"The reading of work-related articles last thing at night, propped up in bed, is finally getting to me. I actually dreamed about MMT last night after reading a Lunch with the FT interview with one of MMT’s highest profile advocates, Stephanie Kelton. Then as a final nightcap I read an article for and against MMT with Kelton as proponent and Edward Chancellor opposing. Later, I dreamed that helicopter money was being delivered by Kelton around the US, not by helicopter, but in a long goods train. It was quite sinister though as the train looked a lot like the armoured train Strelnikov used in my favourite film, Dr Zhivago."Here's what ZH did catch:

For Albert Edwards This Is The One Chart Proving Just How Insane The Market Has Become

By now everyone has seen some version of this chart which we first presented a month ago and updated yesterday, demonstrating just how disconnected stocks are from reality.

SocGen's resident permabear (... for stocks, and permabull for bonds) Albert Edwards has seen it too, and he too is stunned by the ludicrous gap between reality and expectation, which he has been tracking for decades but never has it gotten as wide as it is now, because as he writes in his latest global strategy weekly:

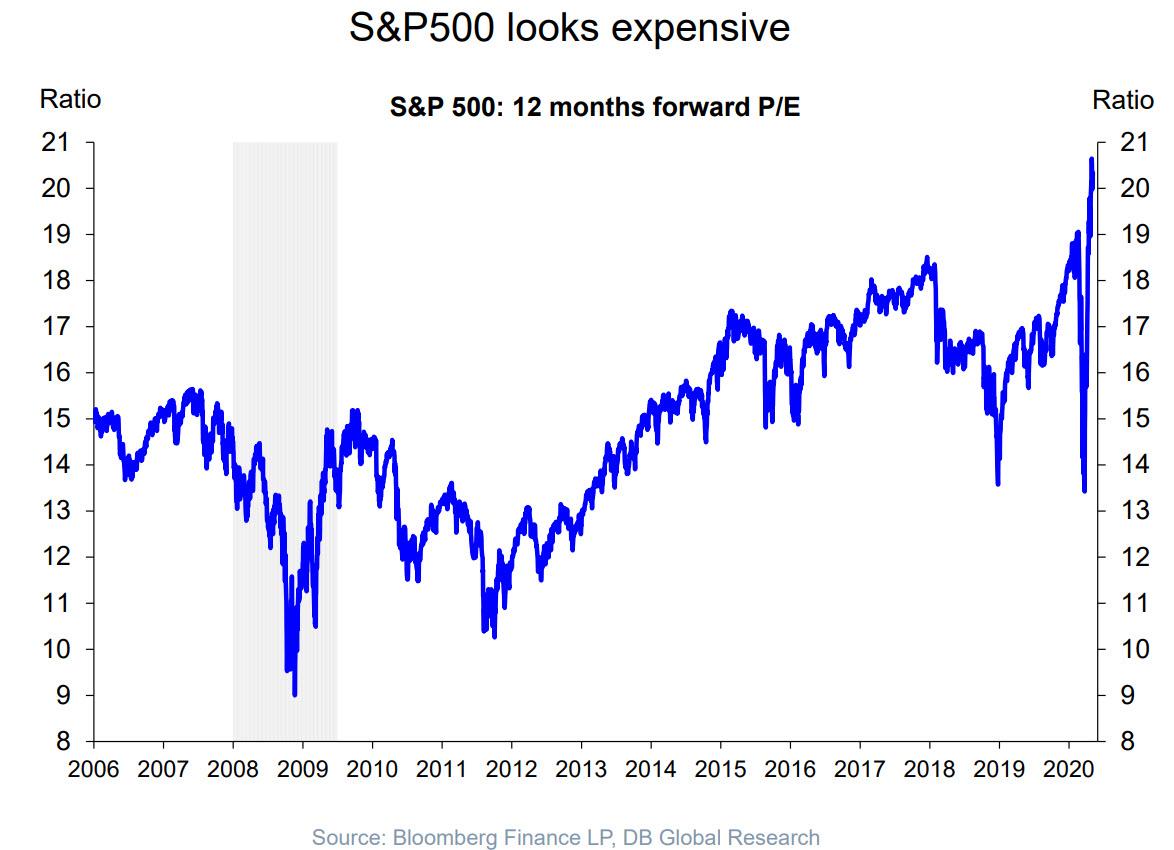

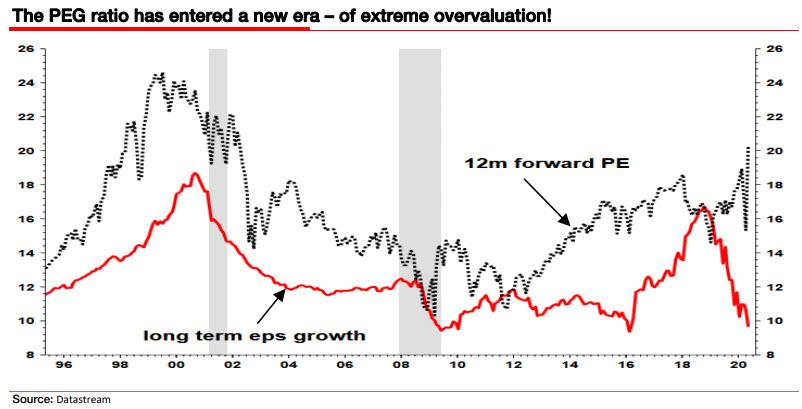

We are in the midst of a monetary and fiscal ideological revolution. Nose-bleed equity valuations are being supported by nothing more than a belief that a new ideology can deliver. Meanwhile the gap between the reality on the ground and expectations grows wider.While Edwards admits that there are many ways to show "how ludicrous current equity valuations have become and by implication how vulnerable equities are to a collapse", the SocGen strategist avoids focusing on the "ubiquitous chart" shown above which shows the rise in