Asked and answered.

From BloombergBusinessweek, August 4:

On a clear night at the end of April 2024, arsonists slipped into a tidy residential neighborhood in Hermannsburg, a German village of about 8,000 people surrounded by flat farm fields, heathland nature reserves and military bases. Under the cover of darkness, they arrived at a large redbrick home, where they set fire to a clapboard garden house and a towering beech tree out front. They escaped undetected before the fire brigade arrived. Neighbors awoke the next morning to the smell of still-smoldering wood.

The home belonged to Armin Papperger, the chief executive officer of Rheinmetall AG, Germany’s largest defense company. Papperger, a stocky, white-haired 62-year-old engineer, wasn’t home at the time. In fact, he hadn’t been there since 2022, when Russia launched its full-scale invasion of Ukraine, local residents say. The war had made Papperger a busy man: He was turning a sleeping industrial giant into an international defense juggernaut on track to bring in almost €10 billion ($11.6 billion) in revenue that year. Rheinmetall had already provided Ukraine with armored vehicles, military trucks and ammunition, and Papperger had recently announced plans to set up four weapons production sites inside the country.

An anonymous letter soon surfaced on a left-wing internet platform claiming responsibility for the arson attack. The letter lambasted Rheinmetall for profiting from Russia’s invasion and ended with a curious demand: to free from jail a former member of the Red Army Faction, or RAF, a militant group that murdered prominent German businesspeople and public figures in the 1970s and 1980s, including the CEO of Deutsche Bank in 1989. “His place of retreat is not safe,” the anonymous perpetrators wrote of Papperger.

A few months later, CNN revealed that US intelligence agencies had warned Germany earlier in the year that Russia was preparing to kill Papperger, the most advanced of a series of plans to kill defense industry executives across Europe. The story did not mention the arson attack—which appeared to be an act of intimidation rather than an actual targeting of the CEO—but people familiar with the situation said the assassination plot involving Russian proxies was active at the time it occurred. The arsonists were never caught, leaving their possible involvement in the wider scheme a mystery.

This January, James Appathurai, who headed NATO’s response to hybrid warfare, publicly confirmed during a session of the European Parliament that Russia was plotting to kill Papperger. “All indications are that the Russians have a much higher appetite to risk the lives of our citizens, and a very substantial response from us, to achieve their aims,” Appathurai told Bloomberg Businessweek before becoming interim managing director of the alliance’s defense innovation accelerator in July.

The targeting of Papperger represented a new frontier, even when compared with Russia’s long-established and well-documented history of violence against enemies living on foreign soil. Before the war, Moscow had focused attacks on its “near abroad”—Baltic states and former members of the Soviet bloc—or on Russians it viewed as traitors. The attempted poisoning in 2018 of Sergei Skripal in England showed Russia’s willingness to use a banned chemical in a NATO country, risking civilian casualties. But Skripal was a Russian colonel who’d spied for the UK—not the CEO of a major Western defense company.

After the invasion of Ukraine, Russian hybrid warfare—not just assassinations but also sabotage, disinformation and covert attacks on critical infrastructure—accelerated sharply, reaching a fever pitch last year. During the Cold War, these techniques were known as “active measures.” Analysts say the volume and intensity of the tactics was greater during the Ukraine war’s first three years than in the heyday of the Soviet Union, though the pace has slowed in 2025.

