical component of the transmission mechanism.On the portfolio balancing side of things, here are the current holders of JGBs and the expected increase in the BoJ’s holdings from 12 per cent now to more than 20 per cent by the end of 2014:

Second, there is a risk appetite channel. The shift in BoJ policy and the broader impact of Abenomics (including the fiscal and growth oriented pillars) has already led to a significant shift in risk appetite. This effect is not directly a function of BoJ related flows, but it is related, and it impacts investor behavior across the entire spectrum of investors, including outside Japan. Importantly, it impacts households, even if they don‟t have large direct exposures to the JGB market.

The vast majority of the remaining JGBs are held by banks, insurance companies and pension funds...MUCH MUCH MORE