So here's a little victory dance 'til we figure something out.

And after that, a pretty good Warren Buffett story.

Beginning with May 2015's "Nvidia Wants to Be the Brains Of Your Autonomous Car (NVDA)" with the stock at 21 bucks. In November 2015's ""NVIDIA: “Expensive and Worth It,” Says MKM Partners" (NVDA)", with the stock up 50%, we began adding what became our standard boilerplate:

We don't do much individual stock stuff on the blog but this one is special.By the end of 2016, after a hundred or so posts on NVDA we closed the year with "The Financial Times Gives NVIDIA a Nod (NVDA)":

We use it as an example of what Silicon Valley used to be, when high tech meant high technology and not a new app for some (still) mundane task.

Simply put, NVIDIA makes some of the fastest computer chips in the world.

They are used in gaming systems that require graphics that don't make you (literally) puke. Right now automakers use their chips for graphic displays....

Chipmaker Nvidia tops S&P 500 as best performer of the yearAt the time of posting the stock was at $108.59 so the 238% for the year was actually a five banger going back to May 2015.

High expectations for artificial intelligence drive stock up 238%

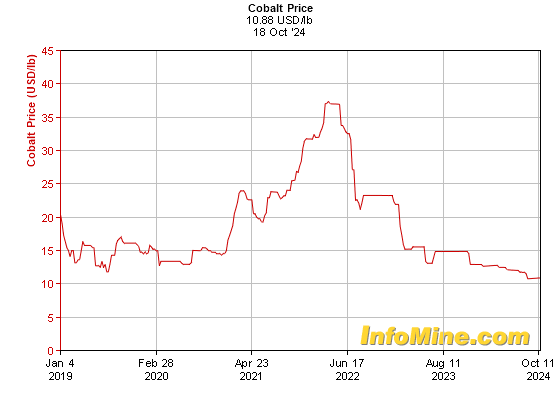

Starting in May 2016 we dropped an Easter egg on cobalt with ""Freeport Sinks On Sale of Africa Copper Mine To Chinese" (FCX; LUN.TO)". Seventeen days later we came clean in "Why the CIA Reads The Financial Times (and you should too) Tesla and Cobalt"

A couple weeks ago we posted a seemingly innocuous piece with a boring headline: "'Freeport Sinks On Sale of Africa Copper Mine To Chinese' (FCX; LUN.TO)".

I figured there were at best two thousand people in the whole world who knew or cared about the back story and real import of what was going on so I'd just drop it as an Easter egg for the cognoscenti and other assorted electric vehicle/conflict mineral/African warlord/Elon Musk/extractive industry/Génocidaire hunter/U.S. political corruption watchers to find.And the game was afoot.

Well now that cat's out of the bag.

Big kudos to the FT's Henry Sanderson for recognizing one hell of a story and a small request for the Financial Times: Can you tell us what the old ENRC is up to these days?...

Going back to the Financial Times, Dec. 27, 2017:

Cobalt’s rise, Enigma trade, Portuguese bonds, bitcoin, Snap and shorting the dollar

Investors have enjoyed a banner year, with the FTSE All World index up nearly 20 per cent, but several specific trades generated far more spectacular returns. Here, FT market reporters highlight some of the eye-popping trades that lit up 2017.

Cobalt’s rise as EV demand soars

Cobalt has been the hottest commodity trade, driven by demand for electric vehicles, which use the metal in their batteries. The price of cobalt has surged by over 120 per cent, boosting shares of the largest producers Glencore and China Molybdenum.

That has left carmakers scrambling to secure supplies as they unveil ambitious plans for electric vehicles. In September Volkswagen issued a tender for five years worth of cobalt at a fixed price. That was rebuffed by miners, with Ivan Glasenberg, the chief executive of Glencore, saying it does not do fixed price deals.

Adding to the shortage of cobalt, investors have bought up stockpiles of the metal, betting that prices will continue to go higher. Cobalt 27, a Canadian-listed vehicle, has amassed a hoard of over 2,800 tonnes of the metal, worth about $209m at current prices. Over half of the world’s cobalt comes from the Democratic Republic of Congo, where some of it is mined by hand by artisanal miners. That’s likely to come under greater scrutiny in 2018 as cobalt enters electric vehicle supply chains....

Henry Sanderson

***

Which brings us to today when all I have to offer are a couple snips from Warren Buffett's Letters to the Shareholders of Berkshire HathawayThe '85 Berkshire letter continues one of my favorite BRK stories.

First the background, from the 1984 Chairman's Letter:

"...Using my academic voice, I have told you in the past of the drag that a mushrooming capital base exerts upon rates of return. Unfortunately, my academic voice is now giving way to a reportorial voice. Our historical 22% rate is just that - history. To earn even 15% annually over the next decade (assuming we continue to follow our present dividend policy, about which more will be said later in this letter) we would need profits aggregating about $3.9 billion. Accomplishing this will require a few big ideas - small ones just won’t do. Charlie Munger, my partner in general management, and I do not have any such ideas at present, but our experience has been that they pop up occasionally. (How’s that for a strategic plan?)..."And then, the dénouement in the paragraph which immediately preceded the Halley's bit in the 1985 letter:

...You may remember the wildly upbeat message of last year’s report: nothing much was in the works but our experience had been that something big popped up occasionally. This carefully- crafted corporate strategy paid off in 1985. Later sections of this report discuss (a) our purchase of a major position in Capital Cities/ABC, (b) our acquisition of Scott & Fetzer, (c) our entry into a large, extended term participation in the insurance business of Fireman’s Fund, and (d) our sale of our stock in General Foods....So, for 2018 we think something might turn up but until it does we'll leave you with a post that might be important to remember if you hold NVIDIA: "Big Winners and Big Drawdowns (NVDA; AAPL; AMZN)".

And hope springs eternal.

Here's a possible lesson in December's "Rush for Ruthenium Has Metal Soaring 375 Percent in 2017: Chart".