the S&P500 12m forward PE above 20x driven by the ongoing profits collapse - after all we did that just yesterday highlighting the "Idiotic Disconnect Between Markets And Reality" - to Edwards the real show-stopper is a different chart, one which shows on one hand the continued Ice Age slump in analysts’ collective expectations for long-term eps growth, and on the other the soaring PE ratio. The combination of the two is what is also known as the PEG, or Price to Earnings Growth, ratio.

Looking at the first component, long-term, EPS growth, Edwards notes that it "has now slid below 10%, a trend only likely to accelerate during the current profits slump." This is shown in the chart below.

Looking at the chart above, Edwards urges readers to compare the current LT EPS situation with the late 1990s tech bubble, when - like now - "the S&P forward PE rose above 20x, but at least back then the cycle was still intact, and as technology stocks increasingly dominated the index, the market’s LT eps was also surging higher in tandem with the rising PE." As he further explains, at least back in the tech bubble, the market had a LT eps leg to stand on "albeit a wooden leg, riddled with woodworm." By contrast, this time around, despite technology stocks once again dominating the index, something Goldman warned two weeks ago always ends in pain, "the 20x PE is based on nothing more than an ideological dream." The dream he is referring to, is one spawned by the destructive ideology of MMT (i.e., the Magic Money Tree), where the merger of the Treasury and Fed, and the joint issuance and monetization of debt, magically creates an economic perpetual engine and social utopia... for at least a short while before the currency collapse. No wonder this ideological dream is that anchor pillar of socialists who wish to pass off as financial gurus.

