Two from Bloomberg. First up the headliner, October 7:

- Benchmark CSI 300 Index jumps as onshore markets reopen

- Gauge of Chinese stocks in Hong Kong drops after recent rally

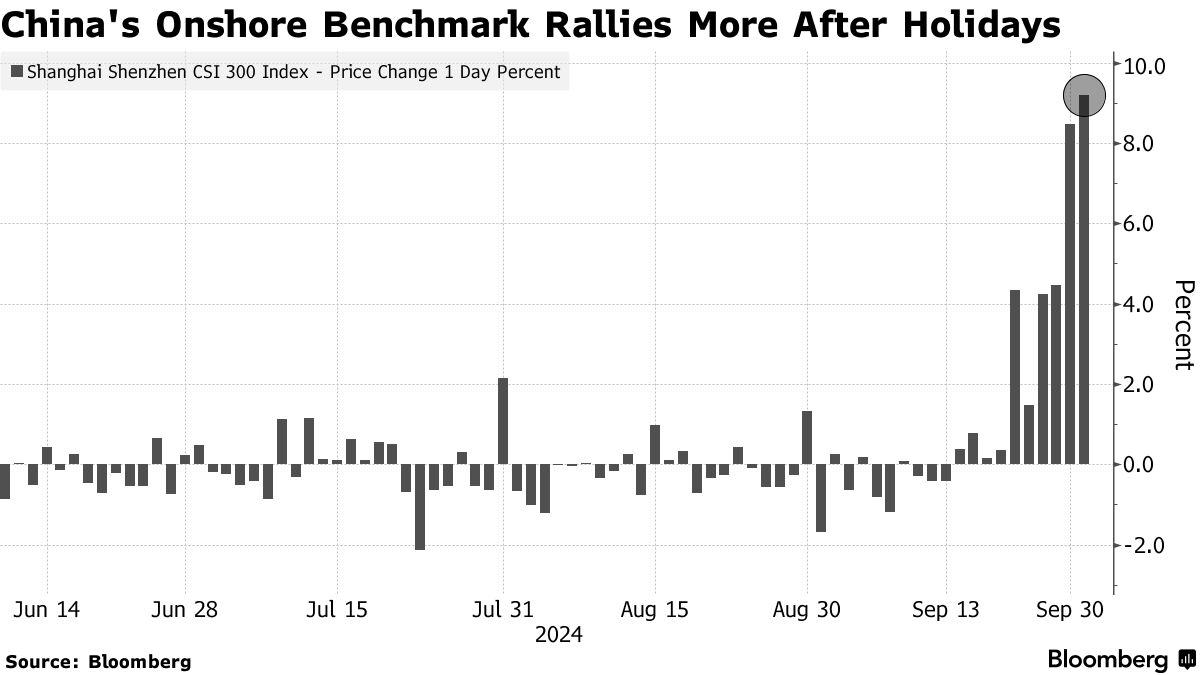

Chinese stocks listed onshore jumped as trading resumed following a week-long holiday, with encouraging home sales and consumption data giving fresh impetus to a rally sparked by Beijing’s stimulus blitz.

The benchmark CSI 300 Index climbed almost 11% in early trading before paring its advance. The measure had gained for nine straight sessions through Sept. 30 before heading into the Golden Week break. In Hong Kong, a gauge of Chinese shares slid 4.3% after having rallied almost 11% in the period that onshore markets were shut.

Sentiment toward Chinese equities has seen a dramatic turnaround since late-September as the authorities unveiled a range of supportive measures that included interest-rate cuts, freeing-up of cash for banks and liquidity support for stocks. Wall Street heavyweights including Goldman Sachs Group Inc., HSBC Holdings Plc and BlackRock Inc. have upgraded the once-beaten down stock market amid bets of further stimulus.

China’s top economic planner said it will hold a press briefing Tuesday morning to discuss a package of policies aimed at boosting economic growth.

“The durability of this China rally will depend on action following words on the fiscal side of the equation,” said Aleksey Mironenko, global head of investment solutions at Leo Wealth in Hong Kong. “The key thing we are watching going forward — what policies will be announced in coming weeks following the Politburo and State Council statements? That will determine if our overweight is a tactical one — to be taken off as relative valuations change – or a strategic one.”....

....MUCH MORE

Related October 2 - "China’s sudden stock rally sucks money from rest of Asia"

And back to Bloomber October 7:

Mark Mobius Sees More Upside for China Stocks on Growth Support

Mark Mobius said the rally in Chinese stocks may continue if policymakers continue to roll out measures to support the market.

“The bearish sentiment has already been broken so we can expect a continued bullish market,” Mobius, chairman of Mobius Emerging Opportunities Fund, said in an email on Monday. How long the rally can continue will depend on “government measures to increase liquidity available for the market,” he said.

The 88-year-old money manager turned bullish on Chinese equities earlier this year, as the government rolled out measures to support the property sector. The country’s stocks have skyrocketed since late September, after Beijing unveiled fresh stimulus measures that included interest-rate cuts and liquidity support to boost the economy....

....MUCH MORE

I'm thinking the briefing from the National Development and Reform Commission referenced in the first story could stir up the emotions, fear, greed etc.