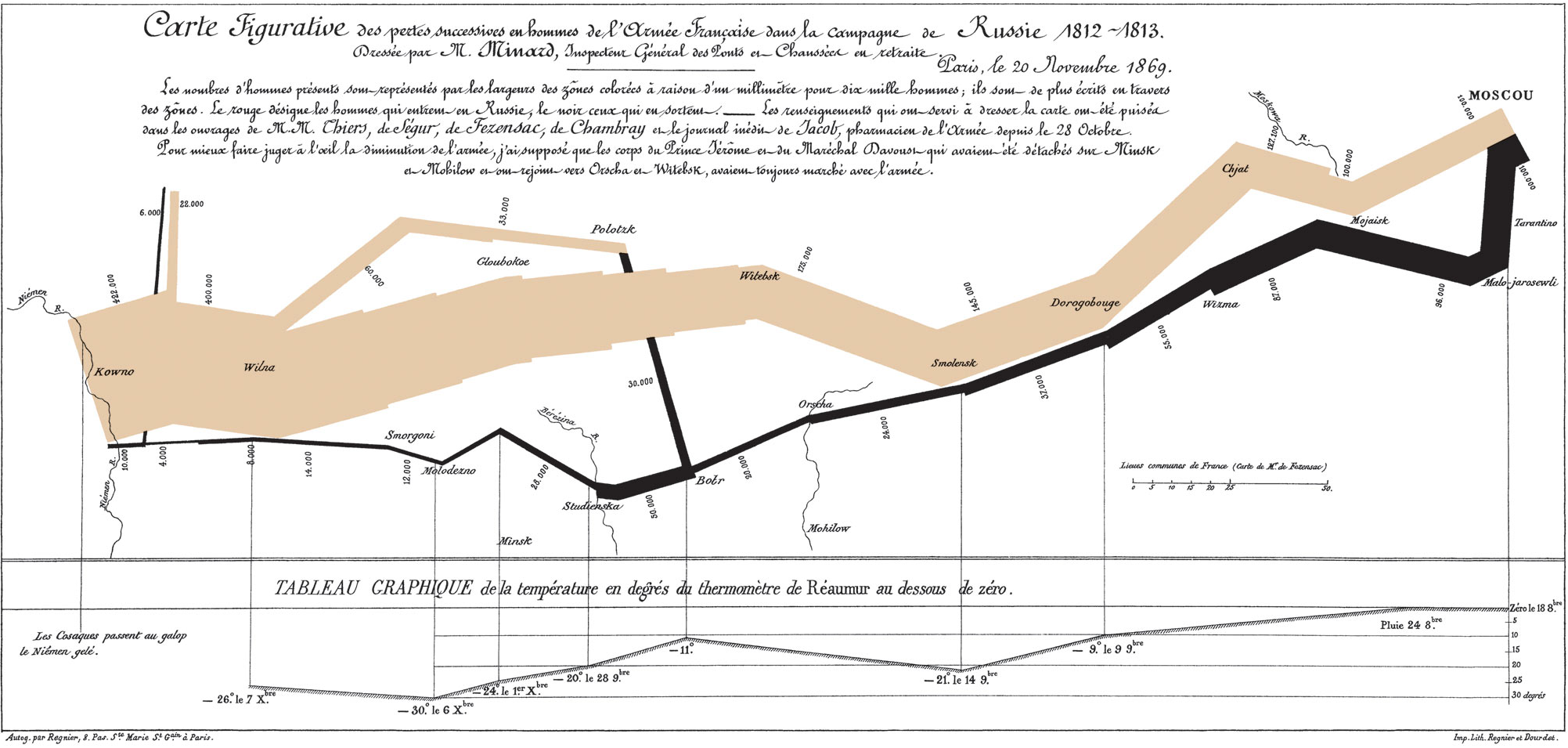

Though not as groundbreaking as Minard's graphical portrayal of the casualty count of Napoleon and the ):

Though not as groundbreaking, the presentation below is absolutely first rate.

From PitchBook, August 2:

Grid infrastructure energizes clean energy’s futureClean energy is on a hot streak with investors.

VC funding in the sector has remained historically high since its 2021 peak, with deal value hitting $3.5 billion across 197 deals in Q1 2024, according to PitchBook’s Q1 2024 Clean Energy Report. More investors are flocking to the category. In recent days, Breakthrough Energy Ventures, the Bill Gates-backed firm, revealed it has raised $839 million toward its third flagship fund as climate-focused investments gain steady traction.

Startups are feeling the excitement, too, with several securing large fundraising rounds in recent months. Zap Energy, a fusion power startup, raised $130 million of new funding in July, according to new filings. The battery manufacturer EnerVenue raised $308 million as it targets $515 million in new funding, also according to new filings.

Driving the excitement and growth in clean energy is the grid-infrastructure segment. With startups developing new power generation and storage solutions alongside management and monitoring technologies, the segment has consistently generated the most capital within the sector. As the global transition toward cleaner energy continues, the segment is poised for more growth.

The market map below explores the grid infrastructure segment, highlighting the startups investors are bullish on to lead the green transition. Click on the teal title for more details....

....MUCH MORE

Click, then click again.