UPDATE: Another slam on Krugman: "Woman Who Invented Credit Default Swaps is One of the Key Architects of Carbon Derivatives, Which Would Be at the Very CENTER of Cap and Trade"

Original post:

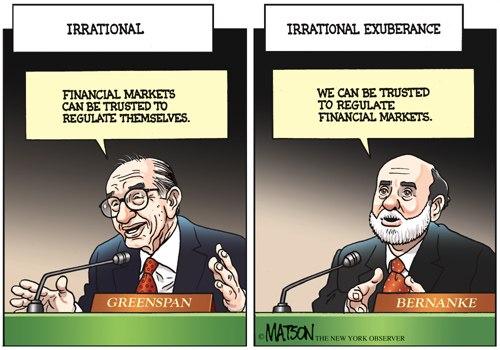

So much for Krugman's:

...Oh, and the argument that if you create a market, you’re opening the door for Wall Street evildoers, is bizarre. Emissions permits aren’t subprime mortgages, let alone complex derivatives based on subprime; they’re straightforward rights to do a specific thing. It will truly be a tragedy if people generalize from the financial crisis to block crucially needed environmental policy....From Mr. Krugman's very own New York Times:

From his Dec. 7 post: -Unhelpful Hansen

Post Updated | 3:53 p.m. Europol, the European Union’s law enforcement arm against organized crime, announced on Wednesday that carbon-trading fraud has cost the bloc’s governments $7.4 billion in lost tax revenue over the last 18 months.

“We have an ongoing investigation,’’ said Soren Pedersen, Europol’s chief spokesman, in a telephone interview on Thursday from The Hague. “We’re afraid the fraud is not completely finished yet, unfortunately. But it’s positive to see that actions are being taken and we hope soon it will disappear.”

FourSix member countries have changed their tax codes to protect against a recurrence, the agency said. The fraud involved adding the European Union’s value-added tax to the price of carbon dioxide permits sold to businesses. Fraudulent brokers then disappeared before turning the tax over to the government, according to Europol....MORE

From The Europol press release:

The European Union (EU) Emission Trading System (ETS) has been the victim of fraudulent traders in the past 18 months. This resulted in losses of approximately 5 billion euros for several national tax revenues. It is estimated that in some countries, up to 90% of the whole market volume was caused by fraudulent activities....From yours truly, one week ago:

GOP utters the "T" word for dealing with carbon

Long time readers know we are adamantly opposed to allowing Wall Street anywhere near the carbon piggy bank. The numbers are so big and the opportunities for traders to act like traders so numerous that I have come to the conclusion (festering in my fevered brain since the Rio shindig in '92) that the better option is to run the money through the U.S. treasury.From The Big Picture:

That was not an easy thing to write but if we were to cap-and-tax or cap-auction-100% rebate and/or eliminate the payroll tax we would be practicing the basic economics taught in Econ 10: tax what you want less of, don't tax what you want more of....