Disclaimer up front: There Is No Magic Formula.

In a bull market long ain't wrong.

In fact, the only strategy that performs better in a bull market is Buy the Dip.

But things change and being attuned to the changes is important. Even (especially?) quant trading only works until it stops working and the signals mined through big data or AI or your wild-ass guess results in gobbledygook. Or worse, a false sense of omnipotence.

Humble and wary sucks as a way for the exuberant egos attracted to the business to go through life but it's a wonderful way to go through markets.

And come out alive.

From Of Dollars and Data:

In a bull market long ain't wrong.

In fact, the only strategy that performs better in a bull market is Buy the Dip.

But things change and being attuned to the changes is important. Even (especially?) quant trading only works until it stops working and the signals mined through big data or AI or your wild-ass guess results in gobbledygook. Or worse, a false sense of omnipotence.

Humble and wary sucks as a way for the exuberant egos attracted to the business to go through life but it's a wonderful way to go through markets.

And come out alive.

From Of Dollars and Data:

The problem with being good at sports betting is that most bookmakers learn who you are and refuse to take your bets. Why? Good sports bettors will cut into a bookmaker’s profit, especially when placing larger bets. However, this all changed in 1998 with the founding of Pinnacle Sports.

Pinnacle proclaimed that it was happy to take larger bets (up to a maximum) from anyone who played. And if Pinnacle found a player who consistently made money, they did not stop them. This was considered heresy in the sports betting market in the early 2000s, but Pinnacle had made an intriguing discovery. The Perfect Bet: How Science and Math Are Taking the Luck Out of Gambling reveals Pinnacle’s secret (emphasis mine):Whereas all bookmakers look at overall betting activity, Pinnacle also puts a lot of effort into understanding who is placing those bets…Pinnacle generally posts an initial set of odds on Sunday night. It knows these numbers might not be perfect, so Pinnacle only takes a small amount of bets at first. It has found that the first bets almost always come from the talented small-stakes bettors: because the early odds are often incorrect, sharp gamblers pile in and exploit them.But Pinnacle is happy to hand an advantage to these so-called hundred-dollar geniuses if it means ending up with better predictions about the games. In essence, Pinnacle pays smart gamblers for information.Pinnacle was able to revolutionize the sports betting market because they paid a premium for data and insights on the outcome of sporting events. All they had to do was follow the money.Pinnacle’s discovery reveals an important lesson for investors that I have recently come to accept: you are likely to outperform a traditional buy and hold investment approach…if you follow the money. When I say “follow the money”, I mean using a simple trend following rule. One such rule for investing in the S&P 500 could be:

- When the current price > average price over the last 12 months, stay invested (or buy in if you aren’t invested).

- When the current price < average price over the last 12 months, sell everything and move to cash (or bonds).

This rule translated into simpler terms would be:

- When everyone is buying and the market is moving up, stay invested.

- When the price starts dropping below where it was over the last year, get out.

