The author of this piece, University of Colorado's Professor Roger Pielke Jr. pretty much wrote the book on making catastrophe losses comparable over time. He is almost ridiculously prolific in his writing, Google Scholar has 775 entries for his various books, papers, articles, letters etc.

From Professor Pielke Jr.'s personal substack, The Honest Broker, January 12, 2024:

An update that may surprise you

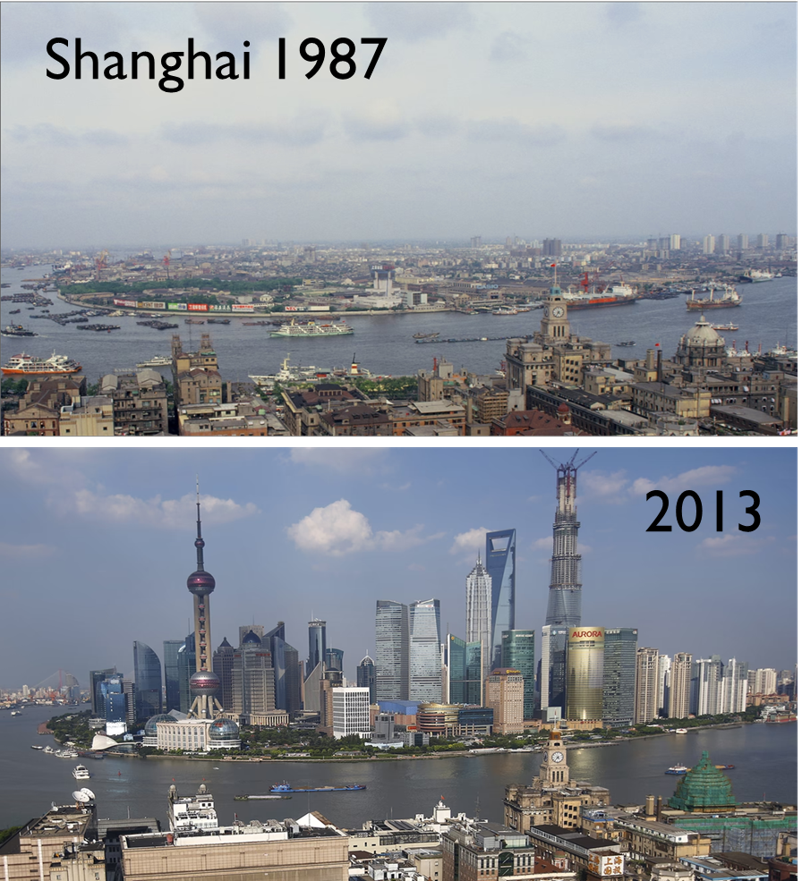

Spot the difference, note the clock tower in both photos, 26 years apart. Source.

The United Nations Sendai Framework for Disaster Risk Reduction identifies disaster losses as a proportion of GDP to be a key metric for tracking progress on disaster risk reduction.1 This makes obvious sense because as the global economy grows there is more “stuff” exposed and vulnerable to being damaged. The sort of changes to the built environment that you see in the photos of Shanghai above have occurred all over the world as the global economy has more than doubled in size since just the 1990s.

