On a holiday. Happy Dominion Day!

Totally retro.

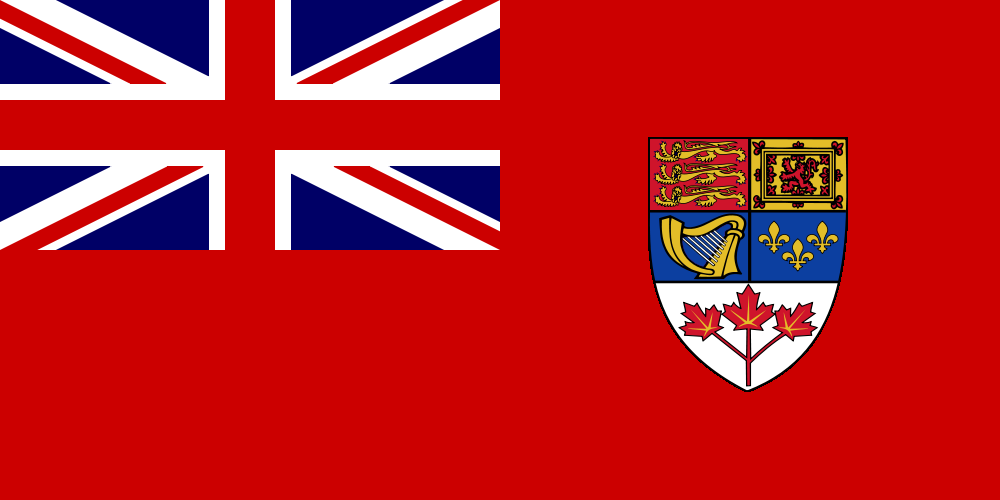

That flag is the Red Ensign, the unofficial national flag, 1957-1965.

The holiday was renamed Canada Day in 1982.

Some folks are still a bit peeved.

From Pension Pulse:

On Thursday, I met three sharp hedge fund managers based in Montreal: Jacques Lacroix and Paul Beattie of BT Global Growth and Brian Ostroff of Winderemere Capital. Their offices are all next to each other. I first met with Jacques and Paul and chatted a little with Brian before heading off to lunch with Paul.

My meeting with Jacques and Paul was extremely interesting. I've met many managers in my career and you can always tell which ones have substance and brains as opposed to the ones that are slick marketing types. The two met at Telesystem International Wireless (TIW), a company founded by Quebec entrepreneur Charles Sirois. Jacques was among the first hires there and Paul followed soon after.

Both men made more money on TIW stock towards the end when it was trading for pennies and they scooped it up than while working at TIW (Paul told me he dumped some shares at $55 and bought back a boatload at 33 cents when institutions dumped and the company's enterprise value was $4). Paul worked in private equity briefly after TIW before teaming up with Jacques to form BT Global Growth. They manage roughly $25 million, have their liquid assets in the fund, and their clients are mostly former senior managers they worked with at TIW. Paul told me flat out: "we want smart clients who we can interact with and learn from."

Both managers have extensive global finance experience and it shows in the way they invest. Paul told me straight out "We're finance guys and invest based on cash flows. We don't like highly levered companies." Indeed, they can look at any balance sheet and understand the potential of any company as well as the pitfalls. Their global finance experience serves them well. Paul has traveled to India and China countless times as well as other parts of Asia, and he's a big believer in the secular shift towards that part of the world. "We're going to have huge problems in the future competing with Asia."...

...Anyways, towards the end of our meeting, we started talking about their core mining holdings. They like phosphate and zinc and told me they have big stakes in Ressources d'Arianne (DAN.V), a small Quebec mining company that holds interest in the Lac à Paul project, a phosphorus and titanium deposit, and Focus Metal (FMS.V), which explores for flake graphite, rare earth elements, and precious and base metals like zinc.

I wanted to know more on phosphate. Paul introduced me to Brian Ostroff of Windermere Capital, another extremely sharp manager with years of experience. Brian knows his stuff on mining stocks. He told me that his fund is a an excellent diversifier in an overall portfolio and too volatile when looked at on a standalone basis. He and his investors own almost 20% of Ressources d'Arianne and firmly believes in their Canada Phosphate potential. "My only concern is that management is going to find growth challenges ahead that they're not prepared to deal with right now which is why I'm actively involved on finding competent board of directors."...MORE