From FT Alphaville:

The New York Fed thinks it’s time to make cashout refis great again

A return to a reasonable pattern of home equity extraction would be a positive development for retailers, and would provide a boost to aggregate growth… If households and lenders again become comfortable with financing consumption with debt in addition to income, this will provide additional support to household spending and to the current economic expansion.–Bill Dudley, January 17 2017

America has yet to fully recover from the last downturn — and for those who don’t remember, one of the defining features of the 2000s bubble was the extent to which American households borrowed against rising home values to pay for consumption.

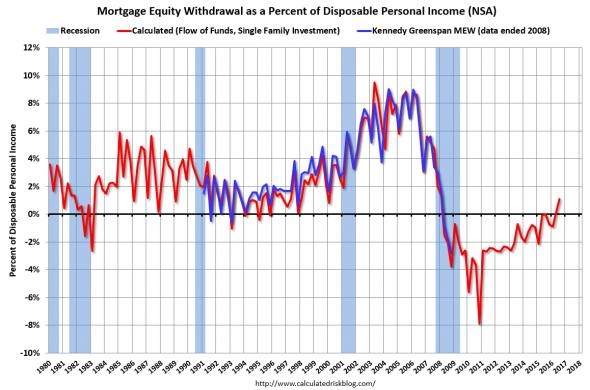

The following chart from Bill McBride at Calculated Risk, using methodology developed by Alan Greenspan and James Kennedy, gives a flavour of the magnitudes involved:

During the peak of the bubble, housing-backed debt let Americans boost their spending power by about 8 per cent....MUCH MOREThe comments in his Twitter feed are also pretty interesting (click through):

Oh, great: "a return to a reasonable pattern of home equity extraction would be a positive development" -- Dudleyhttps://t.co/RHtwIn7qWU— Matthew C. Klein (@M_C_Klein) January 24, 2017