Thanks to a reader.

When the fraudsters get on this You can say...saaay... *

From the Kingsport (TN) Times-News:

China has a secret: It owes American investors hundreds of billions of dollars.

The

Chinese government doesn't like to talk about it and the U.S.

government doesn't want to raise it. But decades ago, Beijing defaulted

on debt owed to Americans, as well as investors and governments around

the world. In one case, it was paid. In the rest it was not. More than

20,000 American investors own this debt. The U.S. government may also

own Chinese war debt, unpaid since World War II.

With the simple

stroke of an executive proclamation, President Barack Obama can begin

the process of addressing this issue. A 1930s-era law has established a

quasi-public agency within the Securities and Exchange Commission, known

as the Corporation of Foreign Securities Holders, which can arbitrate

this dispute, much as a predecessor agency did for decades. China can

both afford and benefit from this solution; it will afford goodwill at a

time when relations between the world's two superpowers are strained.

The story begins nearly 100 years ago, in 1913, when the government of

China began issuing bonds to foreign investors and governments for

infrastructure work to modernize the country. As the country fell into

civil war in 1927, paying these debts became increasingly difficult and

the government fell into default. Even so, in April 1938, the

Nationalist government of China began to issue U.S.-dollar denominated

bonds to finance the war against Japan's brutal invasion.

Locked

in a pitched battle for survival, the government issued these bonds into

1940. As part of its wartime financial aid, the U.S. government further

provided a $500 million credit to China in March 1942, shipping gold

there and helping to stabilize the currency. In return, it appears that

the U.S. government redeemed some of these dollar-denominated bonds. But

China doesn't appear to have repaid this debt either, according to

State Department records, and the declaration of the People's Republic

of China in 1949 ended decades of political, military and financial

cooperation.

While successor governments are usually bound by the

debts of predecessor governments, the new Communist government refused

to pay any of these claims. The issue lay dormant for decades, just as

the bilateral relationship did. Then, in 1979, as part of normalizing

relations, Washington released government financial claims regarding the

expropriation of American property and appears to have dropped the

matter of the war debt entirely. However, it is one thing for government

decision-makers to let go of government debt, however questionable that

is.

And it is entirely another thing for individual citizens to

press their claims. Some U.S. investors tried to sue the Chinese

government in the 1980s and 1990s. However, the Foreign Sovereign

Immunities Act makes it very hard for any U.S. citizen to sue a foreign

government in U.S. courts because the law generally says that U.S.

courts do not have jurisdiction....MORE

See our May 2009 post "

So a Sicilian mafioso walks into HSBC…":

....In a less sophisticated move, I once had a

slightly deranged money guy insist that his $1 Billion of Japanese

government bonds were good collateral. Here's one of the issues he

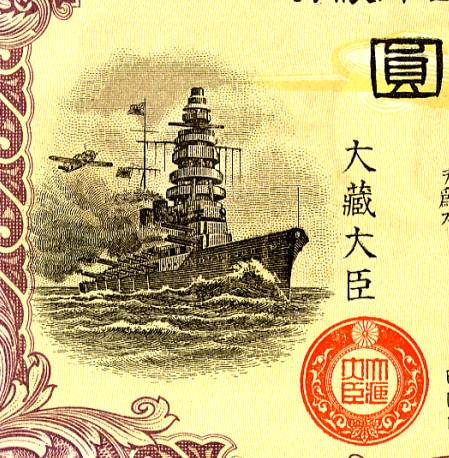

proffered, image via Scripophily.com:

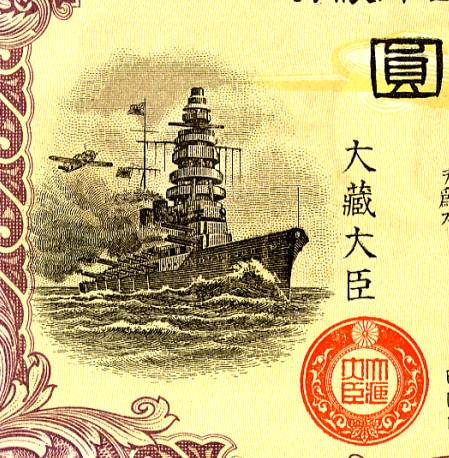

Here's a close-up of the engraving:

Certificate Vignette

For

the longest time Carl Marks & Co. (or was it Herzog?) made markets

in defaulted bonds, for some reason I remember the Kingdom of Serbs,

Croats and Slovenes 8's of 1922.

It may have been a different S,C&S issue, I can't find any record of the paper. Off to Zagreb?

[try 'off too, Zagreb' -ed.]

Here's a quick story about this odd corner of the market, from Time Magazine, Aug 8, 1983:

...Foreign

bonds are riskier because it is difficult to force payment or arrange

settlements. The Wall Street firm Carl Marks & Co. is still

fighting a class-action suit against the People's Republic of China to

recover losses from Hukuang Railroad bonds issued by the imperial

Chinese government in 1911. Last year a U.S. district court in Alabama

ordered China to cough up to U.S. bondholders the unpaid principal plus

the interest that has been mounting at 5% annually, a total of $41.3

million. Marks also has two suits against the Soviet Union involving

$75 million in dollar-denominated bonds issued by the imperial Russian

government. The bonds, held by U.S. investors, were repudiated by

Moscow after the 1917 revolution. Daniel Collier, a Marks vice

president, is not holding his breath. In his firm's offices, one of the

Russian bonds is mounted, with a small hammer beside it, along with the

words: IN CASE OF SETTLEMENT, BREAK GLASS.

Even if the court

actions fail, some of the paper still has value. A Hukuang Railroad

bond for 20 gold pounds ($96) that is in good condition is worth from

$50 to $100 as a collector's item....