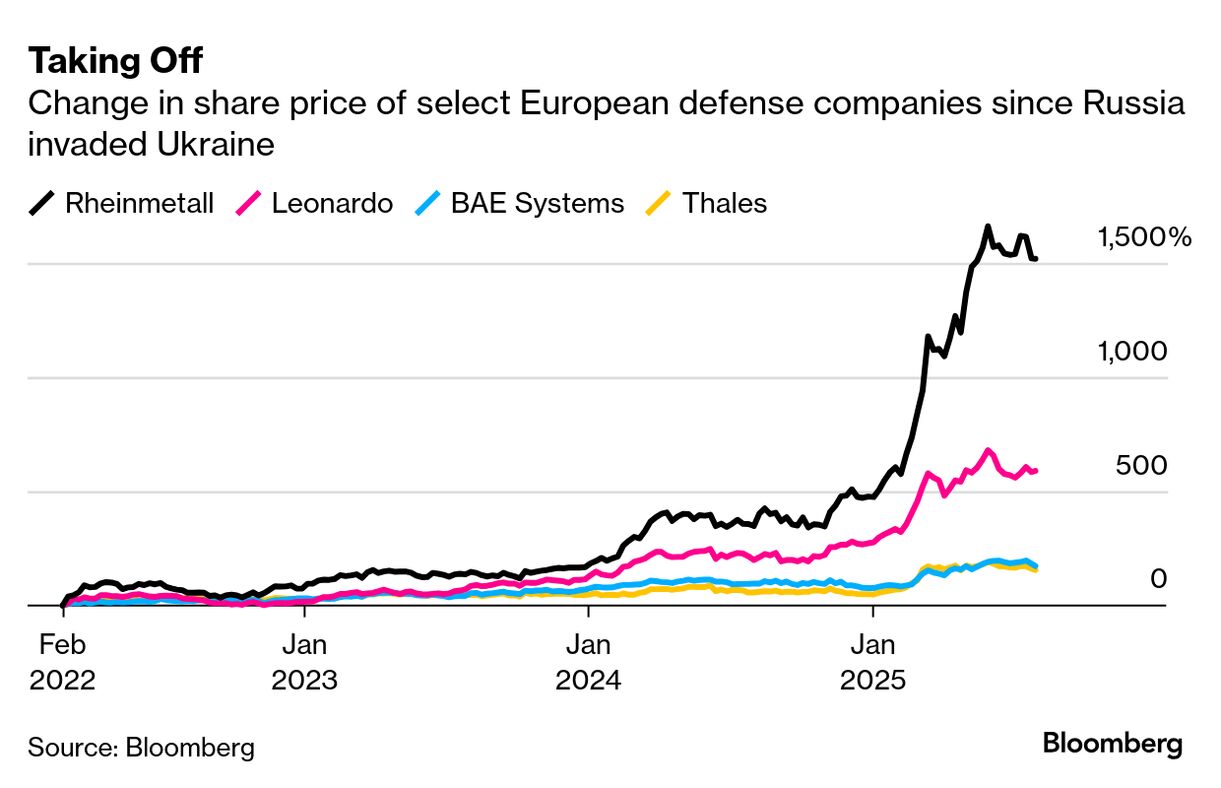

Papperger is by far the most prominent known target of this new era. He’s also central to Europe’s efforts to arm Ukraine and is a major beneficiary of the continent’s biggest investment in defense in decades. While rival executives have kept their heads below the parapet, he’s been noisily leading the charge for European rearmament, buying up competitors, ramping up production and even glad-handing Ukrainian President Volodymyr Zelenskiy in Kyiv. This, combined with the German government’s recent announcement that it will dramatically increase defense spending, has resulted in an investor frenzy. Rheinmetall’s stock has risen more than 18-fold since the war began. It’s now Europe’s most valuable defense company, with a market capitalization of about €81 billion.

Papperger has lamented that investors “ostracized” the defense industry for years. “Now we are a key player in the global defence supercycle,” Papperger said in an email in response to questions from Businessweek. ”We were always prepared, and that is now paying off.” Over the past two years, Rheinmetall, Europe’s top ammunition producer, has invested more than €8 billion in deals and new production. Papperger said Rheinmetall is building or significantly expanding 10 plants....

....MUCH MORE

We've had a few mentions of the big dog since Russia invaded Ukraine:

March 2024 - "Arms Maker Rheinmetall Forecasts Record Sales, Profit Growth Amid Rising Geopolitical Tensions" (RHM.de)

It was just a throwaway line in a March 7 post about possible Chinese yuan weakness but there must have been something in the air:

The last time we saw this sort of stockpiling behavior the yuan was under 7-to-the-dollar and our guess was that the order had gone out to importers to convert currency into storable commodities ahead of a devaluation in the yuan....*****....So who knows? But if I was long the German export industry I would be concerned that further weakening in the yuan would make Chinese exporters even more competitive than they already are.Except maybe for Rheinmetall. The armaments industry seems pretty well insulated from currency fluctuations. RHM.de 437.40 +1.18%

Getting a bit of that 'ol "Arms of Krupp" vibe.*

April 2024 - RWE Says ‘Significant Structural Demand Destruction’ Means Germany Will Never Fully Recover From Energy Crisis

Those companies that shut down or moved production are not coming back.

There's always Rheinmetall though. €543.20 last.

March 2025 - "Europe’s defense-tech startups launch into new era of growth"

*Butler was received the nation's highest award for valor, the Medal of Honor, twice for separate actions.

March 2025 - "As Germany Positions To Be The World's Liquidity Pump...."

"The world's" may be a bit of hyperbole but combined with what China will have to do to achieve the 5% growth figure that was reaffirmed yesterday, we are looking at potentially maybe $2 trillion in deficit spending over the next six years between the two economies and though not enough to offset the shrinkage of the U.S. deficit—which shrinkage must happen to delay slow-motion but inevitable worldwide disaster—it looks like the global party could continue until sunrise and/or 2030.

The fact much of the German deficit spending will go toward armaments is all the better—it is the most inflationary bang-for-the-buck, so to speak, spending a government can do; you make stuff, you blow it up, you make more stuff. It may not add to a country's real national wealth but boy-oh-boy does it boost nominal GDP growth.

This is a really big deal. If you don't believe me, believe the German bond market....

June 2025 - "Rheinmetall partners with Anduril to build military drones for Europe"

RHM.de closed at 1,741.00 up 12.50 (+0.72%)

July 2025 - “It’s Military Keynesianism” On Germany's Role In The Arms Business

July 6 - Defense stock surge triggers one of the hottest ETF launches in European history

July 18 - "Can the Developed World Grow Its Way Out of Stagnation?"

July 26 - "Spy cockroaches and AI robots: Germany plots the future of warfare"