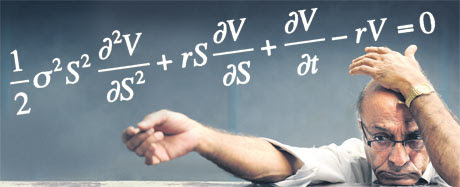

First up, George Soros via Real Investment Advice, June 2016:

Soros – A Rudimentary Theory Of Bubbles

....David’s comments reminded me of George Soros’ take on bubbles.

“First, financial markets, far from accurately reflecting all the available knowledge,

always provide a distorted view of reality. The degree of distortion

may vary from time to time. Sometimes it’s quite insignificant, at other

times, it is quite pronounced. When there is a significant

divergence between market prices and the underlying reality, there is a

lack of equilibrium conditions.

I have developed a rudimentary theory of bubbles along these lines. Every bubble has two components: an underlying trend that prevails in reality and a misconception relating to that trend.

When a positive feedback develops between the trend and the

misconception, a boom-bust process is set in motion. The process is

liable to be tested by negative feedback along the way, and if it is

strong enough to survive these tests, both the trend and the

misconception will be reinforced. Eventually, market

expectations become so far removed from reality that people are forced

to recognize that a misconception is involved. A twilight period ensues during which doubts grow and more and more people lose faith, but the prevailing trend is sustained by inertia.

As Chuck Prince, former head of Citigroup, said, ‘As long as the music

is playing, you’ve got to get up and dance. We are still dancing.’ Eventually, a tipping point is reached when the trend is reversed; it then becomes self-reinforcing in the opposite direction.

Typically bubbles have an asymmetric shape. The boom is long and slow to start. It accelerates gradually until it flattens out again during the twilight period. The bust is short and steep because it involves the forced liquidation of unsound positions.”

....MUCH MORE

RIA revisited and expanded on Soros and bubbles in January 2020's "Market Bubbles: It’s Not The Price, It’s The Mentality."

Soros used to say something along the lines of "When I see a bubble forming, I rush to buy, adding fuel to the fire." I believe—but cant find the source—that exact quote is from early 2020 but HUGE Caveat, Soros later that year changed his public pronouncements:

“Pivoting to his legendary approach to financial markets, Soros acknowledges that investors are in a bubble fueled by Fed liquidity, which creates a situation that he now avoids. He

explained that ‘two simple propositions’ make up the framework that has

historically given him an advantage. However, since he shared it in his

book, ‘Alchemy of Finance,’ the advantage is gone.” – MarketWatch

So we have two diametrically opposed statements in the same year.

You have my word as a hedge fund manager....

And more interestingly, and definitely less confusingly, a post originally from 2012 but updated:

For the third time our link to the South Sea Bubble paper has rotted,

Here's the version hosted at MIT before it was published in the American Economic Review.

By PETER TEMIN AND HANS-JOACHIM VOTH

Original post:

Prop Trading the South Sea Bubble: Hoare's Bank 1720

I've mentioned the archives at Hoare's bank a few times, firstly, I believe, in "

South Sea Bubble Survivor Says Dismantle RBS Along With Lloyds":

*From deep in the link-vault comes a tiny treasure, an analysis of Hoare's trading during the South Sea bubble (15 page PDF):

Riding the South Sea Bubble

By PETER TEMIN AND HANS-JOACHIM VOTH

This

paper presents a case study of a well-informed investor in the South

Sea bubble. We argue that Hoare’s Bank, a fledgling West End London

bank, knew that a bubble was in progress and nonetheless invested in the

stock: it was profitable to “ride the bubble.” Using a unique dataset

on daily trades, we show that this sophisticated investor was not

constrained by such institutional factors as restrictions on short sales

or agency problems....MORE

The bank has opened their records to academics and Temin and Voth have taken full advantage.