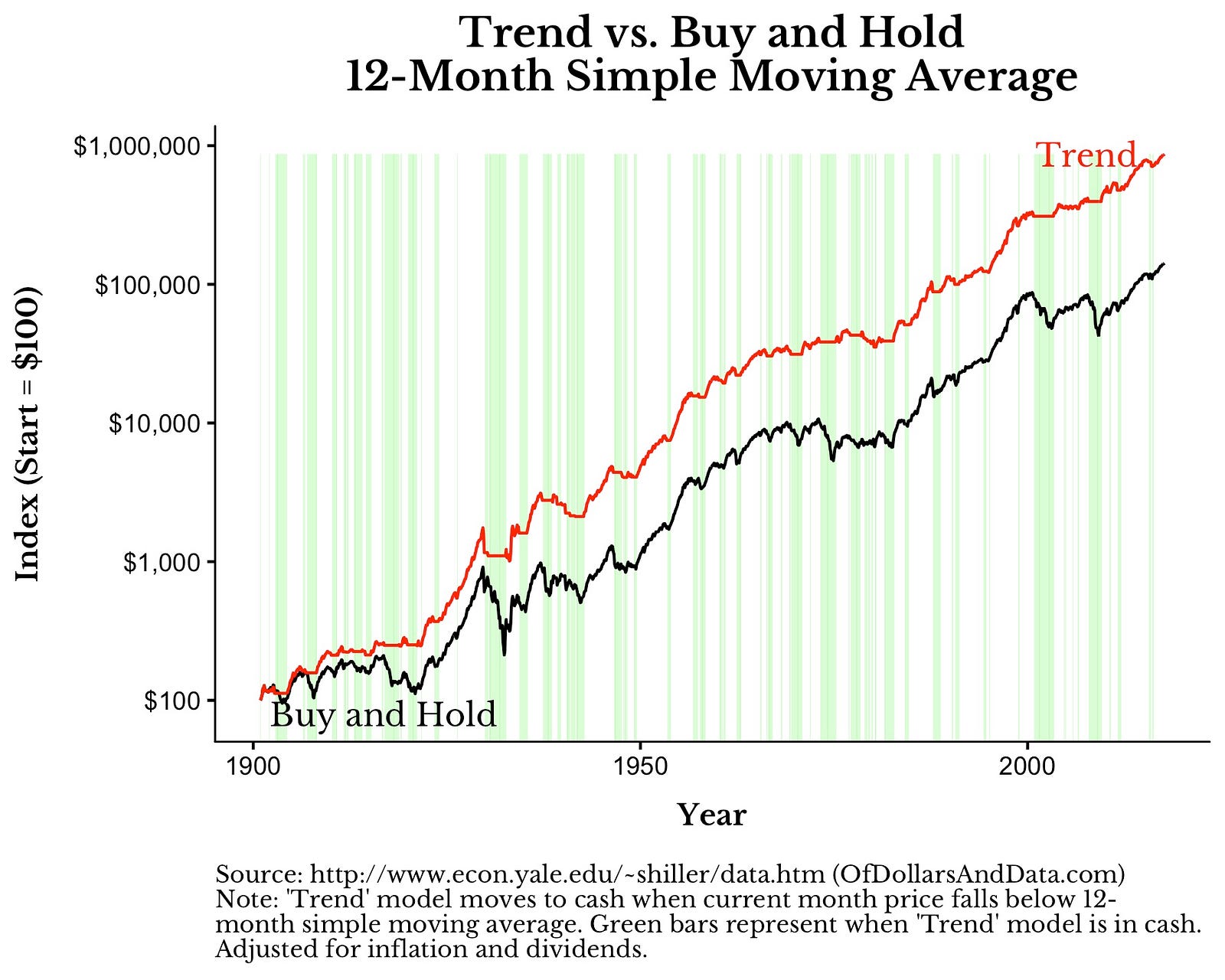

That’s it. That simple rule has outperformed buy and hold for almost every 40 year period I tested starting in 1900–1939 and going through 1978–2017 (assuming no taxes or transaction costs). It has also done so with far less downside risk than buy and hold.To visualize this, I put together a chart that shows both a buy and hold approach and the trend following rule (“12-month simple moving average (SMA)”) outlined above. I also shaded in green in the background every time the trend model “moved to cash” (i.e. this is inflation-adjusted cash, so it technically moves to TIPS, which I refer to as “cash”). As you can see, the trend following model outperforms over the 1900–2017 period:[Author’s Note: I was informed after posting this that the prices I used from the Shiller data are average monthly prices, instead of closing prices. I have been told this can overstate the outperformance of trend following. My understanding is that trend following still works, but the size of the outperformance is not as large as the charts below display. If I have time to change the data in the future, I will update these charts and remove this note.]

If we zoom in on the period of 1990–2017 we can see more detail on how this model outperforms:...MUCH MOREHT: Alpha Ideas Linkfest, January 22