From the Economist:

FEW people outside Russia have ever heard of Gunvor—and Gunvor would probably prefer it that way. It is the world’s fourth-biggest oil trader, and at its peak handled roughly a third of Russia’s seaborne exports of crude oil. We suspect that Gunvor has been driving down the price of Russian oil. An investigation by The Economist into Gunvor’s trading in Urals crude, a benchmark blend in north-west Europe, suggests that such a strategy could have helped the firm buy oil in Russia cheaply and, in theory, earn inflated profits when it sold the same oil on the international market at full price.

Spot markets for oil are virtually unregulated so the law allows Gunvor considerable freedom of manoeuvre. Yet any fall in Russia’s revenues could have harmed the country’s citizens, who benefit from oil taxes. Moreover, the spot markets have become the subject of official concern. In March, after a request from the leaders of the G20 (including Russia), the International Organisation of Securities Commissions (IOSCO), a forum for regulating financial markets, issued an appeal for ideas on reforming oil-price reporting. One of its aims is to “ensure the integrity of [the oil markets’] price assessment”. If our suspicions are well-founded, Gunvor’s Urals trade would show how vulnerable oil markets are to distortion.

Nobody but Gunvor itself knows for sure whether it set out to move the Urals price, as we suspect. The firm is adamant that it has done nothing wrong.

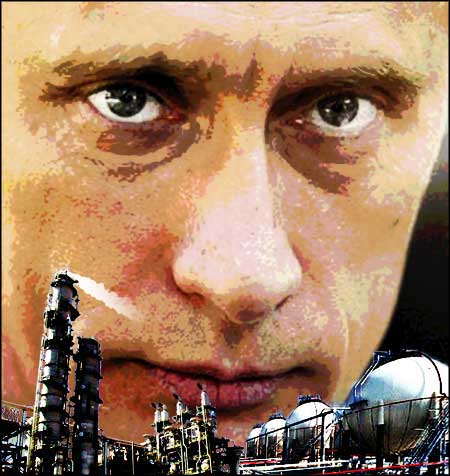

So we have no proven case. But we do have a set of suspicious circumstances. Under Vladimir Putin, who was elected Russia’s president in March and will be sworn in next week, Gunvor has grown from a small, virtually unknown company into the most important trader of Russian oil (see article). Before Russia’s presidential election, Gunvor attracted criticism from opposition protesters for making money out of the country’s oil and for being based in Switzerland. Given Gunvor’s political sensitivity and that Russia needs to get the best price for its oil, Mr Putin should look into the Urals market.

Our investigation has three parts. The first is based on public data, which show that over a period of years Gunvor’s trading was repeatedly associated with falls in the market price for Urals crude over a few days or weeks. The second is our analysis, which founds our suspicion that Gunvor intended to drive the price down temporarily in this way. And the third is the related question of what such a strategy might have accomplished.

The “Urals blend” includes much of the 5m barrels a day or so of crude oil that Russia exports. The sellers are oil producers, including Rosneft, Surgutneftegaz and Gazprom Neft. The buyers are European refiners such as Hellenic and INA and the refining arms of oil companies such as Royal Dutch Shell and Total. In among the buyers and sellers are the trading companies, such as Glencore, Vitol—and Gunvor.

The way of the window

Most of the Urals spot trading takes place in private and is not reported. The published price for Urals oil is set by Platts, part of McGraw-Hill, a media company. Platts writes about the market in its daily Crude Oil Marketwire, a representative summary containing the day’s most noteworthy public bids, offers and trades.

Platts sets its daily price using the bids, offers and transactions that are published on its systems. Its reporters can consider trades at any time in the day, but what counts is the last half-hour of trading, which ends at 4.30pm sharp London time, when the price is established. Platts invites parties to disclose open bids and cargoes for sale in the lead up to a 3.45pm cut-off, after which it accepts no new bids or offers. Starting at 4pm, it watches the dealing in the half-hour “window”. It uses its knowledge of the market plus the prices of these trades, bids and offers to establish the published price for the day.HT: FT Alphaville

This system, known as the “Market-on-Close” (MOC) methodology, has many advantages. Instead of relying only on the subjective impressions of reporters telephoning around for news from their contacts, it also uses a formal mechanism to help establish a price at the same time each day. It brings together buyers and sellers who want a part in forming the published price. It avoids the drawbacks of average prices, set over the whole trading day, which tend to be too high in a falling market and too low in a rising one....MUCH MORE

*From our Dec. 2010 post "Putin Takes a Stand Against Wind Power":

I have always thought of the Prime Minister as Hydrocarbon Man.

Back in 2007 the Guardian published "Putin, the Kremlin power struggle and the $40bn fortune" which stated:

...In an interview with the Guardian, Belkovsky repeated his claims that Putin owns vast holdings in three Russian oil and gas companies, concealed behind a "non-transparent network of offshore trusts".This led to a letter to the editor the next day, from Gunvor's CEO. "Putin owns no part of Gunvor". which categorically denied that Vlad had any interest in the trader.

Putin "effectively" controls 37% of the shares of Surgutneftegaz, an oil exploration company and Russia's third biggest oil producer, worth $20bn, he says. He also owns 4.5% of Gazprom, and "at least 75%" of Gunvor, a mysterious Swiss-based oil trader, founded by Gennady Timchenko, a friend of the president's, Belkovsky alleges....

Last Thursday the Financial Times published "Oil trading group Gunvor denies Putin links":

Setting Gunvor aside, both of the oil and gas companies are down considerably from their YE '07 market caps: 4 1/2% of Gazprom is worth around $6 billion while 37% of Surgutneftegaz clocks in at $12 1/2 bil.

Still a nice pile....