Before gentle reader decides to run to the parimutual window with cash in both hands—a sight I once witnessed and which prompted my companion to muse, "It would be better if he were running from the window"—before racing to get one's bets down, the tipster is me.

However, the blog has exhibited a bit of form on the Chinese economy and equities and following the $6 trillion dollar decline in Chinese stocks the odds have shaded a bit toward the bulls.

Lifted in toto from Bloomberg, April 30:

Chinese Stocks See Longest Foreign-Buying Streak in a Year

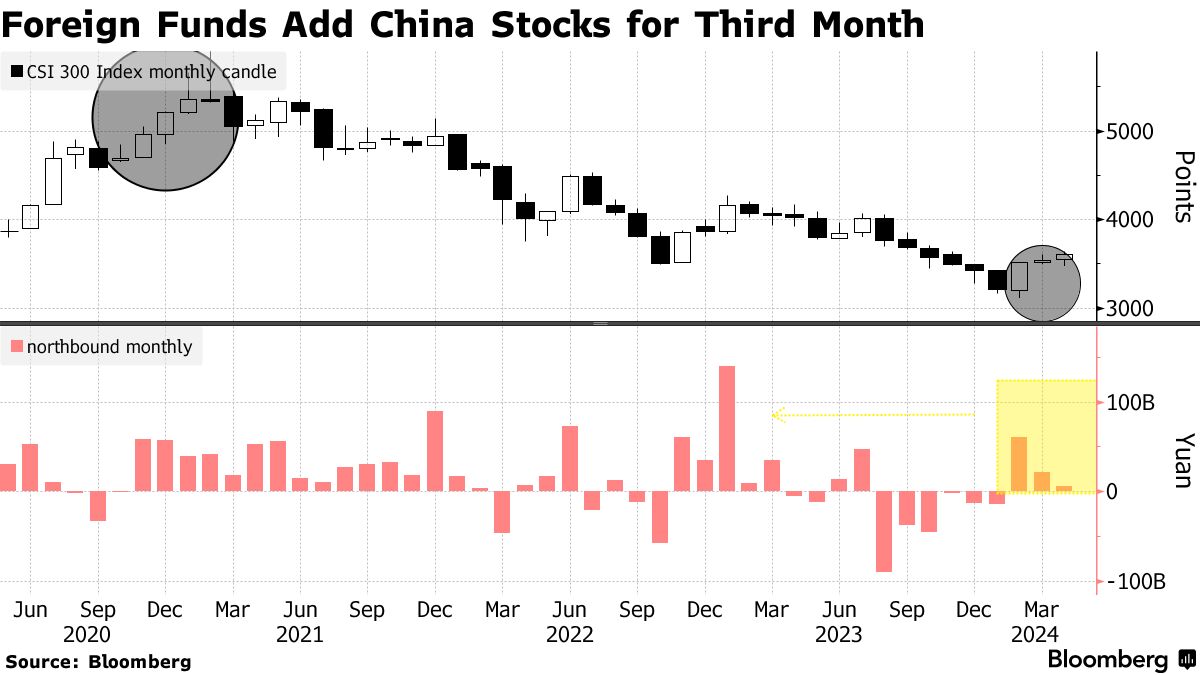

Foreign funds boosted holdings of Chinese shares for the third straight month, with positive policy tone from the Politburo meeting expected to bolster sentiment after the Labor Day holiday.

Overseas investors added 6 billion yuan ($829 million) of onshore equities via the trading links with Hong Kong in April, notching the longest run of monthly net purchases since March 2023. While the flows would have been negative had it not been for a record one-day buying last week, foreign investors may continue to pile in after the country’s top leaders hinted at further measures to support the ailing property market.

The CSI 300 Index ended April with a 1.9% gain, its third monthly advance. Mainland markets reopen on Monday.

And from Nikkei Asia, April 29:

China stocks rally as investor 'fear of missing out' spreadsGeopolitical risks, 'dire' housing market still seen discouraging long-term bets

China stocks have gained momentum as market players scurry to avoid missing rallies driven by supportive policies, analysts say, while cautioning that the upswing does not yet reflect a return of long-term investors.

A series of measures announced since mid-April to support the mainland and Hong Kong stock markets are playing a key role, analysts at Goldman Sachs said in a report published Monday.

"Portfolio inflows have improved moderately in recent weeks from both benchmark-unconstrained and mutual fund mandates," wrote analysts led by Kinger Lau at Goldman Sachs. But positions are "still broadly conservative among investors. This suggests that the setup for FOMO (fear of missing out) might be building if the positive momentum extends, as partly suggested by the all-time daily record of US$3.1 billion northbound inflows last Friday."

Foreign investors trade A-shares -- stocks of China-based companies listed in Shanghai and Shenzhen, and traded in yuan -- through the Connect system linking Hong Kong and the mainland. On Friday, the network recorded the largest single-day net investment since the scheme opened in 2014, at 22.45 billion yuan ($3.1 billion).

Buying of A-shares continued on Monday, when foreign investors snapped up the equivalent of 10.9 billion yuan worth of such equities, the sixth-largest single-day net investment this year, data from financial information provider Wind shows.

Hong Kong stocks have been on a roll as well. Led by tech stocks like Meituan, JD and Kuaishou, the Hang Seng Index cleared the 18,000 mark at one point on Monday morning, a level not seen since November....

....MUCH MORE

And finally, a similar take from Reuters BreakingViews, May 3:

FOMO finally returns to Chinese equities

After a $5 trillion fall, green shoots are appearing in Chinese equities: Hong Kong’s benchmark Hang Seng Index is up 20% from its most recent low in January and is gaining momentum. Shares traded on the mainland are up 16%. Unlike previous rallies which quickly fizzled out, these look better supported.

Inflows to both destinations have been prodigious, with offshore investors pouring 22.5 billion yuan ($3.11 billion) into onshore stocks in a single day last Friday. More important than the size of those flows is their composition.It's not just China's national team of state-owned entities buying. Local traders say global long-only investors are returning to the market at a meaningful scale for the first time since early 2023, when Beijing finally ended onerous Covid-19 restrictions.There is an external push in China's favour too: falls in U.S. equities spurred by the Federal Reserve's higher-for-longer interest rates and the weak Japanese yen have made cheap Chinese stocks an attractive hedge, both globally and within the region. Chinese shares trade at 9.3 times forward price-to-earnings, half their ratio in 2021, LSEG data shows....

April 28, 2024

Equities: We 'May' Have A Breakout In The Chinese CSI300 Index

It's "May" because, although we waited patiently for over a year before calling it, we were still early on the big change of direction. As recounted March 12:

On December 27, 2023 we posted "A Bottom In Chinese Equities".

We were early. The Shanghai-Shenzhen CSI300 Index continued lower for another month.

Finally on February 1, the rat-bastard turned up with some conviction.

Here's the latest, a poke above triple-top resistance:

Investing.com (also on blogroll at right)

What you want to see is today's action holding and tomorrow some follow-through.

If that happens you can start to get comfortable with the idea that the sellers are out of shares they want to let go at that particular level.

"Chinese Stocks Gain 20% From Lows, Fueling Market Bottom Calls"

That sort of headline is a bit scary. What you want to see, to get the most from these major turning points is gloom, doom, despair and most importantly, disbelief.

But that cat's out of the bag. From TradingView, our bogey, the Shanghai-Shenzhen CSI 300 Index:

From Bloomberg via Yahoo Finance, March 12....

"Nervous about the U.S. market at all-time highs? Buy China stocks"

That's their headline not ours. We don't get nervous, preferring instead to go directly to sheer terror....