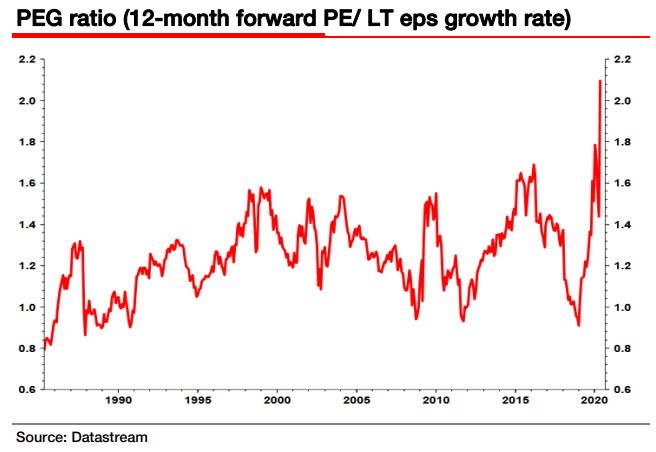

In any event, going back to the chart above, when one combines the two data sets, one gets a snapshot of the so-called PEG ratio (the ratio of the P/E to Long-Term eps growth) which as Edwards notes, has risen above 2x for the first time ever, which prompts the stunned strategist to exclaim that "this is even more shocking than a 20x PE!"

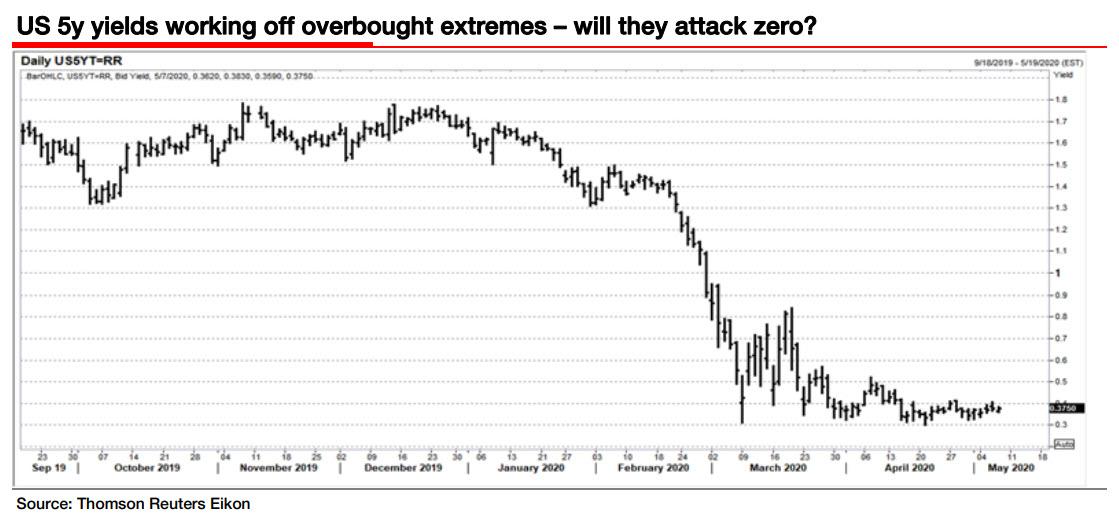

While not nearly as dramatic, Edwards also highlights a few charts from the far more rational world of bonds - at least until the Fed locks it down too, when it launches BOJ-style Yield Curve Control in a few months. The first one is of 5Y yields which as Edwards points out, have not bought into the latest risk rally and yields remain close to rock bottom. "Watch the 5y yield particularly closely as a break below the recent 0.3% floor would likely see an attempt to attack zero."

And speaking of zero rates, Edwards concludes with a quick take on the dollar, which as we first showed two months ago exploded to an all time high due to an ongoing and systemic $12 trillion US dollar margin call as countless offshore issuers of dollar-denominated debt suddenly find themselves cut off from cashflows as a result of the global economic stop, which in turn means that there is a shortage of up to $12 trillion in synthetically created dollars, which is precisely what the Fed has been struggling to flood the entire globe with thanks to its expanded FX swaps........MORE

For what it's worth we don't need Albert to tell us the PEG ratio is rich, we need Albert to talk about rates, which he does at the tail end of his commentary.