The announcement at the end of August that Tesla was going live with their supercomputer — Elon Got Himself A Supercomputer: "Tesla's $300 Million AI Cluster Is Going Live Today" (TSLA)—reminded me of this piece at ZeroHedge, last month. We'll be back with more on Morgan Stanley's Tesla note later today but for now the TL;dr is "To the victor go the spoils" or "The rich get richer" or "Those who can afford a supercomputer will get closer to discovering the profitability (if any) of AI than those who can't afford a supercomputer."

Via ZH, August 8:

Authored by Simon White, Bloomberg macro strategist,

The huge outperformance in the stocks of the largest US firms will become further entrenched as they outspend on capex and buybacks, while smaller companies defensively build up cash levels.

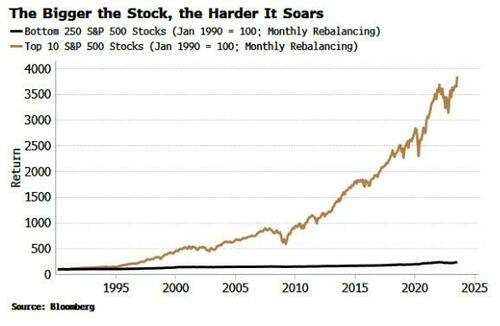

Big is beautiful. That’s been the resounding lesson from stock markets over the years. The biggest stocks have not only outperformed the rest, they have made their performance look like a rounding error.

Stock pickers are in a bind as it makes it increasingly unavoidable to own the largest stocks, for fear of missing out on where the bulk of returns are coming from. Unfortunately, it looks like that trend is set to continue as the largest firms fortify their already increasingly unassailable position.

The gulf between the largest and smaller companies can be seen in the chart below. Since 1990, a portfolio of the 10 largest companies in the S&P 500 rebalanced monthly has returned a stupefying 37x versus only 2.3x for the bottom 250 firms in the index.

Some of the stratospheric performance of the large-stock portfolio is due to calendar effects from rebalancing at the start of the month, but the smaller portfolio also benefits from that.

No matter which day of the month we rebalance, the largest stocks greatly outperform.

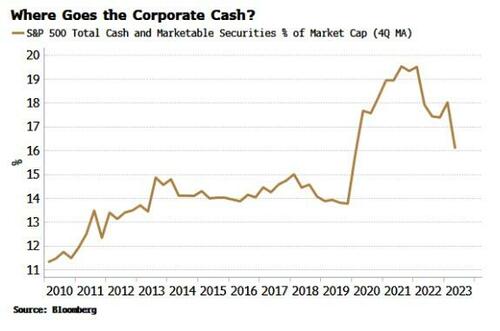

That is unlikely to change and, if anything, is set to extend even further. To see this, we need to look at corporate cash. One key post-pandemic trend has been the running down of firms’ cash levels. As with consumers who built up excess savings in the pandemic, companies built up their cash positions. Now these are falling.

Rising interest rates are not the driver. The net interest expense for the companies in the S&P has fallen marginally over the last two years. One conjecture that’s been put forward is that companies have deployed their excess cash in higher interest-paying accounts and MMFs, and this is mitigating their net interest costs. But that’s not why corporate cash is falling.

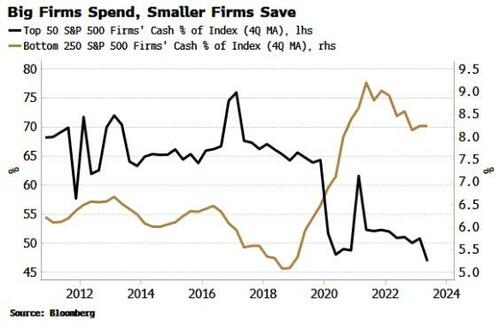

To see why it is, we need to look beyond the simple average. What we find is a significant bifurcation: the largest firms have driven all of the fall in corporate cash for S&P 500 companies. The smallest companies, on the other hand, have been raising their cash levels. (As an aside, note that the top 10% of the firms in the S&P 500 have 50% of the cash).

Perhaps larger firms have been paying out more in dividends? But the median payout ratio of the biggest firms has fallen significantly over the last five years while it has remained static for companies in the bottom half of the S&P.

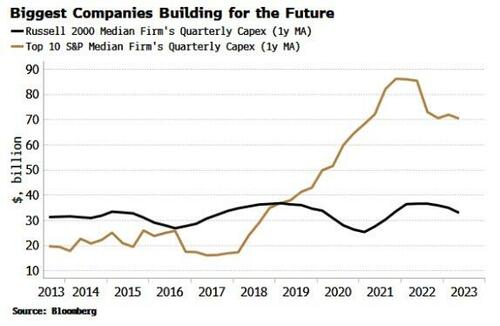

Instead, the fall in cash of big companies has been driven by rising capex and share buybacks. The 10 largest companies have significantly increased their capex over the last five years, while smaller companies defensively hold on to cash. We can see this most clearly by looking at the median capex of the companies in the mid-cap Russell 2000.

Surging investment in AI accounts for the tech-dominated top-10’s rise in capex. Microsoft, Alphabet et al are investing billions of dollars in new data centers and processing units to increase their capacity to train and run huge AI models. Elon Musk recently remarked that it seems like “everyone and their dog is buying GPUs”....

....MUCH MORE

And a couple prior posts on the flywheel effect, which effect is referenced in the Morgan Stanley Tesla note.

Flywheel Effect: Why Positive Feedback Loops are a Meta-Competitive Advantage

Following up on April's "How to Think About Companies: 'Advantage Flywheels'".

From Eric Jorgenson at Evergreen Business Fortnightly, Aug 7, 2017:

Evergreen is a collection of links to the best learning resources in business, collected by a group of managers, founders, and investors. We contribute resources about one topic, which are synthesized and shared in this Collection. The goal is to learn more efficiently through increased context and focus.Remember, these are designed to feel like short books, you’re meant to meander and spend ~3 hours on this topic. Save these links and read them throughout the week. Immerse yourself in this topic and leave the week smarter than you started it!I admit, I was not completely sure what I was talking about when I chose “Flywheel Effects” as a topic. But that’s part of the fun.This turned into a fascinating adventure through Competitive Advantages, Mental Models, and practical lessons for operators. Also lots of fun pictures and diagrams in this one!Here’s the “Table of Contents”:

- What is the Flywheel Effect?

- Applications of Flywheel Effect (and Meta-Competitive Advantages)

- The Best Examples of Flywheels

- How to Push the Flywheel....

....MUCH MORE

And August 19, 2023:

From Bot Populi:

Who Learns and Who Profits in the Era of Artificial Intelligence?

Me: My flight was canceled, and I want to check if the refund claim I made yesterday is being correctly processed.

Chatbot: Hmmm. Sorry, I didn’t understand that. I’m a new Chatbot and still learning. I’m better with simple, short questions. If you prefer to choose a topic from our menu, type ‘Help’ (31 March 2023).

....MUCH MORE