Along with the above they published "

Banking as an emerging technology: Hoare’s Bank, 1702–1742" in Financial History Review and "

Private borrowing during the financialrevolution: Hoare’s Bank and its customers, 1702–24" in Economic History Review.

It's

Riding the South Sea Bubble that really stands out though and is the 'tiny treasure'.

Yesterday, as I was putting "

The World's First Stock Exchange (and first bear raid, first dividend, first equity derivatives...)" together I wanted to refer to RtSSB and did a quick search of the blog.

The link was broken.

The entire original purpose of this blog was to give me a database of

things that caught my interest during the trading day. Hosted on

Google's servers. Searchable by the Goog's algos (or anyone else).

And the damn link was broken. So I had to replace it.

And I re-read the whole 15 page paper, starting with:

What allows asset price bubbles to inflate? The recent rise and fall of

technology stocks have led many to argue that wide swings in asset

prices are largely driven by herd behavior among investors. Robert J.

Shiller (2000) emphasized that “irrational exuberance” raised stock

prices above their fundamental values in the 1990s. Others, however,

have pointed to structural features of the stock market, such as lock-up

provisions for IPOs, analysts’ advice, strategic interactions between

investors, and the uncertainties surrounding Internet technology, as

causes of the recent bubble. We use a historical example to ask which of

these explanations is most apt, with the potential to shed light on

other important episodes of market overvaluation.

We examine one of the most famous and dramatic episodes in the history

of speculation, the South Sea bubble. Data on the daily trading behavior

of a goldsmith bank—Hoare’s—allow us to examine competing explanations

for how bubbles can inflate.

While many investors, including Isaac Newton, lost substantially in

1720, Hoare’s made a profit of over £28,000, a great deal of money at a

time when £200 was a comfortable annual income for a middle-class family

(John Carswell, 1993). The behavior of a single knowledgeable investor

can tell us much about the nature of bubbles and investors during

periods of substantial mispricing. The bank did not profit simply by

chance. It “rode the bubble” for an extended period while giving

numerous indications that it believed the stock to be overvalued.

Short-selling constraints and the difficulties of arbitrage that have

been emphasized in recent work on the dot-com mania cannot explain the

South Sea bubble. A zero-investment constraint, if it existed, did not

bind market participants like Hoare’s. Perverse incentive effects

arising from delegated investment management highlighted in recent work

on mutual funds and hedge funds were not at work. We infer that the need

for coordination in attacking the South Sea bubble was the key to

allowing it to inflate to such an extreme extent, in line with recent

theoretical work by Dilip Abreu and Markus Brunnermeier (2003).

There is a rich body of earlier research on the emergence of bubbles.

The efficient markets hypothesis rules out substantial mispricing

(Eugene F. Fama, 1965). The same conclusion emerges from no-trade

theorems under asymmetric information, as well as from backward

induction in finite horizon models (Manuel Santos and Michael Woodford,

1997; Jean Tirole, 1982). Famous historical episodes like the South Sea

bubble, the tulip mania, and the Mississippi speculation are given as

examples of markets functioning reasonably well under uncertainty (Peter

M. Garber, 2000). Recent theoretical and empirical work, however,

suggests that bubbles can inflate even if there are large numbers of

highly capitalized, rational investors....

And I thought "sweet".

The two most important parts of the paper "II. Hoare’s Trading

Performance" and "III. Causes of Success" are definitely worth a couple

minutes. Here's

the link. (also replaced in the original post).

![[George Soros]](https://blogger.googleusercontent.com/img/proxy/AVvXsEjQJIcI9rDefHDEW14gafLiCzzqBGGQK4QiETO-coGmVENQQJv6e7KflaRBmKhKFwTSCnpXyRrHkXIiJ2v9AO7_DhCbHjuwbX6d4UuIUinQlEXguVt7mjfuBVoqS_XpxhtFH35IgISzOzUAJ14whFaX9tmy8CSGh-G1BO9eRw2Cqyb0DA6lIsUg6ceqGWs=s0-d)