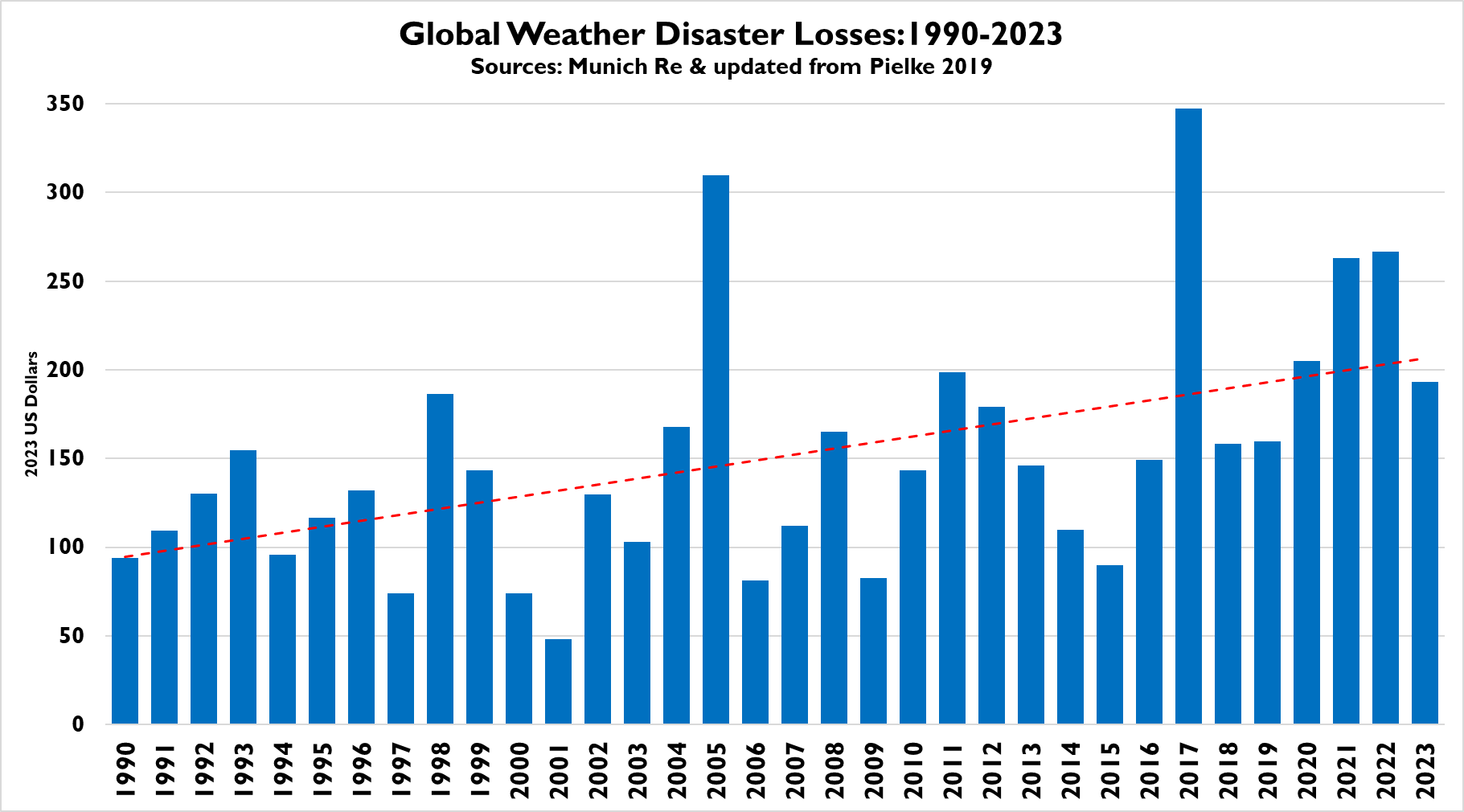

That means that looking just at total disaster losses, even adjusting for inflation, paints an incomplete picture of trends — maybe even misleading. With economic growth, we should expect losses to increase over time, as you can see in the figure below showing total weather disaster losses since 1990, updated based on the 2023 data update from Munich Re earlier this week.2

Some look at the trends in the graph above and conclude: Aha! Climate change! Because disasters occur at the intersection of extreme events and society, it will always be appropriate to look directly at weather and climate data to detect trends in weather and climate. Don’t use economic data — That should be obvious.

To get a better sense of trends in disaster losses it is necessary to normalize disaster losses by taking into account changes in exposure and vulnerability. The UN Sendai Framework recommends looking at disaster losses as a proportion of GDP as a method of normalization.3 The graph below shows the same data shown above, but this time as a proportion of global GDP....

....MUCH MORE

Munich Re, more so than any of the other reinsurance companies is available to the media for ascribing a weather event to global warming. In 2013 we posted:

*The 2013 season has come within a whisker of having the latest first hurricane of the season. If Humberto had held off until 8 a.m. EDT on Wednesday it would have come in later than 2002's Gustav when he made his debut on September 11, 2002.

This does not square with the hype-n-tout of Munich Re, which alone among the big insurers is hellbent on ascribing to AGW things they know aren't true, see last year's Spiegel article "The Disaster Business: Scientists Denounce Dubious Climate Study by Insurer" for a layman's explanation of what they're up to.

As late as this spring Peter Höppe, head of Geo Risks Research at Munich Re was being quoted spouting balderdash:

“Numerous studies assume a rise in summer drought periods in North America in the future and an increasing probability of severe cyclones relatively far north along the U.S. East Coast in the long term”He knows, and anyone who follows this stuff knows, the research points 180 degrees in the opposite direction, see for example the Proceedings of the National Academy of Sciences paper "Model projections of atmospheric steering of Sandy-like superstorms":

AbstractSuperstorm Sandy ravaged the eastern seaboard of the United States, costing a great number of lives and billions of dollars in damage. Whether events like Sandy will become more frequent as anthropogenic greenhouse gases continue to increase remains an open and complex question. Here we consider whether the persistent large-scale atmospheric patterns that steered Sandy onto the coast will become more frequent in the coming decades. Using the Coupled Model Intercomparison Project, phase 5 multimodel ensemble, we demonstrate that climate models consistently project a decrease in the frequency and persistence of the westward flow that led to Sandy’s unprecedented track, implying that future atmospheric conditions are less likely than at present to propel storms westward into the coast.

....MUCH MORE

The big guys are putting their efforts into governments and supranational orgs. If they can get the product mandated it would be a dream come true....

In 2021:

"COP26: Munich Re calls out global failure to hit $100bn climate finance goal"

Last week we saw the lobbyists, while not able to make reinsurance mandatory, might get the U.S. Federal government to pay some of the premiums. Via Artemis, January 10:

INSURE Act calls for Federal Catastrophe Reinsurance, with cat bond backing

And last month we saw at Reuters:

Munich Re aims for 2024 profit of 5 billion euros