Although there is some skittishness among the commentariat regarding the earnings season that began in earnest last week, the quarter just ended won't be the scary one. It's the fourth quarter that will show just how the various spending measures, capex, consumer, government etc. will compare to the end of the Happy Time™ in 2021, and how that spending comparison will impact sales and earning going forward.

Via ZeroHedge, October 13:

By Sagarika Jaisinghani, Bloomberg Earnings Watch reporter and analyst

US inflation is at a 40-year high, Europe is enduring an energy crisis and major economies are nearing recession. The impact on earnings is about to be laid bare.

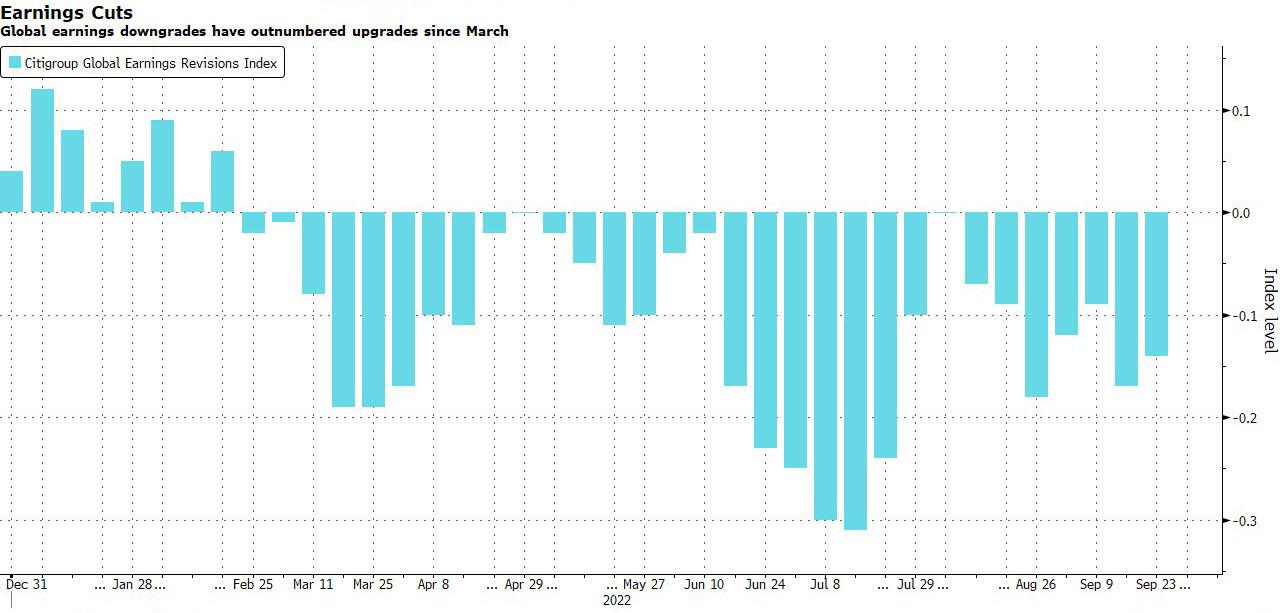

Analysts will scrutinize results and conference calls over coming weeks for details of how firms plan to navigate pressure on margins from rising input and labor costs. Soaring interest rates and China’s Covid restrictions are also fanning worries that they haven’t been fast enough to cut earnings estimates.

“No one expects the profit warnings to date will be the end of the story,” said Danni Hewson, an analyst at AJ Bell.

While Deutsche Bank AG strategists say analyst downgrades of US earnings since July have been among the sharpest on record, Morgan Staney’s Michael J. Wilson warned estimates are still too high. Goldman Sachs Group Inc. strategists last month lowered their forecast on European earnings, taking a contrary view to the consensus, which still expects growth in 2023.

“Estimates are too optimistic and not incorporating the pressure on margins,” said Peter Garnry, head of equity strategy at Saxo Bank A/S. “Our guess is that earnings will come in weaker than estimated and wage pressures will surprise analysts, while many companies possibly skip their outlook due to the lack of visibility.”....

....MUCH MORE