From ZeroHedge, October 10:

On the surface, today's PCI prints came in hotter than expected across the board, yet all were in line with whisper numbers which as we noted, were higher than consensus. To be sure, the continued surge in auto insurance, and medical costs, will come as surprise to exactly nobody....

....Adding insult to wallet injury, food inflation is also back: five of the six major grocery store food group indexes increased. The index for meats, poultry, fish, and eggs rose 0.8% in September; the eggs index jumped 8.4%. The fruits and vegetables index increased 0.9% over the month, following a 0.2-percent decline in August. “The index for shelter rose 0.2 percent in September, and the index for food increased 0.4 percent. Together, these two indexes contributed over 75 percent of the monthly all items increase” the BLS said.

Some other notable highlights from the report:

- College textbook prices jumped 4.2%, a record monthly rise

- Admission to sporting events surged by 10.9%MoM in Sept, the biggest monthly increase on record

- Jewelry and watches rose 5.2% MoM, the biggest-ever monthly climb.

- Despite the narrative around airlines losing their pricing power, airfares rose 3.2% in the month.

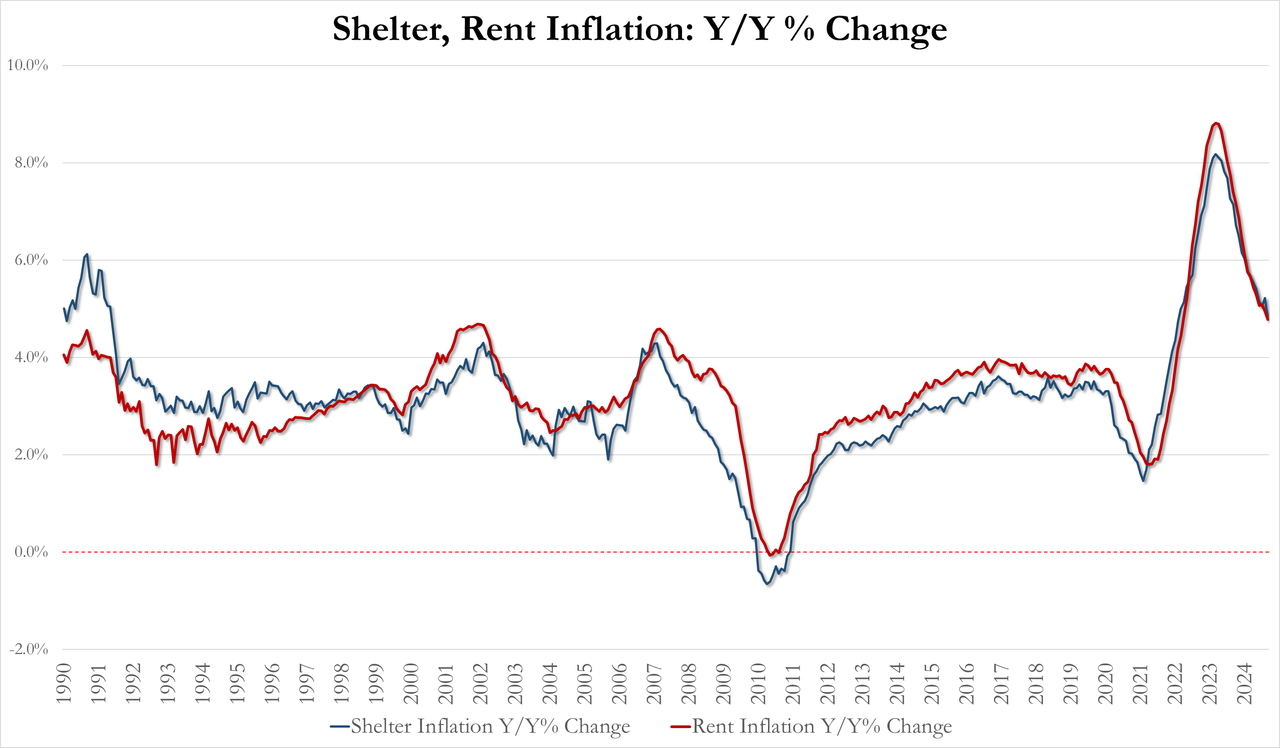

And yet, there was a several silver lining to today's report, most notably the unexpected easing in shelter/rent inflation...

.... yet even here questions emerge: just where does the BLS see this slowdown in housing costs? After all, according to both Case-Shiller and various real-time indexes, both prices are the highest they have been and are rising 6% YoY.

While that contrasting dynamic summarizes today's CPI report, here is a sample of what some of Wall Street's fastest-to-draw analysts and strategists had to say about today's inflation report:

Leo He, UBS S&T

"US headline and core CPI printed 18bp m/m and 31bp m/m in September, respectively, higher than respective 0.1% and 0.2% m/m consensus. Looking at the detail, owners' equivalent rent slowed to 33bp in September from 50bp the prior month. However, medical care services rose to 66bp from -9bp, used cars rose 0.3% m/m from -1%. Super core rose to 40bp, the highest since April."

Ali Jaffery, CIBC Capital Markets

“Today’s data will reinforce the message that the Fed is not in a hurry. The labor market is cooling but not breaking yet, and inflation is trending a bit above target.”

Karl Schamotta, chief market strategist at Corpay

“Investors may have been overoptimistic in expecting a rapid sequence of outsized cuts after September’s decision, but a long series of gradual moves still remains the most likely outcome in coming months.”

Anna Wong, head of Bloomberg Economics

“The September CPI report contains both good and bad news about inflation. The good is that rent disinflation may finally be making faster progress. The bad is evidence that elevated inflation is lingering in some key services categories, like car repairs and insurance. Disinflation in core goods prices has stalled.

“Even so, the Fed’s preferred price gauge, the core PCE deflator (due out Oct. 31), could increase more slowly than the CPI, as has been the case in recent months. Altogether, despite the upside surprise in core CPI, we don’t think the report will do alter the FOMC’s view that inflation is on a downtrend trajectory. We expect the FOMC to cut rates by 25 basis points at the Nov. 6-7 meeting.”

Ira Jersey, head rates strategist at Bloomberg Econ

"The higher-than-expect CPI headlines should take any chance of 50-bp rate cuts off the table and may cause the market to doubt the Fed may cut another 150 bps, as priced. Our focus has been the consumer, so next week’s retail sales report is key for the Treasury-yield outlook for the rest of the month. Core services continued to moderate, and most of the upside surprise appears to have come from automobile costs, which have been extremely volatile... Less-volatile sectors within core CPI continue to trend lower, while this month it was a spike amid more volatile sectors that appear to have driven the core CPI to beat expectations. Over time, this suggests inflation will once again trend lower.”....

....MUCH MORE

Earlier:Inflation: CPI Quick-and-Dirty