Following on this morning's "World’s largest olive oil producer says the industry faces one of its toughest moments ever" here's a repost. Which when combined with yesterday's proposal that we would see cooler temperatures in the relatively near term:

"Major eruption at Ruang volcano, ash to 19.2 km (63 000 feet) a.s.l., Indonesia"

Here's a prop bet for you. By May 15, 2026 we will see the satellite-measured-inferred global lower atmospheric temperature anomaly decline by at least 1/2 degree C....

[note: Ruang going off is not the reason for the prop bet, just the reminder to post it]

leads to the conclusion: Get your hands on as many olive presses as you can. And when the growers of the bumper harvest have to get a-squeezin', you'll be in fat city—more specifically the mono-unsaturated fatty acid, oleic acid (C18:1) city.

So How Did Thales Price The World's First (known) Call Options?

Beats me.

I say first known because Thales had a pretty good press agent in Aristotle and we can't know those earlier math whizzes who got written up by lesser scribes.

We've posted a few times on the first known reference to derivatives. Here's the 2010 iteration:

...The earliest mention of a simple derivative, an option, that I am aware of is found in Aristotle's "Politics", circa 350 B.C.E.

MIT's Internet Classics Archive uses the Benjamin Jowett translation.

From Book One part XI:

Enough has been said about the theory of wealth-getting; we will now proceed to the practical part. The discussion of such matters is not unworthy of philosophy, but to be engaged in them practically is illiberal and irksome.Thales lived c. 624 BC to c. 547 BC.

The useful parts of wealth-getting are, first, the knowledge of livestock- which are most profitable, and where, and how- as, for example, what sort of horses or sheep or oxen or any other animals are most likely to give a return. A man ought to know which of these pay better than others, and which pay best in particular places, for some do better in one place and some in another. Secondly, husbandry, which may be either tillage or planting, and the keeping of bees and of fish, or fowl, or of any animals which may be useful to man. These are the divisions of the true or proper art of wealth-getting and come first.

Of the other, which consists in exchange, the first and most important division is commerce (of which there are three kinds- the provision of a ship, the conveyance of goods, exposure for sale- these again differing as they are safer or more profitable), the second is usury, the third, service for hire- of this, one kind is employed in the mechanical arts, the other in unskilled and bodily labor. There is still a third sort of wealth getting intermediate between this and the first or natural mode which is partly natural, but is also concerned with exchange, viz., the industries that make their profit from the earth, and from things growing from the earth which, although they bear no fruit, are nevertheless profitable; for example, the cutting of timber and all mining. The art of mining, by which minerals are obtained, itself has many branches, for there are various kinds of things dug out of the earth. Of the several divisions of wealth-getting I now speak generally; a minute consideration of them might be useful in practice, but it would be tiresome to dwell upon them at greater length now.

Those occupations are most truly arts in which there is the least element of chance; they are the meanest in which the body is most deteriorated, the most servile in which there is the greatest use of the body, and the most illiberal in which there is the least need of excellence.

Works have been written upon these subjects by various persons; for example, by Chares the Parian, and Apollodorus the Lemnian, who have treated of Tillage and Planting, while others have treated of other branches; any one who cares for such matters may refer to their writings.

It would be well also to collect the scattered stories of the ways in which individuals have succeeded in amassing a fortune; for all this is useful to persons who value the art of getting wealth.

There is the anecdote of Thales the Milesian and his financial device, which involves a principle of universal application, but is attributed to him on account of his reputation for wisdom. He was reproached for his poverty, which was supposed to show that philosophy was of no use. According to the story, he knew by his skill in the stars while it was yet winter that there would be a great harvest of olives in the coming year; so, having a little money, he gave deposits for the use of all the olive-presses in Chios and Miletus, which he hired at a low price because no one bid against him. When the harvest-time came, and many were wanted all at once and of a sudden, he let them out at any rate which he pleased, and made a quantity of money. Thus he showed the world that philosophers can easily be rich if they like, but that their ambition is of another sort....

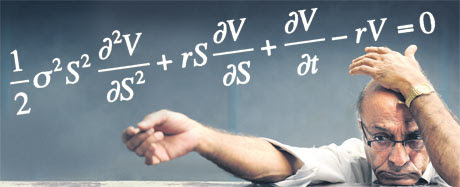

Although they were far from the first—Bachelier's stuff was damned advanced—Black and Scholes formalized options pricing in 1973, with one of the key variables being the risk-free interest rate.

In the Black-Scholes equation, the symbols represent these variables: σ = volatility of returns of the underlying asset/commodity; S = its spot (current) price; δ = rate of change; V = price of financial derivative; r = risk-free interest rate; t = time. Photograph: Asif Hassan/AFP/Getty Images